From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Optimism Despite EU Protectionism: Production Trends and Procurement Strategies

Asia’s steel market maintains a very positive sentiment, despite growing protectionist measures in Europe. While the news articles “Billions at Stake: German Chancellor Merz Backs ‘European Patriotism’ to Rescue EU Steel Industry Amid Existential Crisis,” “The times of open markets ‘are over’: Friedrich Merz,” and “The days of open markets are ‘over’: Friedrich Merz” signal potential shifts in the global trade landscape, no direct impact on Asian steel plant activity is currently observable based on satellite data.

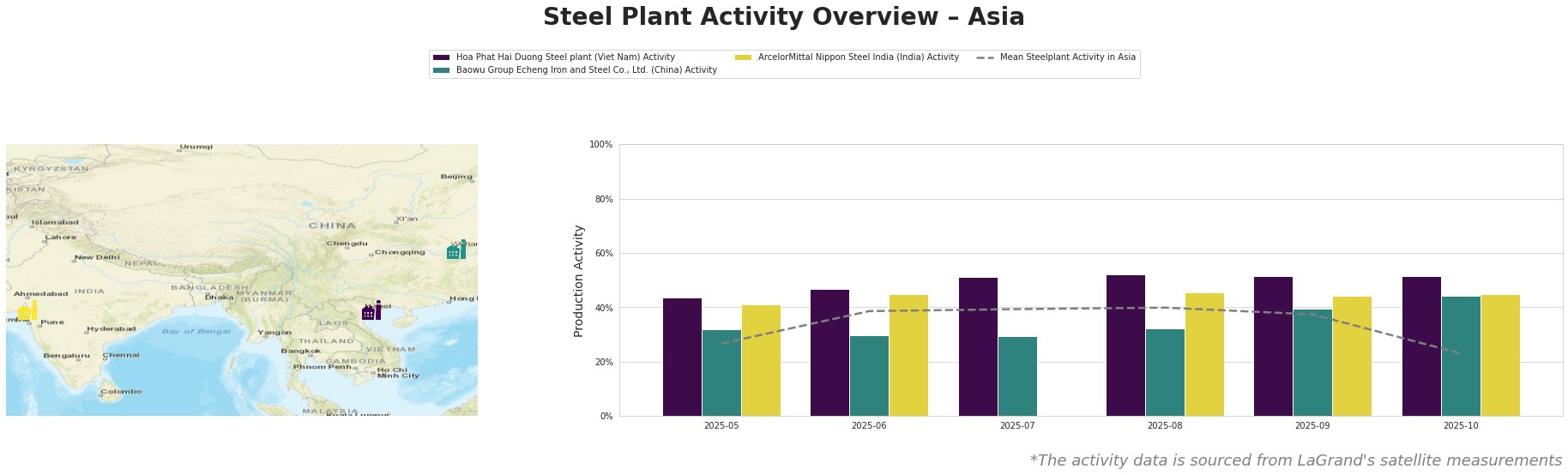

Observed monthly activity trends are as follows:

The mean steel plant activity in Asia shows a decrease to 23% in October 2025, preceded by a peak of 40% in August 2025.

-

Hoa Phat Hai Duong Steel (Vietnam): This integrated BF/BOF plant, producing 2.5 million tonnes of crude steel annually, has consistently operated above the Asian average. Activity remained stable at 51% in October 2025, a significant outperformance compared to the Asian average of 23%. No direct connection between its performance and the EU policy news could be established.

-

Baowu Group Echeng Iron and Steel (China): This integrated BF/BOF plant with a 4.4 million tonne crude steel capacity showed increased activity from 32% in August 2025 to 44% in October 2025, marking a positive trend. There is no direct, evidence-based link to the EU protectionist measures.

-

ArcelorMittal Nippon Steel India (India): This plant, relying on BF and DRI for iron production and EAF for steelmaking with a 9.6 million tonne crude steel capacity, displayed a consistent activity level around 45% from May to October, with a missing reading for July. This stability, despite broader market fluctuations, requires further investigation but lacks direct links to the mentioned EU news.

Evaluated Market Implications:

The news articles “Billions at Stake: German Chancellor Merz Backs ‘European Patriotism’ to Rescue EU Steel Industry Amid Existential Crisis,” “The times of open markets ‘are over’: Friedrich Merz,” and “The days of open markets are ‘over’: Friedrich Merz” indicate a potential shift in EU trade policy towards protecting its domestic steel industry, potentially impacting global steel trade flows.

Procurement Actions:

-

Steel Buyers: Given the potential for increased EU domestic demand and reduced exports due to “Buy European” mandates, steel buyers should closely monitor price trends and availability from Asian suppliers. The outperformance of Hoa Phat Hai Duong Steel in Vietnam indicates a potential reliable source. Buyers who relied on European suppliers, especially in sectors that are not able to meet the “responsible steel” sourcing standards should diversify their supplier base.

-

Market Analysts: Further analysis is needed to assess the long-term impact of EU protectionist policies on Asian steel exports and domestic demand. Analysts should monitor capacity utilization rates at key Asian plants like Hoa Phat Hai Duong, Baowu Group Echeng and ArcelorMittal Nippon Steel India to identify potential supply shifts. The increased domestic activity of Baowu Group Echeng, merits further investigation to see if it indicates a move to increase domestic steel production for internal consumption, and if this is driven by the anticipation of reduced export opportunities to Europe.