From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China’s Export Surge and Production Cuts Impact Q4 Outlook

Asia’s steel market faces continued pressure in Q4 due to overcapacity and fluctuating production, as highlighted in “Asian steel market to remain under pressure in Q4 – S&P Global.” The “OECD Steel Committee: Global overcapacity hits record levels as China’s exports surge” underscores the growing global imbalance partially due to increased Chinese exports. While the articles highlight China’s prominent role, direct links between these broad trends and individual plant activity, as observed by satellite data, cannot be definitively established for all plants.

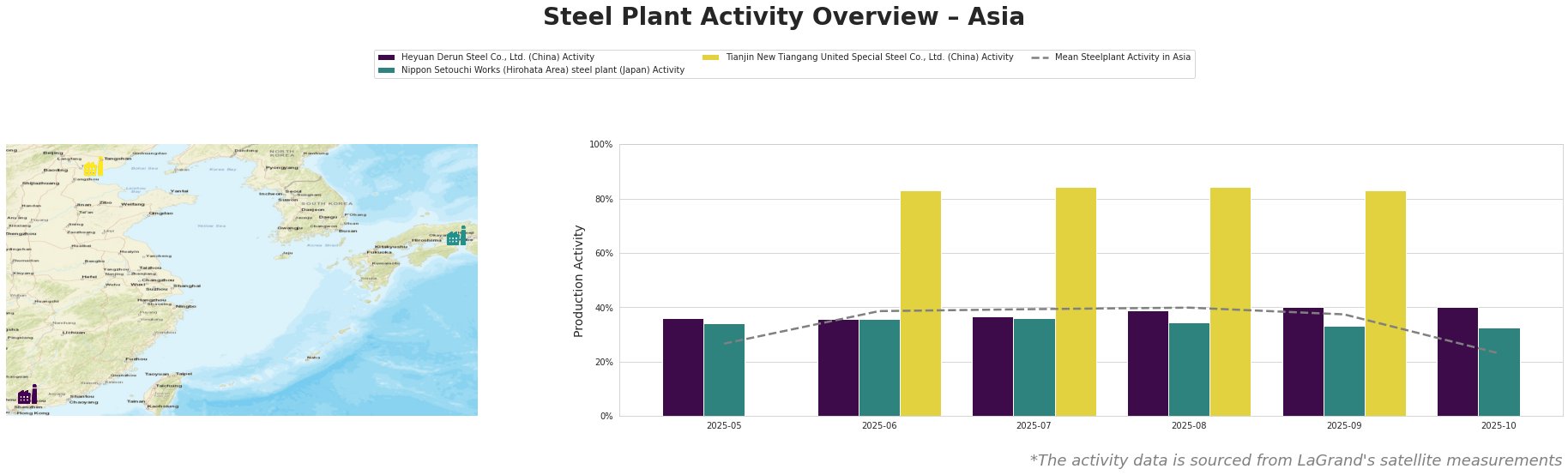

Observed steel plant activity data reveals varying trends across the region. The mean steel plant activity shows a sharp drop to 23.0 in October, following months of activity around 39-40%, highlighting increased market pressure in Q4 as reported in “Asian steel market to remain under pressure in Q4 – S&P Global”. Heyuan Derun Steel Co., Ltd. maintains stable activity around 36-40%. Nippon Setouchi Works activity fluctuates between 33% and 36%. Tianjin New Tiangang United Special Steel Co., Ltd shows high activity around 83-84% from June to September but has no data reported for May and October.

Heyuan Derun Steel Co., Ltd., located in Guangdong, China, operates with an all-electric arc furnace (EAF) setup, boasting a crude steel capacity of 1.2 million tonnes per annum (ttpa) and holds a Responsible Steel Certification. Satellite data shows a relatively stable activity level between 36% and 40% from May to October, above the Asian average in October when the average sharply declined. This sustained activity, despite regional market pressures, could be linked to the plant’s flexible EAF technology, allowing it to adapt to fluctuating scrap availability; however, this cannot be explicitly linked to the provided news articles.

Nippon Setouchi Works (Hirohata Area) in the Kansai region of Japan, possesses a crude steel capacity of 2.816 million ttpa, primarily utilizing basic oxygen furnaces (BOF). The plant also uses in-plant power generation, providing power generated via coal to Kansai Electric Power. Activity at this plant has been relatively stable but remained below the mean in Asia, fluctuating between 33% and 36% during the observed period. This could be indicative of broader demand weakness in Japan or production adjustments, although direct connection to the named news articles is not explicit.

Tianjin New Tiangang United Special Steel Co., Ltd., situated in Tianjin, China, is an integrated steel plant with a crude steel capacity of 4.5 million ttpa, operating blast furnaces (BF) and basic oxygen furnaces (BOF). Observed activity remained consistently high between June and September (83-84%) before data collection stopped, significantly above the mean across all observed plants. While the article “China’s Steel Market Expected to Rebound in November Amid Supply Curbs and Positive Trade Signals” mentions government-imposed production cuts, the absence of October data prevents directly linking observed activity levels with the reported supply-side constraints.

Based on “OECD Steel Committee: Global overcapacity hits record levels as China’s exports surge” and observed Chinese plant activity, procurement analysts should closely monitor Chinese export volumes and their impact on regional pricing. Given potential fluctuations indicated by the news and recent activity dips, buyers should secure supply contracts with built-in flexibility to adjust volumes based on prevailing market conditions, hedging against potential price volatility. As “Asian steel market to remain under pressure in Q4 – S&P Global” highlights the influence of protectionist measures, steel buyers should diversify their sourcing options beyond Southeast Asia and consider markets less impacted by these measures.