From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Shows Resilience Despite Automotive and Engineering Sector Headwinds

Europe’s steel market presents a mixed landscape, with positive trends tempered by challenges in key sectors. The UK car market shows growth, as reported in “UK car market up, but outlook clouded by expected tax changes,” while German engineering faces a sharp decline, according to “German engineering manufacturers face sharp order decline amid global trade crisis“. The former isn’t directly reflected in observed plant activity changes, but the latter aligns with potentially constrained demand, although no direct connection can be explicitly established based on available data alone.

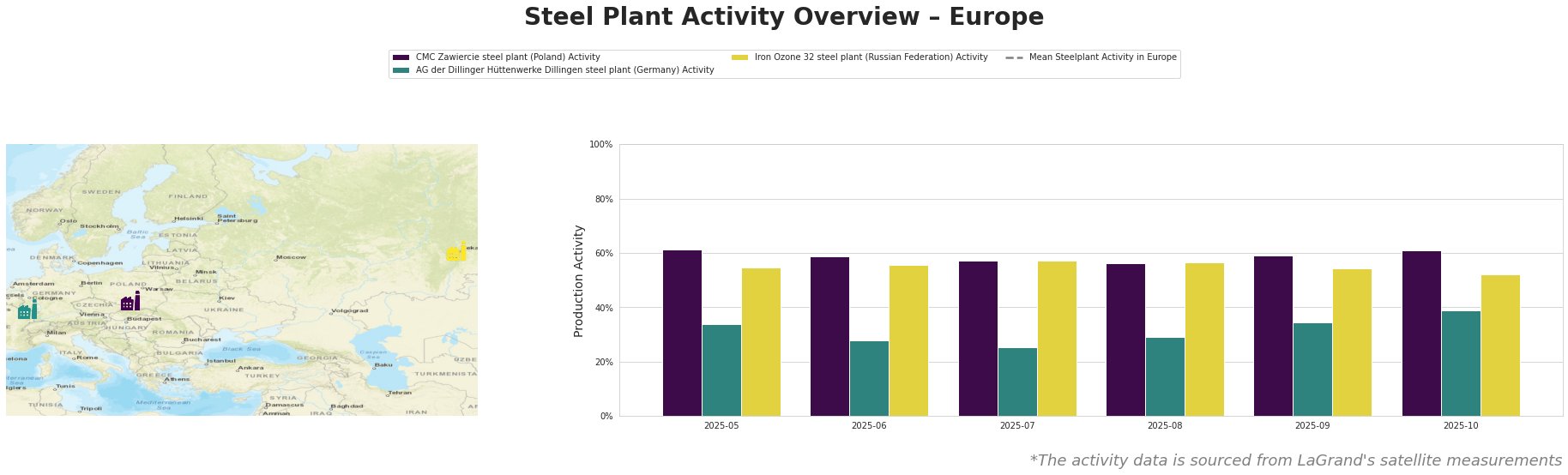

The data shows fluctuating average activity levels across observed European steel plants. CMC Zawiercie in Poland demonstrated relative stability, while AG der Dillinger Hüttenwerke in Germany experienced some volatility, hitting its lowest activity level in July, but rebounding to 39% by October. Iron Ozone 32 in Russia shows a stable trend, peaking in July. The “Mean Steelplant Activity in Europe” is volatile and does not reflect the changes of the three plants.

CMC Zawiercie, an EAF-based steel plant in Poland with a crude steel capacity of 1.7 million tonnes, serves the automotive, building and infrastructure, and energy sectors. Its activity remained relatively stable between May and October, fluctuating from 61% to 56% without a clear trend, ending at 61%. Considering the news “UK car market up, but outlook clouded by expected tax changes“, and the plant serving the automotive sector, there is no immediately obvious impact of UK market changes on the plant.

AG der Dillinger Hüttenwerke, a BF/BOF-based integrated steel plant in Germany with a crude steel capacity of 2.76 million tonnes, supplies the automotive, building and infrastructure, and energy sectors. The plant’s activity dropped from 34% in May to a low of 25% in July, then gradually recovered to 39% by October. This aligns directionally with the “German engineering manufacturers face sharp order decline amid global trade crisis” and “Car production in Germany decreased in October” articles, given the plant’s focus on supplying those sectors. The production of the steel plant has not fully recovered from the low in July and has high exposure to these struggling industries.

Iron Ozone 32, an EAF-based steel plant in Russia with a crude steel capacity of 1.25 million tonnes producing semi-finished products for the energy sector, saw little change in activity levels between May and October, ranging between 52% and 57%. No explicit connection to the provided news articles can be established.

Given the decline in German engineering orders and car production, alongside the satellite-observed drop and subsequent rebound at AG der Dillinger Hüttenwerke, steel buyers should:

- Prioritize Short-Term Contracts with German Suppliers: Negotiate shorter contract durations to capitalize on potential price softening due to reduced demand in Germany. Consider diversifying suppliers outside of Germany where possible.

- Monitor AG der Dillinger Hüttenwerke Closely: Track the plant’s activity for further declines. Any significant drops could signal production cuts and potential supply disruptions, requiring buyers dependent on this plant to seek alternative sources.

- Explore Polish Steel Options: Given the stable activity at CMC Zawiercie and the overall positive trend in the UK automotive market, explore opportunities to secure supply from Polish steelmakers as a hedge against potential disruptions in the German market.