From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market: Production Up Despite Carbon Market Push, Monitor Ningbo

China’s steel market shows robust production levels despite increasing emphasis on carbon reduction strategies. Activity data suggests strong operational momentum, although the implications of new carbon market initiatives remain to be fully seen. The observed activity levels do not yet reflect the full impact of the “EU, China join Brazil in carbon market coalition” and “EU and China join Brazil in carbon market coalition” initiatives, suggesting a potential future shift in production strategies.

The establishment of a global carbon market coalition, as reported in “Cop: EU, China join Brazil in carbon market coalition” and “EU and China join Brazil in carbon market coalition,” aims to harmonize carbon pricing. Separately, “Cop: Climate plans project 12pc GHG cuts over 2019-35” highlights the country’s commitment to reduce GHG emissions, with current plans projecting a 12% reduction from 2019-2035. While these articles signal a strategic shift towards decarbonization, the satellite-observed activity changes do not currently reflect any immediate impact on production levels.

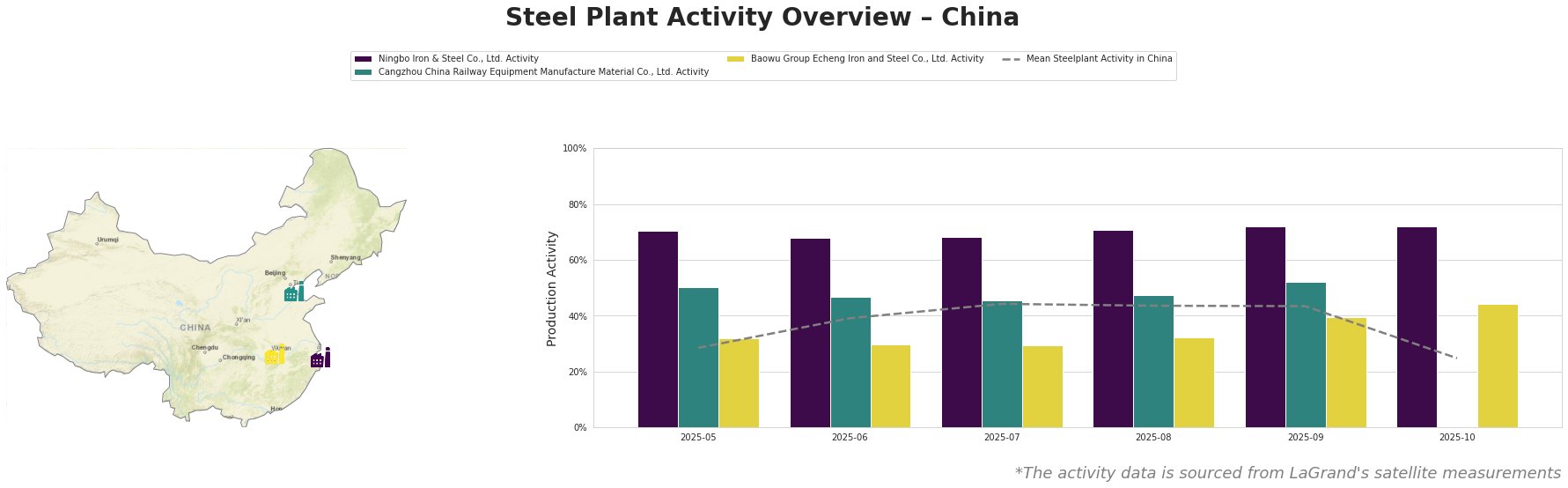

The mean steel plant activity in China saw an increase from May to August, peaking at 44%, before declining to 25% in October. Ningbo Iron & Steel Co., Ltd. consistently showed high activity, ranging from 68% to 72%. Cangzhou China Railway Equipment Manufacture Material Co., Ltd. Activity fluctuated between 45% and 52% before activity data was unavailable in October. Baowu Group Echeng Iron and Steel Co., Ltd. had the lowest activity of the three plants, ranging from 29% to 44%.

Ningbo Iron & Steel Co., Ltd., a BOF-based integrated steel plant in Zhejiang with a 4000ktpa crude steel capacity, has shown consistently high activity levels. From May to October 2025, the activity remained high, between 68% and 72% suggesting stable and strong production. The company holds Responsible Steel Certification. The high and stable activity levels at Ningbo, producing finished rolled products, including automotive structural steel and electrical steel, contrast with the broader push for carbon reduction, highlighting a need for careful monitoring of this plant’s future carbon emissions strategy in line with articles “Cop: EU, China join Brazil in carbon market coalition” and “EU and China join Brazil in carbon market coalition“.

Cangzhou China Railway Equipment Manufacture Material Co., Ltd. in Hebei, also an integrated BOF steel plant with a 7500ktpa crude steel capacity, showed activity ranging between 45% and 52% from May to September 2025. The facility produces high-quality carbon structural hot-rolled coils and low-alloy high-strength hot-rolled coils for the tools and machinery, and transport sectors. Activity data for October is unavailable. Similar to Ningbo, Cangzhou holds Responsible Steel Certification. No direct connection can be established between the news articles related to carbon emissions and observed activity levels at this plant.

Baowu Group Echeng Iron and Steel Co., Ltd., located in Hubei, is another integrated BOF steel plant, albeit with a smaller 4400ktpa crude steel capacity. Its activity ranged from 29% to 44% between May and October 2025. This plant produces a diverse range of products, including spring steel, bearing steel wire rods, and wire rods for pipe pile reinforcement. This plant also holds Responsible Steel Certification. No direct connection can be established between the news articles related to carbon emissions and observed activity levels at this plant.

Evaluated Market Implications:

The strong activity levels observed at Ningbo Iron & Steel Co., Ltd., particularly in light of China’s commitment to carbon emissions reductions as highlighted in “Cop: Climate plans project 12pc GHG cuts over 2019-35,” suggest a potential risk of future supply disruptions if stricter environmental regulations are enforced.

* Procurement Action for Steel Buyers and Analysts: Buyers reliant on Ningbo for automotive or electrical steel should proactively engage with the supplier to understand their carbon reduction strategies and assess potential impacts on future production costs and volumes. Conduct a supply chain risk assessment focused on potential environmental regulation impacts at Ningbo.

Given the absence of activity data for Cangzhou China Railway Equipment Manufacture Material Co., Ltd. in October 2025, further investigation is warranted to determine the cause of the missing data.

* Procurement Action for Steel Buyers and Analysts: Buyers sourcing from Cangzhou should immediately contact the supplier to clarify the production status and potential impact on order fulfillment, and diversify their supply base, especially if Cangzhou is a critical supplier for high-quality carbon structural hot-rolled coils.