From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Strong Amid CBAM Pressures and Stable Activity: Procurement Opportunities Emerge

European steel markets are showing resilience, with “Europe heavy steel plate prices buoyed by CBAM cost pressures, strong slab offers, lack of imports” indicating continued price support from CBAM and limited import competition. Similarly, “High steel sheet prices in Europe are supported by CBAM price pressures, a large supply of slabs, and a lack of imports” reinforces the upward price trend. The Romanian long steel market, as per “Romanian longs prices stable, limited import trade due to high EU prices“, remains stable but import-constrained due to overall high EU prices. No direct relationship can be established between these news articles and the satellite-observed changes in steel plant activity.

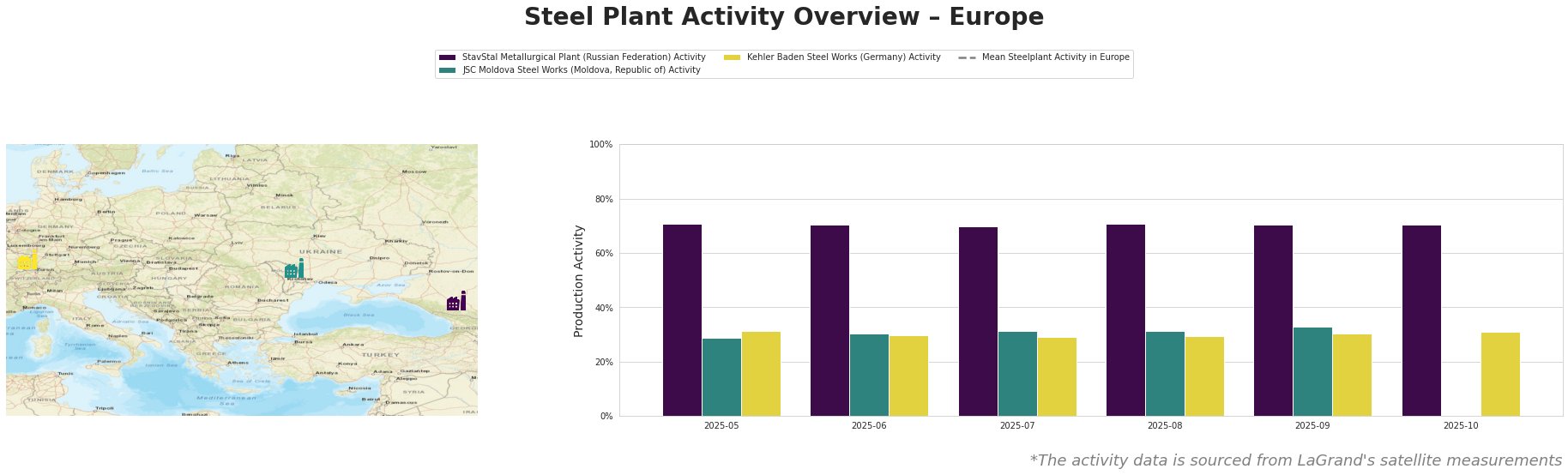

The mean steel plant activity in Europe shows fluctuation throughout the period, with peaks in July and August and troughs in September and October.

StavStal Metallurgical Plant, a Russian Federation-based EAF steel plant with a 500ktpa crude steel capacity, primarily produces semi-finished and finished rolled products like rebar and wire rod. Its activity remained stable at around 70-71% throughout the observed period. No direct connection can be established between this stable activity and the provided news articles.

JSC Moldova Steel Works, located in Transnistria, operates a 1000ktpa EAF-based steel plant producing rebar, wire rod, and billet. Activity at this plant increased from 29% in May to 33% in September before data became unavailable in October. The news article “Romanian longs prices stable, limited import trade due to high EU prices” mentions offers from Moldova at €550/mt CPT, which may be related to increased production at JSC Moldova Steel Works in the months leading up to September as the plant attempts to capitalize on export opportunities.

Kehler Baden Steel Works, a German EAF steel plant with a 2500ktpa capacity, manufactures wire rod, bar, and rebar, mainly for the building and infrastructure sectors. Its activity remained consistently around 30% throughout the observed period. No direct connection can be established between this stable activity and the provided news articles.

Given the limited import competition and CBAM-driven price increases in Europe, as reported in “Europe heavy steel plate prices buoyed by CBAM cost pressures, strong slab offers, lack of imports” and “High steel sheet prices in Europe are supported by CBAM price pressures, a large supply of slabs, and a lack of imports”, steel buyers should:

- Focus on Domestic Supply: Prioritize securing supply agreements with domestic European producers, such as Kehler Baden Steel Works, to mitigate import risks and potential CBAM-related costs.

- Monitor Moldovan Export Pricing: Track JSC Moldova Steel Works’ pricing and availability. Although a land-locked country with a small steel industry, its relative activity increase, coupled with potentially lower costs, offers a more attractive alternative in the current market conditions as indicated in “Romanian longs prices stable, limited import trade due to high EU prices”. Verify compliance with relevant trade regulations before committing to purchases.