From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineTurkish Scrap Demand Boosts West Coast Exports Amidst Mixed Asian Steel Activity

Asia’s steel market presents a neutral outlook, with diverging trends in scrap imports and steel plant activity. Increased Turkish scrap demand, highlighted in “USWC sells rare scrap metal shipments to Turkey: Fix” and supported by “Recent deep-sea and short-sea cfr Turkey scrap deals“, contrasts with fluctuating activity levels at key Chinese steel plants observed via satellite imagery. The “Turkey reduced scrap imports by 6.8% y/y in January-September” article provides context on overall scrap import trends, showing both decrease in earlier periods, as well as a pick up in more recent month(s). While Turkey’s scrap dynamics are evident, a direct relationship to activity changes in Chinese steel plants cannot be definitively established based on the provided information.

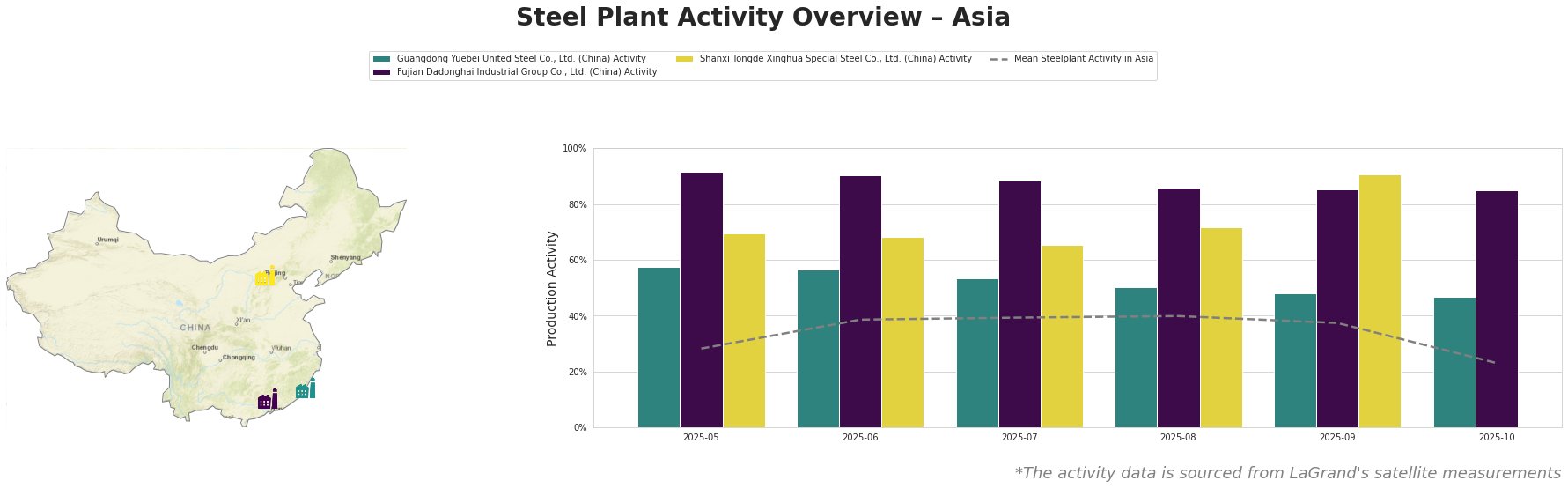

The mean steel plant activity in Asia shows volatility, peaking at 40% in August and dropping significantly to 23% in October. Guangdong Yuebei United Steel Co., Ltd., an integrated BF-based plant producing rebar, experienced a consistent decline in activity from 58% in May to 47% in October. Fujian Dadonghai Industrial Group Co., Ltd., another integrated BF-based plant focused on rebar, maintained a high activity level, fluctuating slightly between 92% and 85% from May to October. Shanxi Tongde Xinghua Special Steel Co., Ltd., also an integrated BF-based plant producing billets and rebar, showed increased activity in September (91%) but data is missing for October. Direct connections between these plant-specific activity changes and the provided news articles cannot be established.

Guangdong Yuebei United Steel Co., Ltd., primarily uses the BF-BOF route. The observed decline in activity from 58% in May to 47% in October does not have a directly identifiable link to the provided articles regarding Turkish scrap imports. Fujian Dadonghai Industrial Group Co., Ltd., with a similar BF-BOF setup and rebar output, shows relatively stable high activity, around 85-92%, throughout the monitored period; again, there is no direct connection to scrap market news that can be ascertained from the provided data. Shanxi Tongde Xinghua Special Steel Co., Ltd. shows an increase in September to 91%, but no data exists for October, preventing trend identification. The company uses BF-BOF process. There is no direct connection to the provided news articles.

The increased demand from Turkey, as highlighted in “USWC sells rare scrap metal shipments to Turkey: Fix”, may exert upward pressure on global scrap prices, particularly HMS 1/2 and shred, impacting EAF-based steel producers. Given the decrease in scrap imports reported in “Turkey reduced scrap imports by 6.8% y/y in January-September”, steel buyers should closely monitor scrap price volatility. Procurement professionals should explore securing longer-term scrap supply contracts to mitigate potential price increases, particularly if relying on US West Coast sources. The observed stability in Fujian Dadonghai’s activity, despite the volatile scrap market and the recent decline in overall Asian activity, suggests efficient operations and stable supply chains. This warrants monitoring of Fujian Dadonghai’s sourcing strategies for potential best practices.