From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Momentum in Asia’s Steel Market: Value-Added Production Drives Growth

Recent developments in Asia’s steel market highlight a positive market sentiment, particularly influenced by “China will promote value-added steel production“ and “China’s Steel Market Expected to Rebound in November Amid Supply Curbs and Positive Trade Signals.” These articles suggest that China is transitioning towards value-added production while simultaneously implementing supply-side constraints, which are expected to boost steel prices and active market participation.

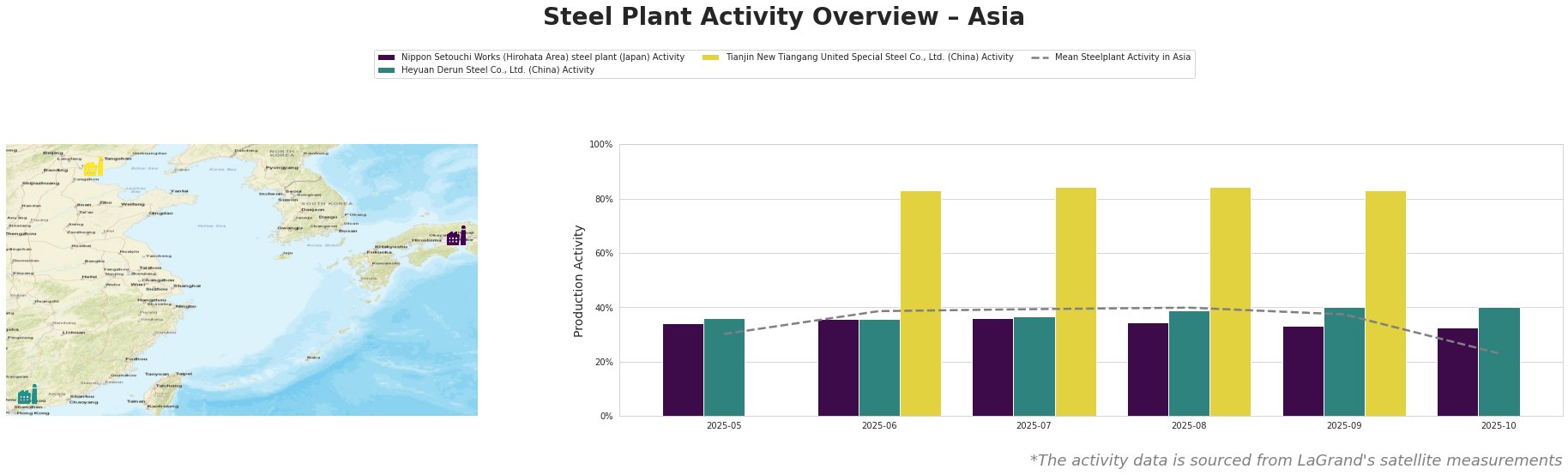

Nippon Setouchi Works in Japan has shown stable activity, peaking at 36.0% in June and July, which correlates with regional stability amidst supply-side strategies outlined in recent news. Conversely, the activity at Tianjin New Tiangang United Special Steel Co., Ltd. reached a significant high of 84.0% in both June and July, before dropping to an inactive point by October. This high production aligns with the higher demand and positive outlook for exports, indicated in the articles. Meanwhile, Heyuan Derun Steel’s activity remained consistently strong, completing the data report with a 40.0% presence by October.

Nippon Setouchi Works focuses on finished rolled and semi-finished products using oxygen processes, with notable stability in activity levels reflecting a cautious optimization amid shifting market dynamics. The recent production cuts across China, as indicated in “China’s Steel Market Expected to Rebound in November Amid Supply Curbs and Positive Trade Signals,” likely support this measured approach to production by Japanese plants.

Heyuan Derun Steel’s EAF operations for producing hot rolled rebar are influenced positively by the strategic shift towards value-added steel production in China, as companies like it may increasingly shift focus to higher-margin products.

Tianjin’s significant activity spikes suggest it could face future scaling challenges, especially if global overcapacity, as mentioned in “OECD Steel Committee: Global overcapacity hits record levels as China’s exports surge,” remains unaddressed. With excess supply and possible regulatory measures in place, procurement strategies might need to adapt based on market fluctuations and policy changes.

To mitigate potential supply disruptions, especially considering the anticipated production cuts in China, steel buyers should focus on securing contracts with suppliers already engaged in value-added production, particularly from reliable plants experiencing upward activity trends. Increased sourcing from steady producers like Heyuan and measuring demand response to production changes signals a need for adaptive procurement strategies. Analysts should closely monitor these developments to identify future buying opportunities in a potentially tightening market.