From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSpain’s Steel Sector Forges Ahead: ArcelorMittal Expansion and Steady Plant Activity Signal Growth

ArcelorMittal’s investment in new powder steel production capabilities in Avilés, Spain, signals a positive outlook for the region. According to “ArcelorMittal receives environmental permit for steel powder production in Spain,” “ArcelorMittal to build steel-powder production plant in Spain,” and “ArcelorMittal to build a powder steel plant in Spain,” the company is expanding into additive manufacturing materials with a focus on low-carbon production. While these developments suggest long-term growth potential, no direct immediate impact on the current activity levels of the observed plants can be established based on this information.

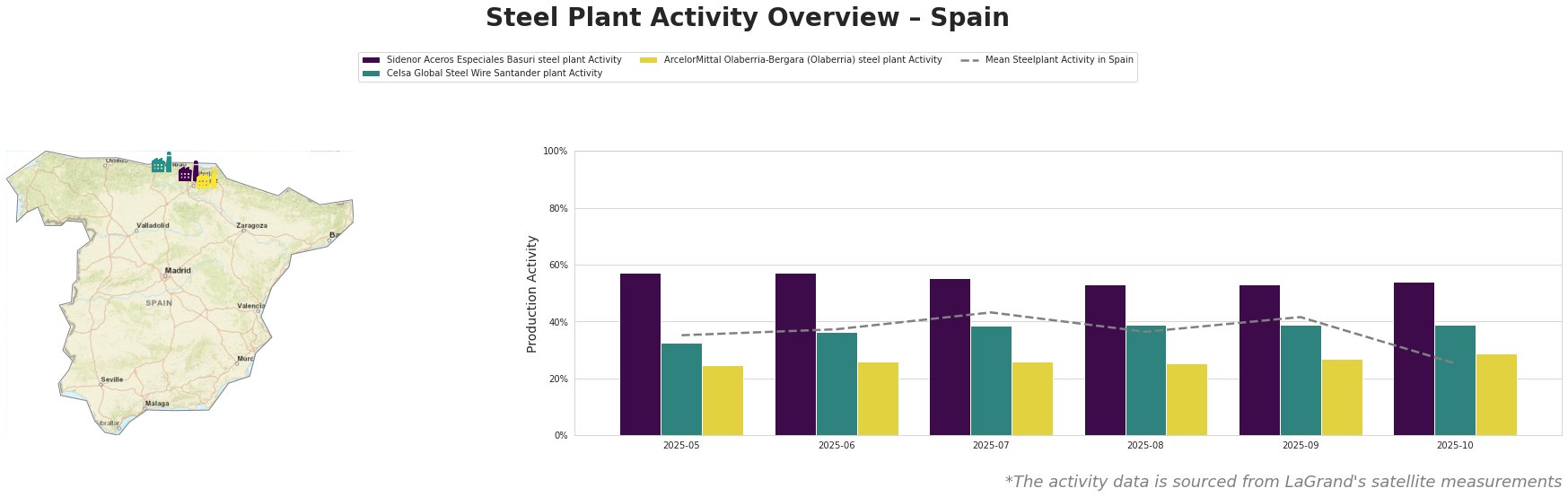

Overall, the mean steel plant activity in Spain has fluctuated, reaching a high of 43% in July 2025 and dropping to 25% in October 2025. Sidenor Aceros Especiales Basuri steel plant consistently exhibits higher activity levels than the average, while Celsa Global Steel Wire Santander plant shows activity levels close to the mean. ArcelorMittal Olaberria-Bergara demonstrates the lowest activity levels among the observed plants.

The Sidenor Aceros Especiales Basuri steel plant, located in Vizcaya, operates a 130-tonne EAF with a crude steel capacity of 740 ktpa, producing finished rolled products for the automotive, building, and energy sectors. Its activity remained relatively stable between May and October 2025, fluctuating slightly between 57% and 53%, before reaching 54% in October. No direct connection between these activity levels and the news articles about ArcelorMittal could be established.

The Celsa Global Steel Wire Santander plant in Cantabria, equipped with a 750 ktpa EAF, manufactures wire rod, sections, and bars for various industries, including automotive and construction. This plant’s activity increased steadily from 32% in May 2025 to a stable 39% from July to October 2025, consistently tracking around the mean plant activity in Spain. No direct connection between these activity levels and the news articles about ArcelorMittal could be established.

ArcelorMittal Olaberria-Bergara (Olaberria) steel plant in Gipuzkoa, with a crude steel capacity of 1450 ktpa utilizing an EAF, produces semi-finished and finished rolled products such as profiles and sections. It consistently showed the lowest activity levels compared to the other plants, ranging between 25% and 29% from May to October 2025. The news articles highlight ArcelorMittal’s broader investments in powder steel production and green hydrogen, but no direct correlation to changes in the activity levels at the Olaberria-Bergara plant is evident.

Given ArcelorMittal’s strategic investment in steel powder production, as highlighted in “ArcelorMittal receives environmental permit for steel powder production in Spain,” “ArcelorMittal to build steel-powder production plant in Spain,” and “ArcelorMittal to build a powder steel plant in Spain,” procurement professionals should:

-

Monitor ArcelorMittal’s product offerings: Steel buyers in the aerospace, defense, and automotive sectors should closely monitor the development and availability of ArcelorMittal’s new steel powder products, as these could offer advanced material solutions.

-

Evaluate supply chain diversification: While current plant activity remains stable, consider diversifying supply chains to mitigate potential disruptions associated with new production lines. Buyers relying heavily on ArcelorMittal’s existing product lines should assess alternative suppliers to ensure supply security during the transition.

-

Engage with ArcelorMittal: Initiate dialogues with ArcelorMittal representatives to gain insights into their production ramp-up plans for steel powders and potential impacts on existing product lines. Understanding their long-term strategy can help buyers align their procurement strategies accordingly.