From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Climate Goals Boost Steel Market Confidence Despite Societal Hurdles: Activity Trends Mixed

Europe’s steel market sentiment remains positive, driven by the EU’s commitment to climate goals, despite observed fluctuations in steel plant activity. The agreement on a 90% emissions reduction target by 2040, as reported in “EU-Staaten einigen sich auf Klimaziel für 2040” and “Ziel für 2040: Nicht nur schlechte Nachrichten für das Klima,” signals long-term demand for greener steel production. However, a direct correlation between these policy decisions and the recent activity levels recorded via satellite is not immediately apparent. The article “Forschung: Gesellschaftliche Blockaden gefährden laut Studie Deutschlands Klimaziele” suggests that societal obstacles could impede climate goals.

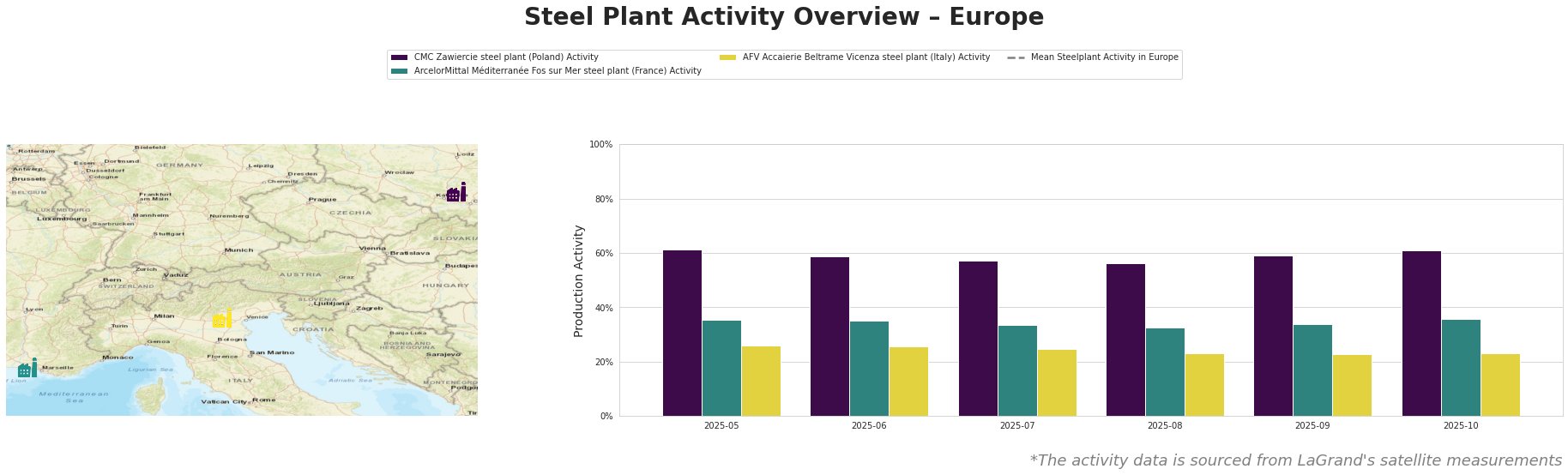

The mean steel plant activity in Europe shows volatility, with activity ranging from roughly 270 million to 407 million. CMC Zawiercie steel plant (Poland) saw its activity gradually decline from 61% in May to a low of 56% in August, before climbing back to 61% in October. ArcelorMittal Méditerranée Fos sur Mer steel plant (France) experienced a slight drop from 35% in May to 33% between July and August, before rising to 36% in October. The AFV Accaierie Beltrame Vicenza steel plant (Italy) had the lowest overall activity, decreasing from 26% in May to 23% in August, before remaining stable at 23% in September and October. None of the news articles provide a specific explanation for these observed trends.

CMC Zawiercie, a Polish EAF steel plant with a crude steel capacity of 1.7 million tonnes, showed a general decline in activity throughout the period. This activity is not directly attributable to developments mentioned in the provided news articles. The plant relies on EAF technology and has ResponsibleSteel certification.

ArcelorMittal Méditerranée Fos sur Mer, a large integrated steel plant in France with a 4 million tonne crude steel capacity and BOF technology, also showed some fluctuations. As “EU-Klimaziel für 2040 – Umweltminister versuchen Einigung” highlights, the EU’s climate goals may impact industrial policy; however, the observed activity fluctuations cannot be directly linked to the news articles. The plant operates a BF-BOF process, and plans to shut down two BOF furnaces by 2030.

AFV Accaierie Beltrame Vicenza, an Italian EAF steel plant with a 1.2 million tonne crude steel capacity, showed lower activity, but no direct relationship with the provided news could be established. The plant uses a 135-tonne EAF.

Evaluated Market Implications:

Given the EU’s continued commitment to emissions reductions discussed in “EU-Staaten einigen sich auf Klimaziel für 2040” and the societal challenges highlighted in “Forschung: Gesellschaftliche Blockaden gefährden laut Studie Deutschlands Klimaziele“, steel buyers should prioritize securing long-term contracts with suppliers committed to greener steel production.

The fluctuating activity levels across the observed plants do not point towards immediate supply disruptions. However, given the observed activity, steel buyers sourcing from ArcelorMittal Méditerranée Fos sur Mer should monitor for potential future disruptions related to the announced BOF shutdowns by 2030. It is further recommended to build relationships with suppliers utilizing EAF technology that are certified with ResponsibleSteel in order to align with the EU’s goals.