From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Shows Resilience Despite Global Headwinds: Plant Activity Stable

Asia’s steel market demonstrates relative stability amid global economic uncertainties. While US manufacturing contracts (“US Manufacturing Shrinks for Eighth Month on Sluggish Demand“), activity at key Asian steel plants remains robust. Observed activity levels do not show an immediate impact from the US manufacturing slowdown; the provided data doesn’t show a clear relationship to the reported US manufacturing decline.

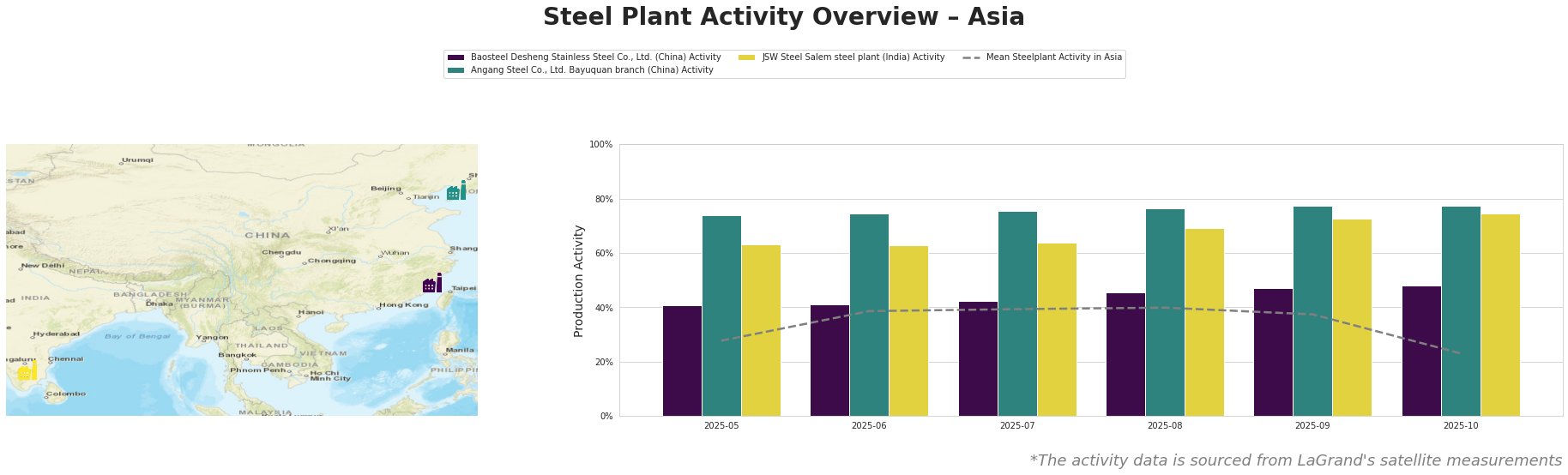

Here is the monthly plant activity in Asia:

Observed activity shows that the mean steel plant activity in Asia declined noticeably from September (37%) to October (23%), following a relatively stable level from June to August (39% to 40%).

Baosteel Desheng Stainless Steel Co., Ltd., a BOF-based integrated steel plant in Fujian, China, specializing in stainless steel, has shown a consistent increase in activity from May (41%) to October (48%). This gradual rise is in contrast to the overall Asian average decrease in October, but no direct correlation to news regarding the US service sector (“US service sector to resume growth in October: ISM” and “US services sector returns to expansion in Oct: ISM“) can be established based on the provided data.

Angang Steel Co., Ltd. Bayuquan branch, an integrated BF/BOF steel plant in Liaoning, China, with a 6.5 million tonne crude steel capacity, maintained a high activity level, fluctuating narrowly between 74% and 77% from May to October. This is significantly higher than the Asian average, indicating robust domestic demand. There is no explicitly available data connecting this to the US steel market dynamics or the US service sector expansion.

JSW Steel Salem, an integrated BF/EAF steel plant in Tamil Nadu, India, producing hot rolled and heat-treated bars and wire coils, displayed a consistent upward trend in activity from May (63%) to October (75%). Similar to Angang Steel, JSW Steel Salem’s activity remains high and increased, defying the regional average decline in October. This trend may indicate a strengthening domestic market for its products, with no established link to the US situation.

Evaluated Market Implications:

The steady activity at Angang Steel Bayuquan and JSW Steel Salem suggests strong regional demand, even with the overall Asian average decline in October. This can indicate a demand shift from the US market.

- Procurement Action: Steel buyers should monitor domestic demand trends in China and India closely, as high activity at these plants could lead to longer lead times or increased prices for certain steel products. No potential supply disruptions are directly indicated by the current plant activities, and US market news does not indicate any direct impact on supply capabilities of Asian Steel plants from the provided data.