From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Surges on Chinese Production Shifts and Export Demand

Asia’s steel market demonstrates strong bullish sentiment, driven by a combination of Chinese policy shifts, increased export demand, and anticipated supply-side constraints. China’s focus on value-added production, as highlighted in “China will promote value-added steel production,” could reshape the competitive landscape. “China’s steel sector PMI increases to 49.2 percent in October” points to improving market dynamics, linking directly to observed production activity. “China’s Steel Market Expected to Rebound in November Amid Supply Curbs and Positive Trade Signals” further supports this outlook.

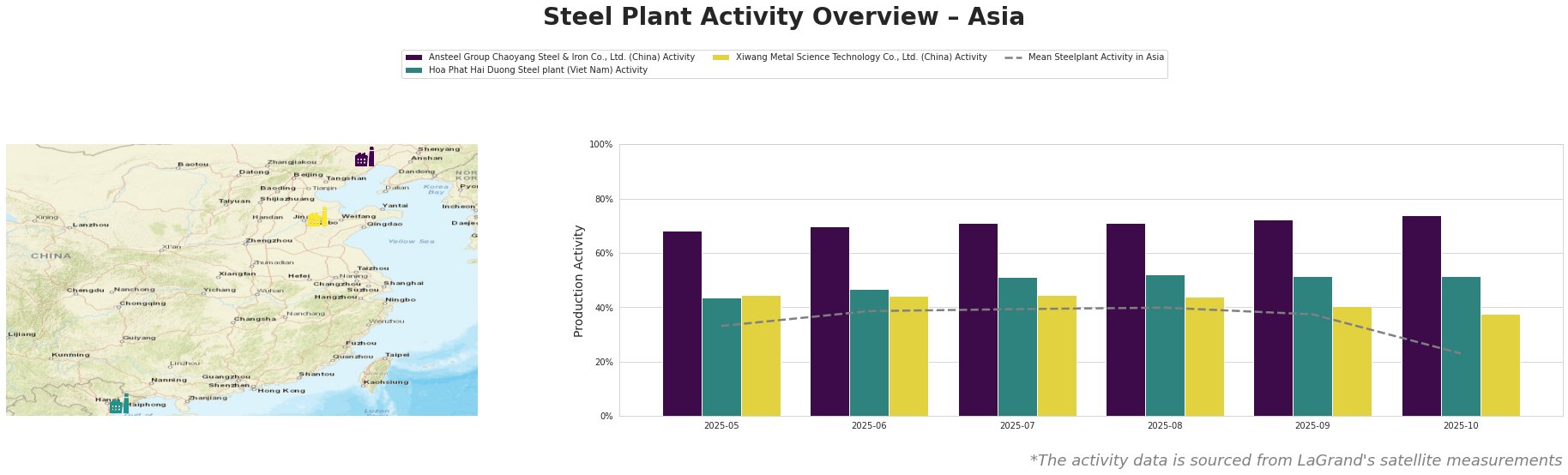

Here’s a summary of observed steel plant activities across Asia:

Overall, mean steel plant activity in Asia declined significantly in October to 23.0% from 37% in September, showing an overall slight increase during the observation period (33% in May up to 40% in August) before the drop in the last two months.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., a BF/BOF integrated plant in Liaoning, China, producing 2,100 ttpa of crude steel and 2,000 ttpa of iron, has consistently operated at levels significantly above the Asian average. Its activity has steadily increased from 68% in May to 74% in October. This elevated activity level could be connected to China’s focus on value-added steel production and modernization efforts, as noted in “China will promote value-added steel production,” although no direct confirmation is possible.

Hoa Phat Hai Duong Steel plant, a BF/BOF integrated plant in Hai Duong, Vietnam, with a crude steel capacity of 2,500 ttpa and iron capacity of 1,700 ttpa, shows relatively stable activity, fluctuating between 44% and 52% during the observed period. Although this steel plant exhibits a smaller change in percentage, its overall higher than average activity could be indirectly influenced by the export demand growth noted in “China’s steel sector PMI increases to 49.2 percent in October”, which has a broad impact on the Asian steel market.

Xiwang Metal Science Technology Co., Ltd., a BF/BOF/EAF integrated plant in Shandong, China, producing 2,800 ttpa of crude steel and 2,286 ttpa of iron, displayed relatively stable activity between May and August, at around 44-45%. Its activity has since decreased to 38% in October, below the overall average activity. While “China’s Steel Market Expected to Rebound in November Amid Supply Curbs and Positive Trade Signals” predicts a rebound, no explicit connection can be established between that news and the recent activity reduction.

Evaluated Market Implications:

The observed increase in activity at Ansteel, combined with the shift towards value-added steel production in China as indicated in “China will promote value-added steel production,” suggests a potential tightening of supply for standard-grade steel. Simultaneously, increased export orders reported in “China’s steel sector PMI increases to 49.2 percent in October” could further strain regional supply.

The reduction in activity at Xiwang, while not directly attributable to the news articles, warrants monitoring to determine if it reflects a broader trend affecting regional supply.

Recommended Procurement Actions:

- Steel Buyers: Given the anticipated supply constraints and potential price increases, buyers should consider securing contracts for standard-grade steel products early to mitigate risks. Focus on suppliers outside of China for standard-grade products to diversify supply chains, or concentrate on value-added steel products if your operations are compatible with higher grade steel.

- Market Analysts: Closely monitor the actual implementation of supply curbs in China and their impact on steel prices and trading activity, specifically focusing on the BF/BOF steel producers, as suggested by “China’s Steel Market Expected to Rebound in November Amid Supply Curbs and Positive Trade Signals“. Pay close attention to the steel plants activities in Liaoning Province, as an indication of the modernization effort highlighted in “China will promote value-added steel production.”