From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItaly Steel Market: CBAM Fuels Bullish Sentiment Amidst Rising Plant Activity

The Italian steel market exhibits bullish sentiment driven by the Carbon Border Adjustment Mechanism (CBAM) and reduced import interest, as highlighted in “European heavy plate round-up: Bullish sentiment prevailed,” “Heavy Metals Market Overview in Europe: bullish sentiment prevailed” and “Europe heavy steel plate prices buoyed by CBAM cost pressures, strong slab offers, lack of imports“. While these articles discuss the overall market trends, a direct link to recent observed changes in activity levels can only be partially established at the single plant level as outlined below.

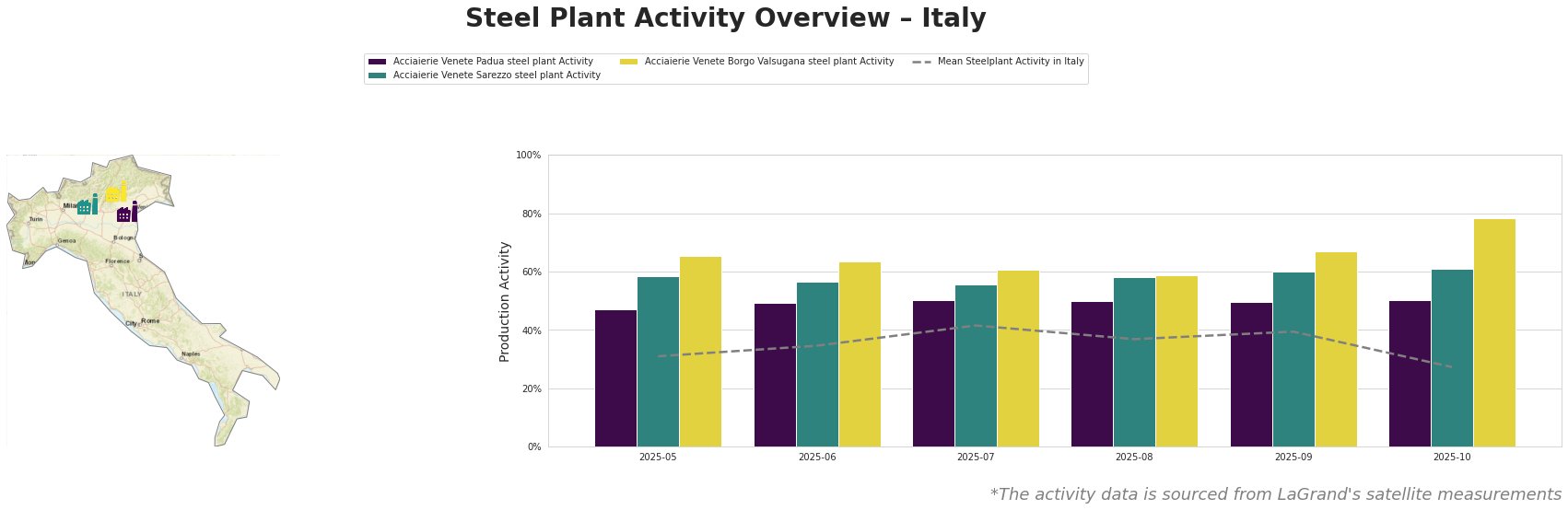

The mean steel plant activity in Italy shows fluctuations, with a peak in July at 42.0 and a notable drop to 27.0 in October. Acciaierie Venete Padua steel plant activity remained stable around 50.0 between August and October. Acciaierie Venete Sarezzo steel plant activity showed a slight increase over time, reaching 61.0 in October. The most significant change was observed at Acciaierie Venete Borgo Valsugana steel plant, which experienced a substantial increase in activity, reaching 78.0 in October. This stands in contrast to the overall decline in mean activity across Italy.

Acciaierie Venete Padua steel plant, located in the Province of Padova, has a crude steel capacity of 600ktpa, utilizing electric arc furnaces (EAF) for production. It focuses on semi-finished and finished rolled products, including bars and wire rods, serving sectors such as automotive and infrastructure. Despite the broader market bullishness reported, activity remained stable at around 50 between August and October, with no correlation to the discussed CBAM impacts or rising prices reported in “European heavy plate round-up: Bullish sentiment prevailed,” “Heavy Metals Market Overview in Europe: bullish sentiment prevailed” and “Europe heavy steel plate prices buoyed by CBAM cost pressures, strong slab offers, lack of imports“.

Acciaierie Venete Sarezzo steel plant, situated in the Province of Brescia, has a crude steel capacity of 540ktpa, relying on EAF technology. Similar to the Padua plant, it produces bars and wire rods for various sectors. Its activity gradually increased, reaching 61.0 in October. This suggests potential responsiveness to the bullish market sentiment, as highlighted in “European heavy plate round-up: Bullish sentiment prevailed,” “Heavy Metals Market Overview in Europe: bullish sentiment prevailed” and “Europe heavy steel plate prices buoyed by CBAM cost pressures, strong slab offers, lack of imports” even without explicit data linking the increases directly to plate or rolled steel production.

Acciaierie Venete Borgo Valsugana steel plant, located in the Province of Trentino-Alto Adige, also operates with a 600ktpa EAF-based capacity, producing similar products. Its activity saw a significant increase to 78.0 in October, the highest among the monitored plants. This surge could indicate increased production in response to the market’s anticipation of higher prices and limited availability driven by CBAM.

The increased activity at Acciaierie Venete Sarezzo and, most notably, Borgo Valsugana suggests a potential shift towards increased domestic production, aligning with the market’s anticipation of CBAM-driven price increases. However, the drop in mean steel plant activity in Italy indicates that not all plants are increasing production. This disparity, and especially the stable production at Acciaierie Venete Padua requires caution in assuming a generally increasing trend. The articles mention pressure on distributors, which may impact overall production capacity, but this effect cannot be isolated from the data.

Given the potential impact of CBAM on import costs and the observed activity increase at some EAF-based plants, steel buyers should:

- Prioritize securing contracts with domestic producers, particularly those demonstrating increased activity, like Acciaierie Venete Sarezzo and Borgo Valsugana, to mitigate potential supply disruptions arising from import limitations.

- Closely monitor the impact of sanctions against Evraz PLC on slab availability, as this could further constrain supply and increase prices, as mentioned in “European heavy plate round-up: Bullish sentiment prevailed“.

- Consider forward buying from domestic mills. Given the limited December deliveries noted in “Europe heavy steel plate prices buoyed by CBAM cost pressures, strong slab offers, lack of imports“, securing supply early may be prudent.