From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Remains Stable Despite Activity Fluctuations; Focus Shifts to Green Initiatives

The European steel market is demonstrating overall stability amidst fluctuating steel plant activity and increasing emphasis on green steel initiatives, as observed from satellite data. Recent developments in Australia, as reported in “Australia launches guarantee of origin scheme“, “Decision on sunset Australian ACCU methods ‘imminent’“, and “Australia’s Greencollar launches EP ACCU carbon fund“, are indirectly relevant to the European market, as they signal a global push towards carbon transparency and reduction, potentially influencing future trade policies and steel production standards. However, no direct relationship to European steel plant activity could be established based on this news.

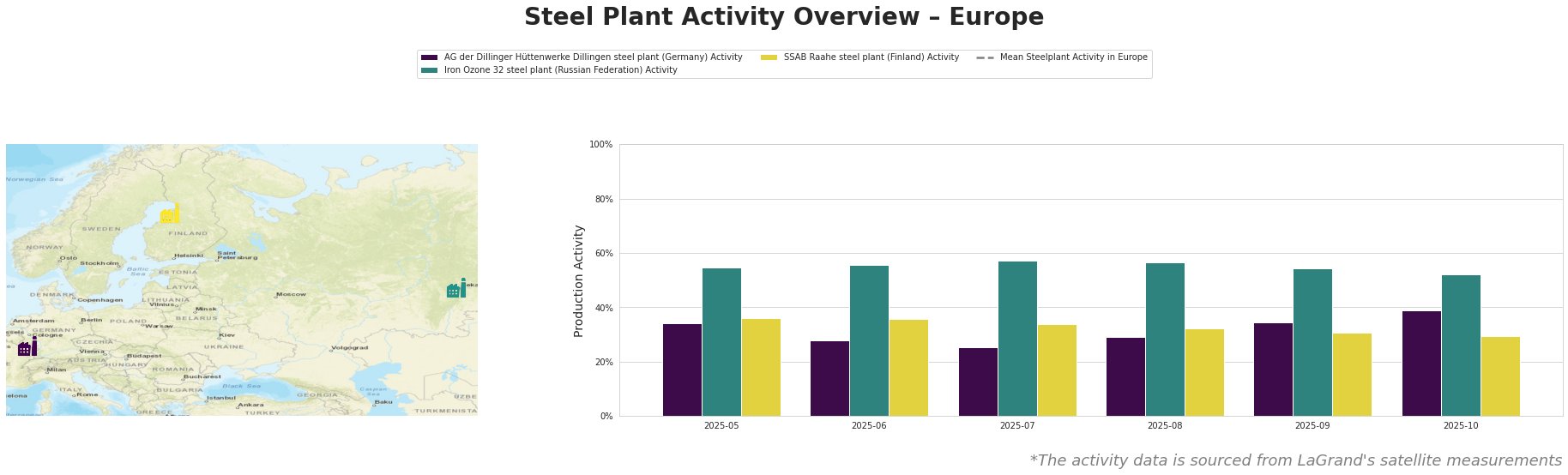

The mean steel plant activity in Europe has fluctuated, showing peaks in July and August, and troughs in September and October. AG der Dillinger Hüttenwerke Dillingen steel plant experienced a low of 25% activity in July, followed by an increase to 39% in October. Iron Ozone 32 steel plant has shown relatively stable activity, fluctuating between 52% and 57%. SSAB Raahe steel plant activity has gradually decreased from 36% in May to 29% in October. None of these shifts can be directly linked to the Australian news articles provided.

AG der Dillinger Hüttenwerke Dillingen steel plant, located in Saarland, Germany, is an integrated BF-BOF producer with a crude steel capacity of 2.76 million tonnes. It specializes in heavy plate products for various sectors, including automotive and energy. The plant’s activity dropped to 25% in July before recovering to 39% in October. This variation in activity cannot be directly associated with any of the provided news articles.

Iron Ozone 32 steel plant, situated in the Sverdlovsk region of Russia, is an EAF-based producer with a crude steel capacity of 1.25 million tonnes, primarily producing billet for the energy sector. The plant maintained a relatively stable activity level between 52% and 57% over the observed period. There is no direct connection between this activity and the provided news.

SSAB Raahe steel plant, located in North Ostrobothnia, Finland, is an integrated BF-BOF producer with a crude steel capacity of 2.6 million tonnes, manufacturing hot-rolled coils and billets. The plant’s activity gradually decreased from 36% in May to 29% in October. This trend does not directly correlate with the information in the provided news articles. The plant’s planned transition to EAF production by 2030 is noteworthy in the context of global decarbonization efforts, though not directly linked to the recent activity levels.

Given the observed fluctuations in steel plant activity and the global trend toward carbon emission tracking, steel buyers and market analysts should:

- Monitor potential supply disruptions from AG der Dillinger Hüttenwerke Dillingen: The fluctuation in activity warrants close monitoring of lead times and potential supply constraints for heavy plate products, particularly for customers in the automotive and energy sectors.

- Track carbon initiatives and their impact on global steel trade: While not directly affecting current activity, the Australian “guarantee of origin scheme” highlights a growing emphasis on carbon transparency. Proactively assess the potential impact of similar initiatives on European steel imports and exports.

- Assess long-term implications of the global shift towards green steel: SSAB Raahe’s planned transition to EAF production signifies a broader movement. Evaluate the availability and pricing of green steel options to align with sustainability goals.