From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineBrazil Steel Market: Production Stable Amidst COP30 Climate Push

Brazil’s steel market shows signs of continued production, despite the strong emphasis on climate action surrounding the upcoming COP30 summit in Belém. Satellite data reveals activity levels remain consistent at Aperam Timóteo, Gerdau Pindamonhangaba, and Simec Cariacica, despite President Lula’s call for a “Cop: Brazil calls for fossil fuel phase-out roadmap” and Brazil’s Environment Minister defending “Brazil environment minister defends mitigation“. No direct relationship can be established between the observed steel plant activities and the increased pressure on the sector to transition to green technologies.

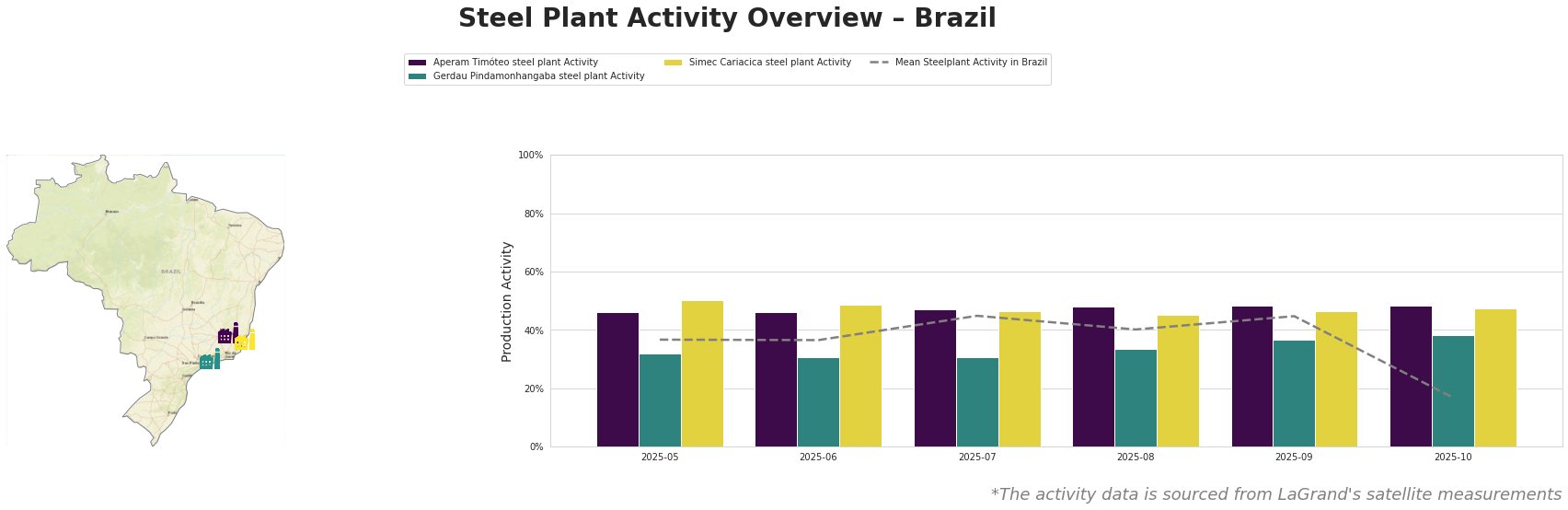

Here’s a summary of the recent monthly activity trends:

The mean activity level across all observed plants in Brazil shows a significant drop to 17% in October, with the reason for the drop not mentioned within the provided articles.

Aperam Timóteo steel plant: This integrated steel plant in Minas Gerais, with a crude steel capacity of 900 ttpa utilizing both BF/BOF and EAF technologies, maintained a relatively stable activity level between 46% and 48% from May to October. The plant produces stainless steel, grain-oriented electrical steel, and special carbon steels, serving diverse sectors. This stable production contrasts with the pressures highlighted in articles like “UN-Generalsekretär sieht “tödliche Fahrlässigkeit” bei Klimawandel“. No direct connection can be established between the observed stable plant activity and the call to reduce emissions.

Gerdau Pindamonhangaba steel plant: Located in São Paulo, this EAF-based plant with a 620 ttpa crude steel capacity displayed consistent activity between 31% and 38% from May to October. The plant focuses on finished rolled products such as bars, wires, and wire rod, catering to the building and infrastructure sectors. While the plant holds a ResponsibleSteel Certification, no change in activity levels can be directly linked to the themes of sustainability discussed in “Cop 30 success hinges on GHG cuts, finance response“. The observed changes remain within a narrow range and may be attributed to regular market fluctuations.

Simec Cariacica steel plant: This EAF-based plant in Espírito Santo, producing rebar and profiles with a 600 ttpa crude steel capacity, exhibited a stable activity pattern between 45% and 50% from May to October. No direct link between the Cop 30 summit and stable activity can be established. The activity remains stable, and the plant’s output is primarily focused on building and infrastructure.

Evaluated Market Implications:

The consistent activity levels observed at the Aperam Timóteo, Gerdau Pindamonhangaba, and Simec Cariacica plants, especially in the face of increasing climate pressures surrounding COP30, suggest a stable near-term supply outlook for their respective product categories. However, the mean steelplant activity shows a significant drop in October.

Recommended Procurement Actions:

- Steel buyers should monitor the mean steelplant activity in the long term.

- Given the stable activity at Aperam Timóteo, purchasing managers requiring stainless and electrical steel may consider securing contracts now to mitigate potential future price volatility associated with the broader push for decarbonization, as articulated in “Cop: Brazil calls for fossil fuel phase-out roadmap,” and the overall low average steel plant activities.

- Buyers relying on rebar and profiles from Simec Cariacica can expect continued supply in the short term, and given the general trend, should closely monitor the future development and policy implementations, particularly any climate-related mandates arising from Cop 30.