From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Faces Headwinds Amid US Flight Cuts and Production Slowdowns

The Asian steel market is facing downward pressure, evidenced by reduced steel plant activity. While no direct link can be established, the current weakness coincides with global economic uncertainty further exacerbated by the US government shutdown and subsequent flight cancellations, as reported in “US to cut 10pc of flights at some airports: Duffy,” “Airports named for planned US flight cancellations,” and “US flight reductions to be staggered over 7 days.”

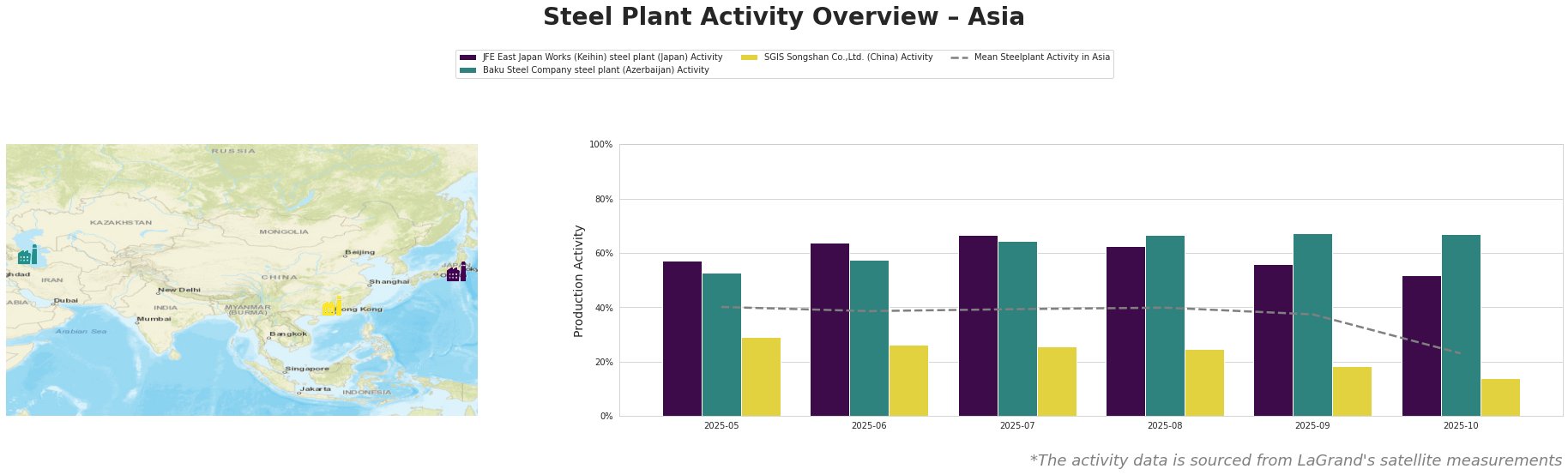

The mean steel plant activity in Asia has declined significantly, dropping from 40% in August 2025 to 23% in October 2025, indicating a substantial downturn. JFE East Japan Works (Keihin) steel plant initially showed higher activity than the Asian average but experienced a decrease to 52% in October. Baku Steel Company steel plant maintained a consistently high activity level, reaching 67% between August and October, significantly above the Asian average. SGIS Songshan Co.,Ltd. consistently operated below the Asian average, with a sharp drop to 14% in October 2025.

JFE East Japan Works (Keihin) steel plant, an integrated BF/BOF steel plant with a crude steel capacity of 4.075 million tonnes per annum, experienced a decline in activity, from 67% in July 2025 to 52% in October 2025. This drop may indicate reduced demand for its sheet, stainless steel, plate, and pipe products but no direct connection to the named news articles concerning US flight reductions can be established. The plant’s planned BF and BOF shutdown by FY2023 (as per provided plant details) could also be a contributing factor to output adjustments, although this was planned and not directly related to current events.

Baku Steel Company steel plant, an EAF-based plant with a 1 million tonne per annum crude steel capacity, has maintained high activity levels. Its focus on billet, rebar, and other construction-related products suggests sustained regional demand. No direct connection to the named news articles concerning US flight reductions can be established.

SGIS Songshan Co.,Ltd., an integrated BF/BOF steel plant with an 8 million tonne crude steel capacity, has experienced a significant decline in activity, dropping from 29% in May 2025 to 14% in October 2025. This plant produces special rods, industrial wires, building materials and plates. The activity reduction might be influenced by reduced construction demand regionally or supply chain bottlenecks, although no direct connection to the named news articles concerning US flight reductions can be established.

Given the overall negative sentiment and declining steel plant activity in Asia, exacerbated by global economic uncertainties indicated by the ripple effects of “US to cut 10pc of flights at some airports: Duffy,” procurement professionals should prioritize securing existing contracts and explore opportunities to negotiate more favorable terms with suppliers, particularly from plants like SGIS Songshan Co.,Ltd., which are experiencing production slowdowns. Diversifying supply sources, especially considering plants like Baku Steel Company that maintain high activity, can mitigate potential supply disruptions. Closely monitor developments related to the US government shutdown and its global economic impact, as it might indirectly affect Asian steel demand.