From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineBrazil Steel Market Reacts to Emission Goals: Activity Shifts at Key Plants

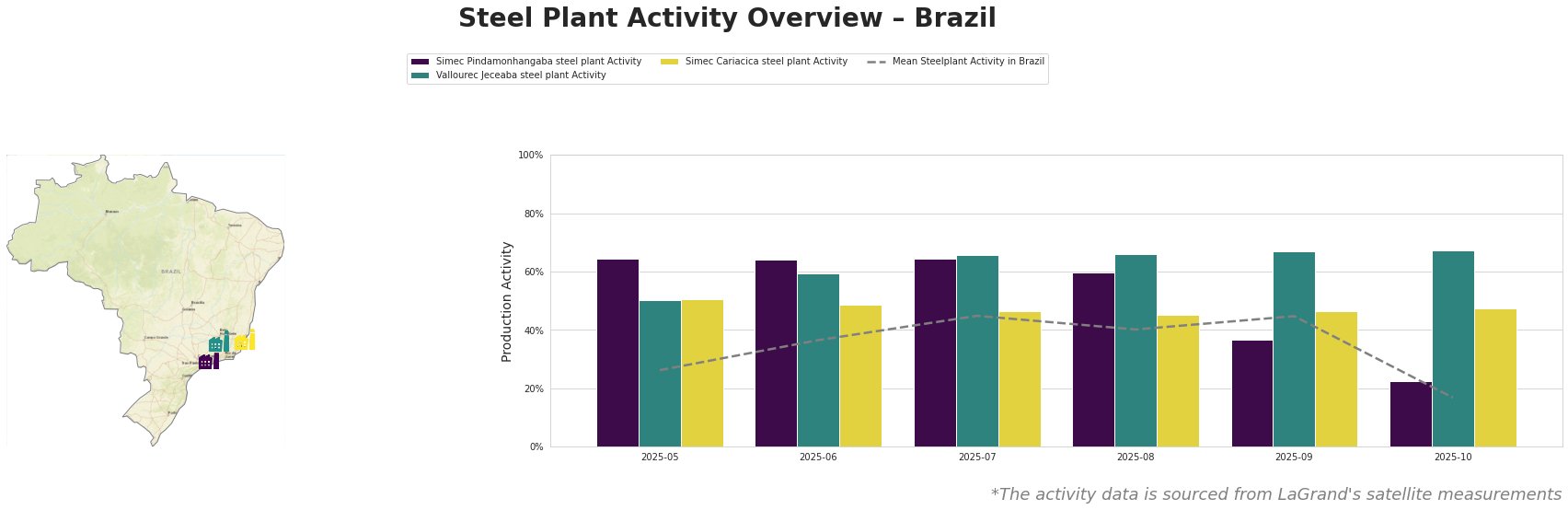

Brazil’s steel sector is showing signs of adjustment amidst ambitious climate targets. Recent activity at Simec Pindamonhangaba, Vallourec Jeceaba, and Simec Cariacica steel plants reflects a complex interplay of factors, potentially influenced by Brazil’s commitment to reducing emissions, as highlighted in “Brazil’s 2024 GHG emissions reach 6-year low” and the launch of a $1 billion climate fund as per “Brazil, GCF to draw $1bn to climate fund“. No direct link between observed activity changes and “Cop 30 success hinges on GHG cuts, finance response” can be established at this time.

Overall, average steel plant activity in Brazil has fluctuated significantly, peaking at 45% in July and September before plummeting to 17% in October.

Simec Pindamonhangaba steel plant, located in São Paulo, operates exclusively with EAF technology and produces 500 ttpa of crude steel, primarily wire rod and rebar for the building and infrastructure sectors. Activity remained consistently high at 64% from May to July, then experienced a decline to 60% in August, followed by a sharper drop to 37% in September and a low of 23% in October. This significant reduction might indicate a strategic adjustment in production levels, potentially influenced by the initiatives mentioned in “Brazil, GCF to draw $1bn to climate fund” as the company is Responsible Steel certified.

Vallourec Jeceaba steel plant, situated in Minas Gerais, has an integrated BF/EAF production route with a capacity of 1000 ttpa of crude steel and 350 ttpa of iron. Its primary output is seamless steel pipes for the energy sector. This plant displayed steadily increasing activity from May (50%) to September (67%) and maintained this high level in October (67%). This sustained high activity, in contrast to the fluctuating average, could be linked to consistent demand from the energy sector. No direct link to “Brazil’s 2024 GHG emissions reach 6-year low” can be established.

Simec Cariacica steel plant, located in Espírito Santo, relies on EAF technology with a crude steel capacity of 600 ttpa. It produces rebar and profiles for the automotive, building, infrastructure, and energy sectors. Its activity has remained relatively stable, fluctuating between 45% and 51% from May to October, with a small drop from 51% in May to 48% in October. The stability could reflect consistent demand across its diversified end-user sectors. No direct link to the named news articles can be established.

Evaluated Market Implications:

The contrasting activity trends between Simec Pindamonhangaba and Vallourec Jeceaba suggest potential supply disruptions in the rebar and wire rod market, particularly from Simec Pindamonhangaba. The reduction in activity at Simec Pindamonhangaba, combined with Brazil’s emissions reduction efforts detailed in “Brazil’s 2024 GHG emissions reach 6-year low” and “Brazil, GCF to draw $1bn to climate fund“, suggests the market may be responding to shifts toward greener steel production, impacting short-term supply.

Recommended Procurement Actions:

- Steel Buyers: Given the potential supply constraints in rebar and wire rod, particularly in the São Paulo region, buyers should:

- Diversify suppliers: Explore alternative rebar and wire rod suppliers to mitigate risks associated with the Simec Pindamonhangaba’s production cuts.

- Secure contracts: Negotiate and secure long-term contracts with reliable suppliers like Vallourec Jeceaba, to ensure stable pricing and supply.

- Monitor inventory: Closely monitor inventory levels and adjust procurement strategies to account for potential delays or shortages.

- Market Analysts:

- Track production shifts: Closely monitor production shifts in EAF-based steel plants like Simec Pindamonhangaba in relation to Brazil’s climate initiatives.

- Assess energy sector demand: Analyze the sustained high activity at Vallourec Jeceaba and its correlation with energy sector demand, which might indicate a more resilient market segment.

- Evaluate regional impacts: Assess how regional climate policies and funding, such as those discussed in “Brazil, GCF to draw $1bn to climate fund“, are impacting steel plant operations and regional supply dynamics.