From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Trends in Austria’s Steel Market: Activity Levels Reflect Growing Demand

Recent developments in Austria’s steel industry signal a positive market sentiment as evidenced by increasing activity levels observed in key steel plants. Notably, the satellite data reveals significant variations across plants, which can be correlated with market conditions. As highlighted in the news article titled “Decision on sunset Australian ACCU methods ‘imminent’“, the shifts in emission-related policies may indirectly influence local market dynamics, promoting an increase in sustainable steel production practices among suppliers.

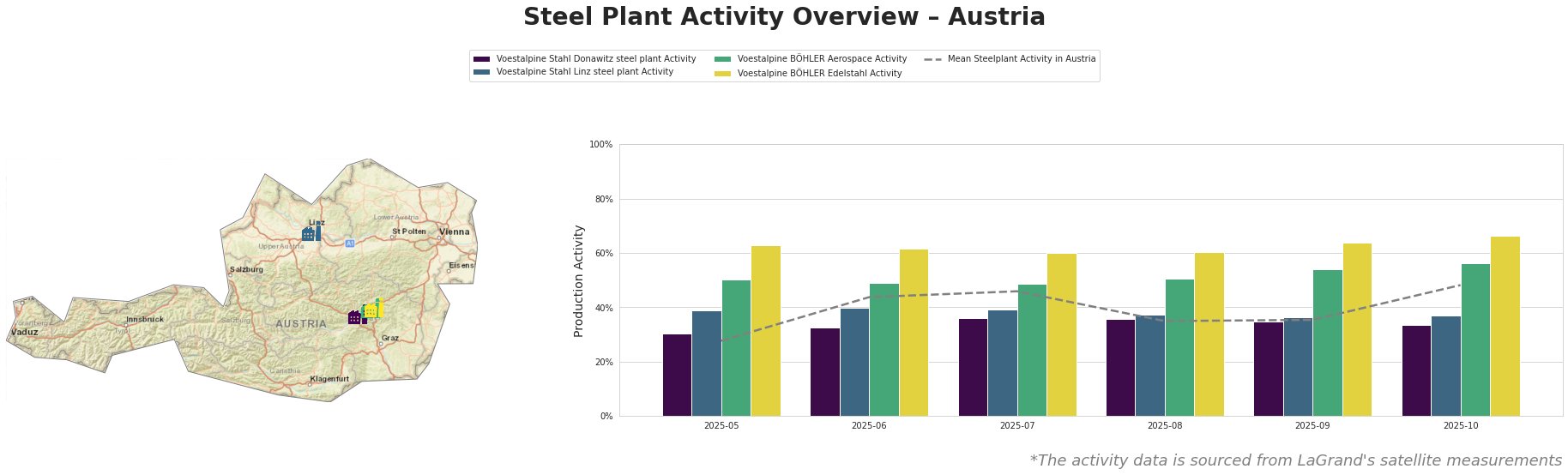

The Voestalpine Stahl Donawitz steel plant has shown mixed activity, starting at 30.0% in May, peaking at 36.0% in June, but declining to 34.0% by October. This fluctuation reflects broader market stability, perhaps forecasted in the impending decisions on emission reduction strategies cited in “Decision on sunset Australian ACCU methods ‘imminent’.” However, Voestalpine Stahl Linz has remained relatively stable, with consistent activity levels indicating resilience amid market changes.

On the other hand, Voestalpine BÖHLER Aerospace and Voestalpine BÖHLER Edelstahl displayed high performance, achieving 50.0% and 63.0%, respectively, in May and evolving towards 56.0% and 66.0% by October. This sustained activity suggests strong demand for specialized steel products, possibly buoyed by the anticipated outcomes reflected in the “Australia launches guarantee of origin scheme,” which signifies a shift towards low-carbon steel production practices.

Despite Voestalpine Stahl Donawitz‘s recent activity dip, its position remains crucial in supporting capacity needs as the industry shifts towards sustainability. High activity levels at BÖHLER plants underline strong market demand for niche applications in aerospace and engineering sectors, emphasizing procurement strategies focused on specialty grades.

With anticipated expansions in low-emission steel products reflecting Australia’s sustainability efforts, steel buyers should leverage these insights to prioritize suppliers with established production capabilities and certifications, specifically those aligning with sustainable practices as evidenced by the ongoing trend in emissions management. This strategic procurement focus will not only safeguard against any supply disruptions from the Donawitz operations but will enhance access to high-quality finished products from the BÖHLER facilities.

In conclusion, as the steel industry in Austria adapts to evolving environmental policies and growing demand for specialty products, procurement strategies must be carefully aligned with these market dynamics to ensure robust supply flow and compliance with emerging sustainability standards.