From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Activity Declines Amid US Tariff Uncertainty, Presents Procurement Opportunities

Asia’s steel market faces uncertainty due to potential shifts in US trade policy, impacting plant activity. News articles titled “US Supreme Court Signals Intervention As It Rules Trump ‘Wrongly Imposed Tariffs On Dozens Of Nations’” and “US high court questions Trump’s tariff powers” raise the prospect of tariff adjustments, but no direct link to plant activity changes can be explicitly established based on the provided data. The article “Trump Pushes For A US-Led Digital Economy That’s Free Of Tariffs” discusses a shift towards digital trade agreements which don’t appear to have a direct impact on the satellite-observed steel plant activity levels.

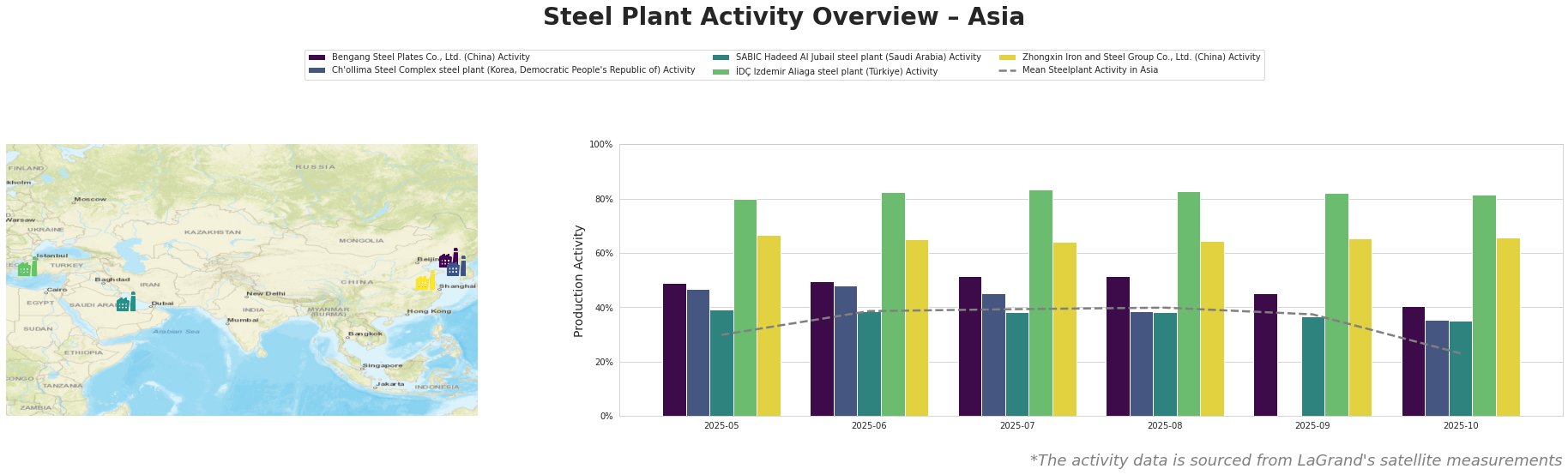

Overall, steel plant activity in Asia saw a significant drop in October, decreasing to 23.0% from 37.0% in September and 40.0% in August. Bengang Steel Plates Co., Ltd. showed a decrease from 52.0% in August to 40.0% in October. Ch’ollima Steel Complex steel plant saw a decrease from 47.0% in May to 35.0% in October. SABIC Hadeed Al Jubail steel plant decreased to 35.0% in October. İDÇ Izdemir Aliaga steel plant activity remained relatively stable at high levels. Zhongxin Iron and Steel Group Co., Ltd. activity also remained relatively stable, with a slight increase in October. The mean activity levels highlight that İDÇ Izdemir Aliaga steel plant is performing significantly above average.

Bengang Steel Plates Co., Ltd., located in Liaoning, China, is an integrated BF steel plant with a crude steel capacity of 12,800 ttpa, producing finished rolled products such as automotive, home appliance, and oil pipeline steel. Activity at Bengang decreased from 52% in August to 40% in October. While this plant is a ResponsibleSteel certified producer catering to sectors potentially affected by tariffs, such as automotive and energy, there’s no explicit connection to the news articles to explain the observed activity drop.

Ch’ollima Steel Complex steel plant, located in South Pyongan, North Korea, produces semi-finished and finished rolled products like plates and wire rod, with a crude steel capacity of 760 ttpa. The plant’s activity decreased from 47% in May to 35% in October. Given North Korea’s limited engagement in international trade subject to US tariffs, and the lack of information on its end-user sectors, no direct link to the news articles concerning US tariff policy can be established.

SABIC Hadeed Al Jubail steel plant, located in the Eastern Province of Saudi Arabia, is an integrated DRI steel plant with a crude steel capacity of 6,000 ttpa. It produces semi-finished and finished rolled products. Activity decreased to 35% in October. While SABIC Hadeed supplies products for various sectors, no direct connection to the US tariff news can be explicitly established.

İDÇ Izdemir Aliaga steel plant, located in İzmir, Türkiye, is an EAF-based steel plant with a crude steel capacity of 1,400 ttpa, producing semi-finished and finished rolled products. The plant’s activity remained stable at 82% in October, and has the highest activity of the observed plants. Given Turkiye’s trade relationship with the US, and ongoing tariff developments, the observed high plant activity can not be explicitly linked to the provided news articles.

Zhongxin Iron and Steel Group Co., Ltd., located in Jiangsu, China, is an integrated BF steel plant with a crude steel capacity of 5,700 ttpa, producing steel billets and various structural steel products. Its activity slightly increased to 66% in October. Despite operating in a region significantly affected by US-China trade relations, no direct link to the news articles can be explicitly established.

The potential US tariff adjustments introduce uncertainty into the Asian steel market. The recent drop in overall steel plant activity in Asia, coupled with uncertainty surrounding US trade policy, could lead to supply disruptions, particularly if the Supreme Court rules against existing tariffs. Steel buyers and analysts should prioritize the following:

- Evaluate Current Inventory Levels: Given the activity decrease in October, buyers should assess their inventory levels and consider increasing them if they rely on steel from Bengang Steel Plates Co., Ltd., Ch’ollima Steel Complex steel plant, or SABIC Hadeed Al Jubail steel plant, as these plants experienced notable activity declines.

- Monitor US Supreme Court Decision: Closely monitor the US Supreme Court’s decision on the legality of Trump’s tariffs, as highlighted in “US Supreme Court Signals Intervention As It Rules Trump ‘Wrongly Imposed Tariffs On Dozens Of Nations’” and “US high court questions Trump’s tariff powers.” A ruling against the tariffs could lead to lower steel prices, while upholding them could maintain upward pressure.

- Assess Alternative Sourcing: Given the consistently high activity levels at İDÇ Izdemir Aliaga steel plant, steel buyers should assess this plant as a reliable alternative source for sections and profiles (I beams, H beams, U channels, equal angles, unequal angles, bulb flat).