From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGreen Steel Surge: Europe’s Production Capacity Expands Amidst Plant Modernization

Europe’s steel market exhibits a very positive sentiment, fueled by significant investments in green steel production and plant modernizations. The “Review of global steel production and production capacities conducted by MEPs” highlights major green metallurgy initiatives, linking directly to observed activity levels at plants undergoing upgrades. Simultaneously, the “ArcelorMittal Luxembourg SteelUp project advances to completion phase” and “The ArcelorMittal Luxembourg SteelUp project is nearing completion” detail the ongoing modernization, although no immediate direct relationship between these projects and monthly satellite activity data can be established.

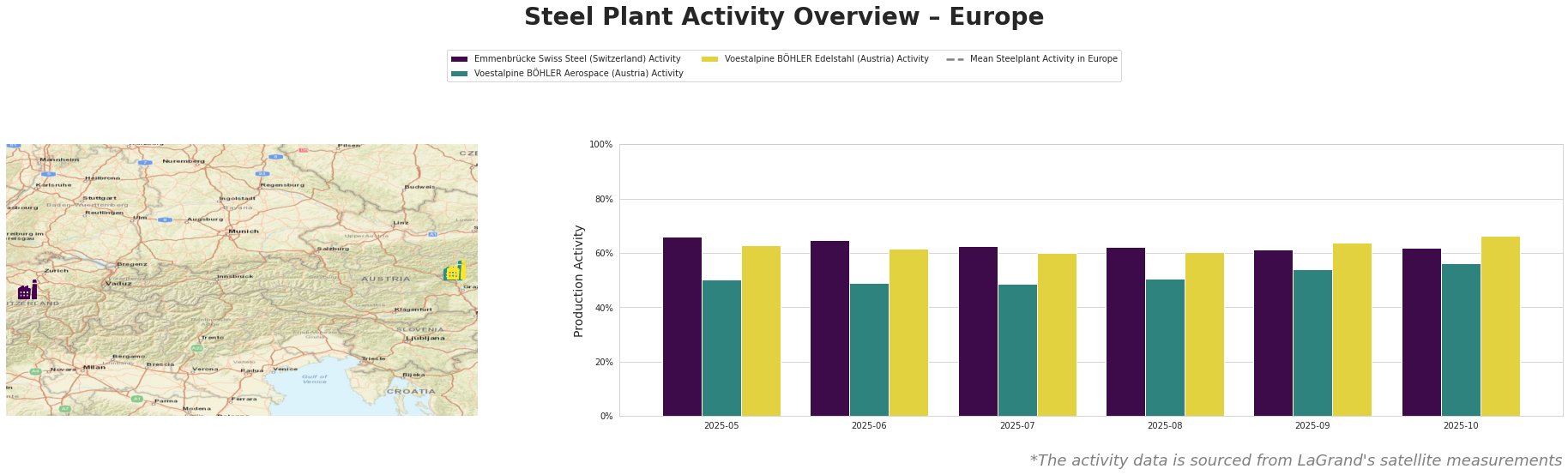

The mean steel plant activity in Europe shows fluctuations over the observed period, peaking in July and August, before decreasing again. Emmenbrücke Swiss Steel in Switzerland, an EAF-based plant, experienced a gradual decrease in activity from May (66%) to September (61%), followed by a slight increase to 62% in October. There is no explicit link to news articles in the provided information. Voestalpine BÖHLER Aerospace in Austria, also using EAF technology, shows a slight increase in activity from May (50%) to October (56%). Voestalpine BÖHLER Edelstahl (Austria), with an EAF capacity of 145ktpa, shows a clear activity increase from May (63%) to October (66%). The latter plant consistently operates above the mean activity levels of the observed steel plants. There is no explicit link to news articles in the provided information for either Voestalpine plant.

Emmenbrücke Swiss Steel, operating an EAF with Responsible Steel certification, exhibits a gradual decline in activity levels. The decrease from 66% in May to 61% in September suggests potential adjustments in production, though the subsequent increase to 62% in October indicates a partial recovery. No direct connection to specific news events can be established with the provided information. Voestalpine BÖHLER Aerospace, similarly utilizing EAF technology, shows a slight but consistent increase in activity over the period. The Voestalpine BÖHLER Edelstahl plant, with a reported EAF capacity of 145ktpa, shows the most significant and consistent activity increase, ending the period at 66% in October, potentially reflecting higher demand for its specialty steel products. There is no explicit link to news articles in the provided information for either Voestalpine plant.

The investment in green steel production capacity highlighted in “Review of global steel production and production capacities conducted by MEPs,” particularly SSAB’s new plant and the Metinvest/Danieli joint venture, signals a long-term shift in the supply landscape. While these projects are still in development, steel buyers should proactively:

- Prioritize contracts with suppliers demonstrating commitment to green steel production: The “Sweden’s Vattenfall orders green steel from SSAB for hydroelectric dam” showcases a concrete example of demand for fossil-free steel. Procurement strategies should increasingly incorporate sustainability criteria.

- Monitor the progress of new green steel projects: The “Review of global steel production and production capacities conducted by MEPs” provides an overview of upcoming capacity. Tracking the timelines and production capabilities of these projects, in combination with environmental permits like “ArcelorMittal receives environmental permit for steel powder production in Spain“, enables proactive adjustments to sourcing strategies.

- Engage in early discussions with suppliers undergoing modernization: The “ArcelorMittal Luxembourg SteelUp project advances to completion phase” and “The ArcelorMittal Luxembourg SteelUp project is nearing completion” indicate potential for enhanced production capabilities and new steel grades. Early engagement will ensure access to these advancements, but also allow to monitor potential supply disruptions during the changeover process.