From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth American Steel Market Heats Up: Activity Surges Amidst Climate Talks

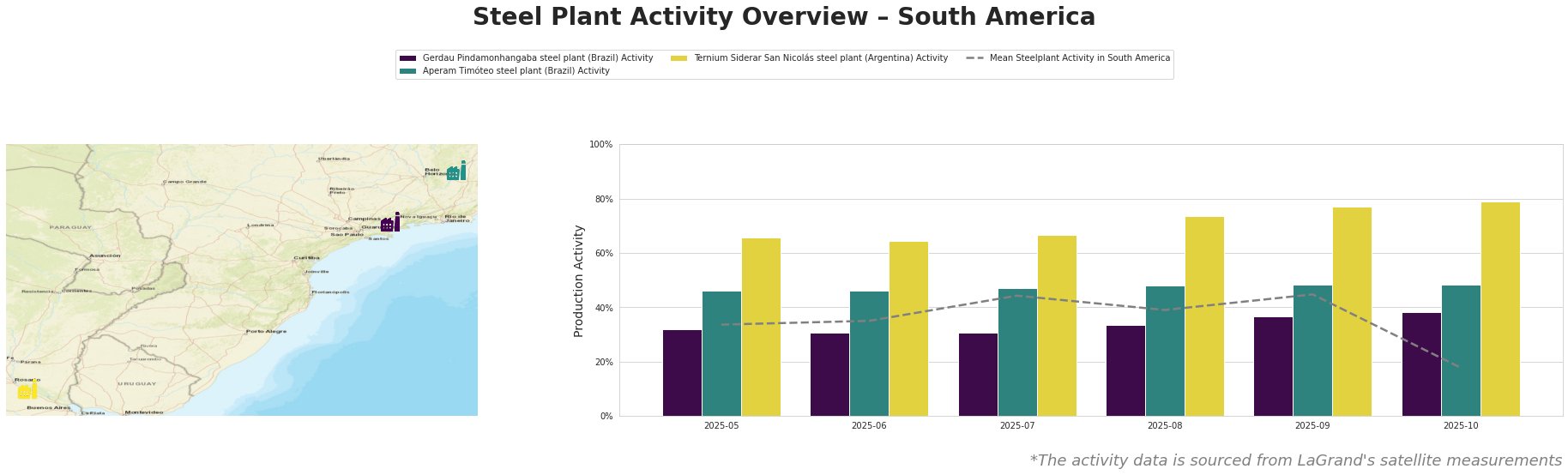

South America’s steel market demonstrates positive momentum. Observed changes in plant activity levels are viewed in the context of the upcoming UN climate conference in Brazil as described in “Cop 30 success hinges on GHG cuts, finance response” and “EU-Staaten beschließen Klimaziel für 2040“. No direct link, however, can be established between the news articles and recent observed changes in plant activity levels.

The average steel plant activity in South America fluctuated, peaking at 45% in September before a significant drop to 18% in October. Gerdau Pindamonhangaba steel plant, relying solely on EAF technology with a 620 ttpa crude steel capacity, showed relatively stable activity between May and September (31-37%), but increased activity in October, reaching 38%. Aperam Timóteo steel plant, an integrated BF-BOF-EAF plant with 900 ttpa crude steel capacity, demonstrated consistent activity, stabilizing around 46% to 48% between May and October. Ternium Siderar San Nicolás, an integrated BF-BOF plant with a large 3200 ttpa crude steel capacity, reported the highest activity levels, consistently increasing from 66% in May to 79% in October. There is no connection between these activity levels and the news article “EU-Staaten verschieben Start des Emissionshandels um ein Jahr“.

Evaluated Market Implications:

The significant drop in mean steel plant activity in South America in October, coupled with consistently high activity at Ternium Siderar San Nicolás, suggests a potential shift in regional production dynamics. Given that Ternium Siderar San Nicolás is an integrated BF-BOF plant, while Gerdau Pindamonhangaba is an EAF plant, the observed trends do not suggest any influence from news regarding climate targets or emissions trading schemes.

* Procurement Action: Steel buyers should consider diversifying suppliers, placing increased emphasis on securing supply from Ternium Siderar San Nicolás, while carefully monitoring activity levels at other regional plants. Request detailed production schedules from Ternium Siderar San Nicolás to ensure consistent supply. Consider negotiating longer-term contracts to secure pricing amidst potential regional supply fluctuations.