From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Bolstered by Tariffs, Capacity Constraints Loom Amidst Approvals

North American steel market dynamics are shifting due to tariffs and acquisitions. The increase in tariffs on steel and aluminum, reported in “US Feds Approve $14.9B U.S. Steel Sale to Nippon Steel and Boost Steel and Aluminum Tariffs to 50%—Industry Experts Weigh Capacity Upgrades, Automation, and Electrical Steel Innovation,” aims to boost domestic production. Simultaneously, “U.S. Stainless Steel Mills Operate Near Capacity Following Section 232 Tariff Hike, Market Faces Potential Supply Constraints” highlights that existing tariffs are driving stainless steel mills to near full capacity, raising concerns about potential supply constraints. However, it remains to be seen whether the plant activity is affected by these recent developments, since there is no time overlap.

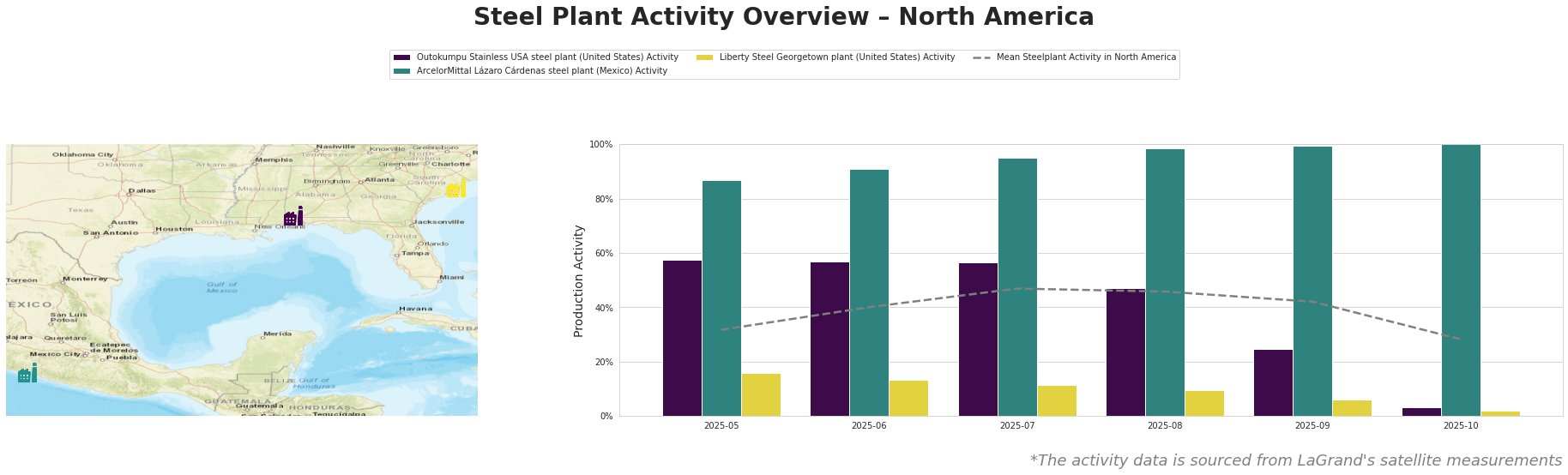

Observed activity across the selected North American steel plants reveals varied trends. The mean steel plant activity in North America peaked in July 2025 at 47.0% before declining to 28.0% by October 2025. Outokumpu Stainless USA steel plant’s activity, which had been above the mean, experienced a sharp decline, dropping from 58.0% in May 2025 to a mere 3.0% in October 2025. ArcelorMittal Lázaro Cárdenas steel plant consistently operated at very high levels, reaching 100% activity in October 2025. Liberty Steel Georgetown plant exhibited a continuous decline in activity, falling from 16.0% in May 2025 to just 2.0% in October 2025.

Outokumpu Stainless USA, an EAF-based stainless steel producer in Alabama with a crude steel capacity of 1000 ttpa, experienced a sharp decline in activity, plummeting from 58.0% in May 2025 to 3.0% in October 2025. This significant decrease does not directly correlate with any of the provided news articles, and its cause remains unclear based on the available information. The plant’s focus on stainless steel production means it is likely affected by the dynamics described in “U.S. Stainless Steel Mills Operate Near Capacity Following Section 232 Tariff Hike, Market Faces Potential Supply Constraints,” but no direct impact can be asserted.

ArcelorMittal Lázaro Cárdenas, a major integrated steel plant in Mexico with both BF/BOF and DRI/EAF production routes and a crude steel capacity of 5700 ttpa, showed consistently high activity. Its activity levels steadily climbed, reaching 100% in October 2025. This sustained high level of activity might reflect increased demand in the region but cannot be directly linked to the provided news articles.

Liberty Steel Georgetown, an EAF-based plant in South Carolina producing billets and wire products with a crude steel capacity of 908 ttpa, demonstrated a consistent decline in activity, reaching only 2.0% in October 2025. This decline does not have an obvious connection to the provided news articles.

The observed high utilization rates at ArcelorMittal Lázaro Cárdenas, coupled with the overall trend in “U.S. Stainless Steel Mills Operate Near Capacity Following Section 232 Tariff Hike, Market Faces Potential Supply Constraints,” suggest potential supply limitations, particularly in stainless steel. Given the tariffs mentioned in “US Feds Approve $14.9B U.S. Steel Sale to Nippon Steel and Boost Steel and Aluminum Tariffs to 50%—Industry Experts Weigh Capacity Upgrades, Automation, and Electrical Steel Innovation,” steel buyers should anticipate potential price volatility.

Recommended Procurement Actions:

- Stainless Steel Buyers: Given the near-capacity operation of U.S. stainless steel mills and the significant drop in activity at Outokumpu Stainless USA, secure stainless steel supply through long-term contracts or explore alternative suppliers to mitigate potential shortages. Closely monitor domestic stainless steel inventories and adjust procurement strategies to accommodate potential lead time extensions.

- Steel Analysts: Closely monitor the impacts of the increased tariffs. Specifically, track capital expenditure announcements from US Steel and other North American steel producers and evaluate whether the tariffs are indeed leading to the capacity upgrades anticipated by industry experts.