From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Downturn: Weak Demand and Production Instability Impact Prices

Europe’s steel market faces headwinds due to weak demand and production disruptions, impacting prices and procurement strategies. The situation is reflected in the news, “European long steel market struggles to gain traction amid limited demand” and “The European long products market is barely gaining momentum amid limited demand“, indicating a challenging environment for steel producers and buyers alike. These market struggles do appear to align with observed plant activity data, as shall be laid out below.

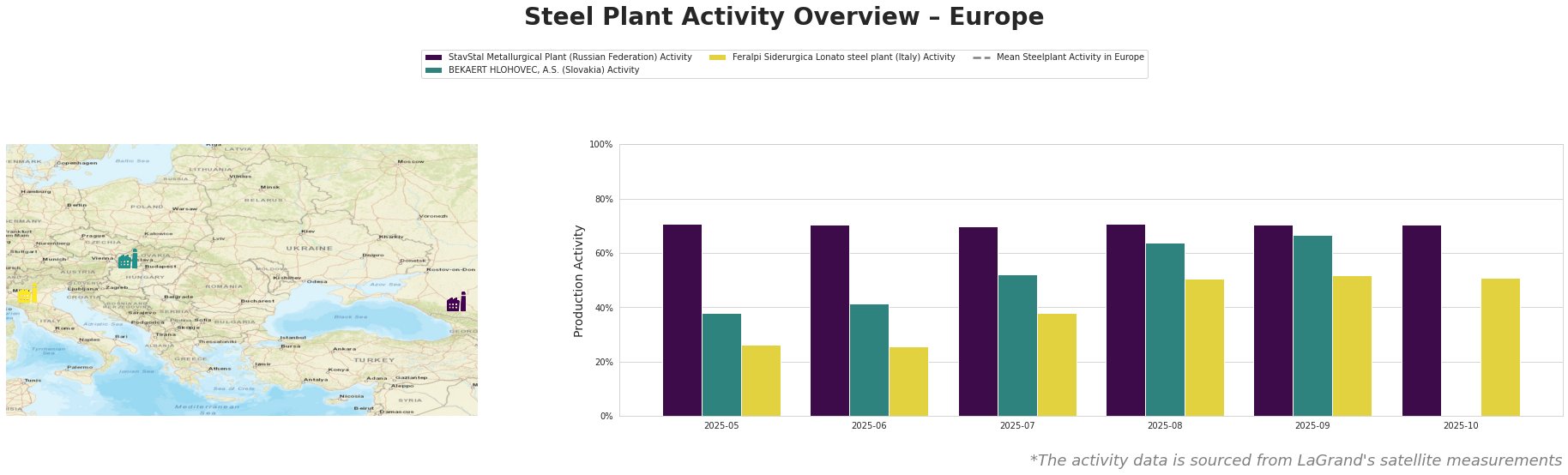

Recent satellite-observed activity trends are as follows:

The Mean Steelplant Activity in Europe shows a distinct downward trend, falling from 407779666.0 in August 2025 to 271853108.0 in October 2025. StavStal Metallurgical Plant has maintained a relatively stable activity level around 70-71% throughout the observed period. BEKAERT HLOHOVEC, A.S. shows a clear upward trend from 38% in May to 67% in September, but activity data is missing for October. Feralpi Siderurgica Lonato steel plant demonstrates a consistent increase from 26% in May to around 50% by August, remaining at similar levels through October. The broader downward trend in mean European steel plant activity seems to align with the challenges reported in the news articles, indicating reduced overall steel production in response to weakened demand.

StavStal Metallurgical Plant

The StavStal Metallurgical Plant, located in the Stavropol Krai, Russian Federation, is an electric arc furnace (EAF) based steel plant with a crude steel capacity of 500 thousand tonnes per annum (ttpa). It primarily produces semi-finished and finished rolled products, including square billets, rebar, and wire rod. Satellite data indicates a relatively stable activity level at StavStal, hovering around 70-71% from May to October 2025. Despite the overall negative market sentiment, Stavstal appears to be maintaining its production levels. No direct connection can be established between the plant’s activity and the European market news, due to its location in the Russian Federation.

BEKAERT HLOHOVEC, A.S.

BEKAERT HLOHOVEC, A.S., situated in Tyrnauer Landschaftsverband, Slovakia, focuses on wire rod production for the automotive and construction sectors. The plant’s activity levels show a clear increase from 38% in May to 67% in September. However, there is no activity data available for October. This observed increase in activity might be linked to previously placed orders that are now being fulfilled, but in light of the current news environment, it is unlikely that demand will continue to grow. The news articles do not explicitly address individual plant activities, and therefore, no direct connection can be established between the reported market struggles and the absence of data for October.

Feralpi Siderurgica Lonato steel plant

Feralpi Siderurgica Lonato steel plant, located in the Province of Brescia, Italy, utilizes electric arc furnace (EAF) technology with a crude steel capacity of 1100 ttpa. Its product range includes rebar, billets, mesh, and wire rod. The plant’s activity increased steadily from 26% in May to around 50-52% between August and October 2025. The news article “Prices for European long positions continue to follow various trends” mentions an industrial accident at the Pittini Group Ferriere Nord site, which may affect Italian market conditions. While Feralpi’s activity shows relative stability, the potential market impact of the Pittini incident, coupled with general demand weakness, could influence Feralpi’s future production decisions. It is not possible to definitively attribute Feralpi’s observed activity levels to the Pittini incident based on the provided information.

Evaluated Market Implications

The European long steel market is facing significant challenges due to limited demand, as highlighted in “European long steel market struggles to gain traction amid limited demand” and “The European long products market is barely gaining momentum amid limited demand“.

Potential Supply Disruptions: The industrial accident at the Pittini Group Ferriere Nord site, as reported in “Prices for European long positions continue to follow various trends“, may lead to temporary supply disruptions specifically in the Italian rebar market. The declining average European steel plant activity suggests broader production cuts in response to the weak demand.

Recommended Procurement Actions:

- Italian Rebar Buyers: Given the potential disruption from the Pittini accident and the stated aim of Italian producers to raise prices, buyers should secure existing contracts or explore alternative supply sources outside Italy to mitigate potential price increases and supply shortages. Monitor local Italian rebar prices closely.

- Northern European Rebar Buyers: With Northern European mills facing resistance to price increases, as highlighted in the news articles, buyers should leverage the weak demand environment to negotiate favorable pricing terms. Avoid entering into long-term contracts at current price levels, given the overall negative market sentiment.

- Wire Rod Buyers: Consider that Turkish wire rod prices are expected to stabilize, buyers should compare offers from Turkish suppliers against domestic prices, but factor in potential risks associated with importing materials, as it is mentioned in the article “Prices for European long positions continue to follow various trends“.

By carefully monitoring these developments and adapting their procurement strategies, steel buyers can navigate the current market turbulence effectively.