From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Steel Market Faces Headwinds: Demand Weakness and Supply Concerns After Pittini Accident

Italy’s steel market is facing downward pressure due to weak demand and potential supply disruptions. As highlighted in “The global rebar market remains under pressure from weak demand in the fall” and “The European long products market is barely gaining momentum amid limited demand“, Italian rebar prices have shown mixed signals with manufacturers attempting to raise prices amidst overall sluggish demand. The accident at Pittini Group’s Italian plant, mentioned in “European longs prices continue to follow different trends” and “Prices for European long positions continue to follow various trends,” may further impact the market. It is currently impossible to link the activity data with the accident at Pittini, since the incident happened after the timestamp of the last datapoint in October 2025.

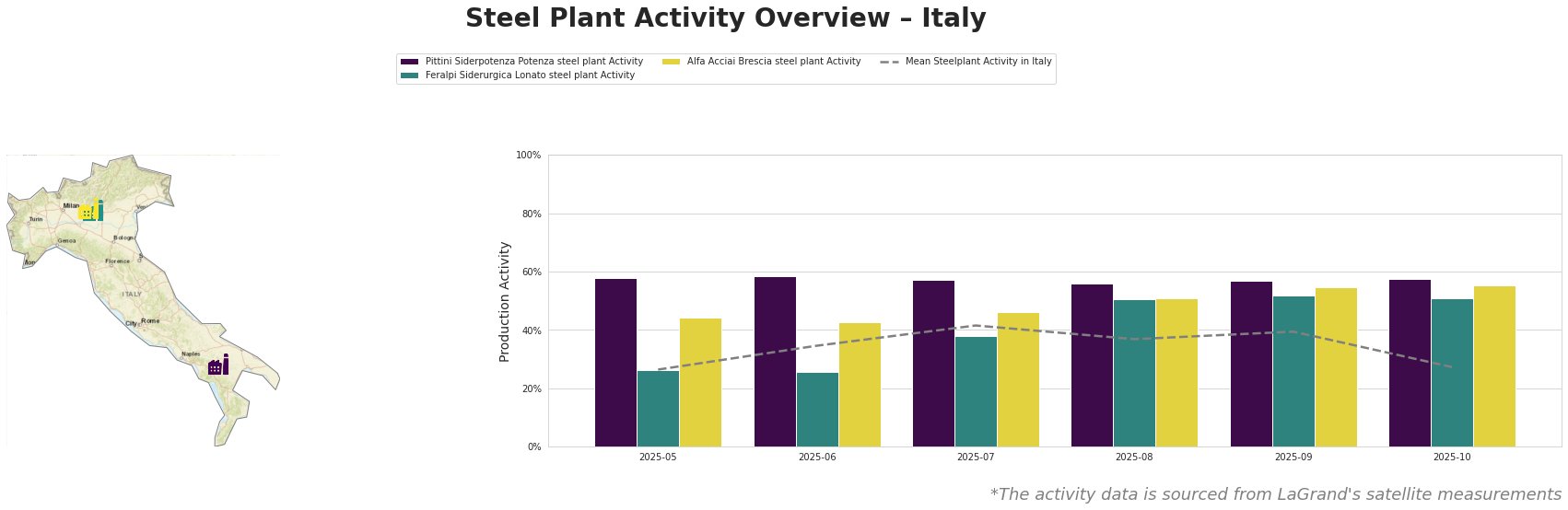

The mean steel plant activity in Italy shows a decline in October, dropping significantly to 27.0% after peaking at 42.0% in July.

Pittini Siderpotenza Potenza steel plant, an EAF-based producer with a 700kt crude steel capacity focused on rebar for the building and infrastructure sectors, maintained a relatively stable activity level around 58% throughout the observed period. This contrasts with the overall Italian market’s volatility. The news article “Prices for European long positions continue to follow various trends” mentions an accident at Pittini Group Ferriere Nord which may affect the Italian market. The Pittini Siderpotenza Potenza steel plant activity level (data from October) does not yet reflect the event.

Feralpi Siderurgica Lonato steel plant, with an EAF capacity of 1100kt and producing rebar, billets, mesh, and wire rod, experienced fluctuating activity. Starting at 26% in May and June, its activity increased to 52% by September before slightly decreasing to 51% in October. This trend is not directly linked to any specific news items, although the general weakness in the long products market, as reported in “The European long products market is barely gaining momentum amid limited demand,” may contribute to this fluctuation.

Alfa Acciai Brescia steel plant, an EAF-based producer with a capacity of 1700kt specializing in billets and rebar, showed a consistent increase in activity from 44% in May to 55% in September and October. This plant’s relatively stable performance, despite broader market concerns, suggests potentially strong order books or efficient operations. No direct connections can be established between Alfa Acciai’s activity and the provided news articles.

The accident at the Pittini Group’s Ferriere Nord site, as reported in “Prices for European long positions continue to follow various trends” poses a potential supply risk, particularly for rebar. Given the weak demand environment described in “The global rebar market remains under pressure from weak demand in the fall”, steel buyers should closely monitor the impact of the Pittini accident on rebar availability and pricing. Specifically, buyers dependent on Pittini’s output should immediately seek alternative supply sources to mitigate potential disruptions. Furthermore, the anticipated decrease in wire rod prices, as mentioned in “European longs prices continue to follow different trends,” presents a potential cost-saving opportunity for buyers of wire rod.