From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Faces Downturn: Weak Demand Drives Plant Activity Declines

Europe’s steel market is facing significant headwinds due to weakening demand, as evidenced by both market reports and observed plant activity. The situation in the long steel market is particularly concerning, as highlighted by “The global rebar market remains under pressure from weak demand in the fall” and “European long steel market struggles to gain traction amid limited demand“. Declining plant activity aligns with these articles and amplifies the negative outlook, especially in the context of Italian rebar producers suspending sales as stated in the article “European long steel market struggles to gain traction amid limited demand”.

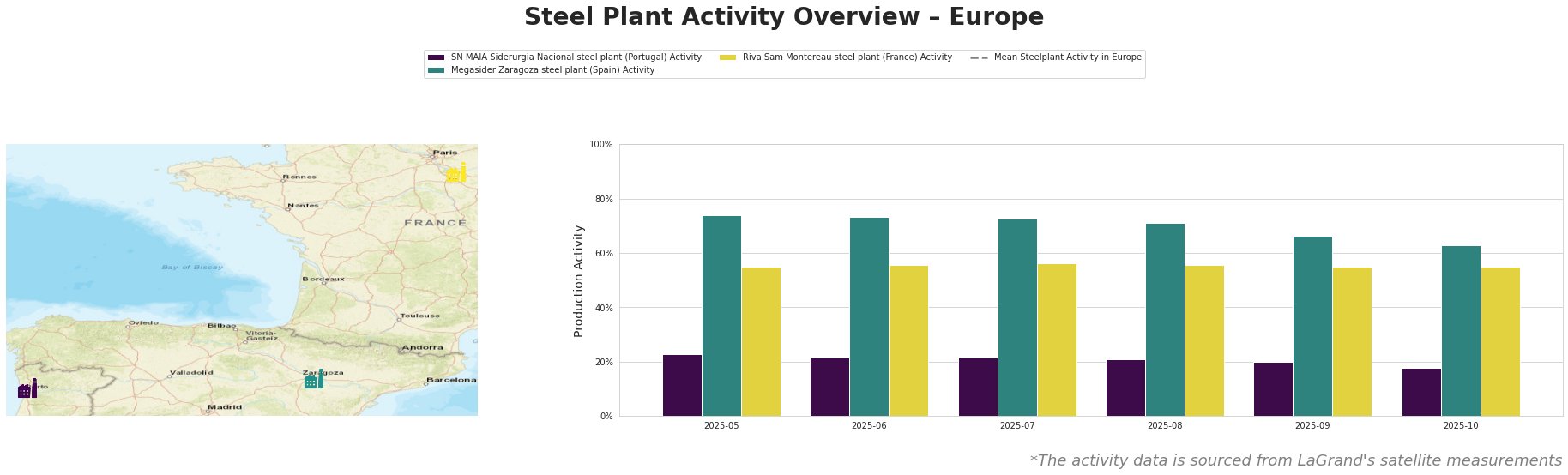

The overall trend indicates a decrease in steel plant activity across Europe from May to October 2025. The “Mean Steelplant Activity in Europe” experienced considerable fluctuations, dropping to its lowest in October. While the activity at Riva Sam Montereau remained relatively stable, SN MAIA Siderurgia Nacional and Megasider Zaragoza both experienced consistent declines.

SN MAIA Siderurgia Nacional steel plant, located in Porto, Portugal, operates an EAF with a crude steel capacity of 600 ttpa and produces rebar. The plant’s activity level has steadily decreased from 23% in May 2025 to 18% in October 2025. This consistent decline might be related to the weak demand and pricing pressures described in “The global rebar market remains under pressure from weak demand in the fall”.

Megasider Zaragoza steel plant in Zaragoza, Spain, also relies on EAF technology with a slightly smaller capacity of 500 ttpa, producing bar, rebar, and sections primarily for building and infrastructure. This plant’s activity saw a decrease from 74% in May 2025 to 63% in October 2025. This decline mirrors the overall European trend and could be related to pressure from suppliers as expressed in “Italian longs flatten amid weak demand, quiet exports“. The plant’s product portfolio is particularly impacted by the weakness in the long steel market.

Riva Sam Montereau steel plant, located in Île-de-France, France, has an EAF-based capacity of 720 ttpa, producing a range of products including rebar. Unlike the other two plants, its activity remained relatively stable at approximately 55%, between May and October 2025. No direct connection between this stable activity and the provided news articles can be explicitly established.

Given the declining activity at SN MAIA Siderurgia Nacional and Megasider Zaragoza, alongside reports of weak demand (“The global rebar market remains under pressure from weak demand in the fall”), buyers should be wary of potential supply disruptions, particularly in rebar and sections originating from Iberia. Given “Italian longs flatten amid weak demand, quiet exports” indicates that Spanish suppliers are actively selling in Italy at lower prices, indicating pressure on domestic mills, steel buyers should:

- Prioritize securing supply contracts with diversified suppliers: Mitigate risk by not relying heavily on single sources, especially those in regions showing significant production declines.

- Closely monitor price movements and supplier communications: Be prepared for potential price increases due to production cuts and proactively seek price protection mechanisms.

- Evaluate alternative product options: Consider alternative materials or product specifications to reduce dependence on specific suppliers facing production challenges.

- Actively negotiate contract terms: Use the current market weakness to negotiate favorable payment terms, volume discounts, or cancellation clauses to protect against further market deterioration.