From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Market Faces Price Volatility Amid CBAM Uncertainty and Production Disruptions

Europe’s steel market is facing increased price volatility and supply concerns as buyers react cautiously to the Carbon Border Adjustment Mechanism (CBAM) and production disruptions. According to the news article “European HRC factories continue to raise prices, but buyers are cautious amid CBAM and import market turmoil,” uncertainty around CBAM is a key factor in buyer hesitancy. The article “EU cold-rolled coil market eyes increasing tightness” highlights production disruptions impacting the cold-rolled coil (CRC) market, although no direct link to recent satellite activity could be established. “European HRC prices climb gradually; buying slow” confirms the price increases, partly driven by news of a fire at thyssenkrupp, and that prices are climbing amid slow buying activity, but again, there is no direct relationship that can be established with recent satellite observations.

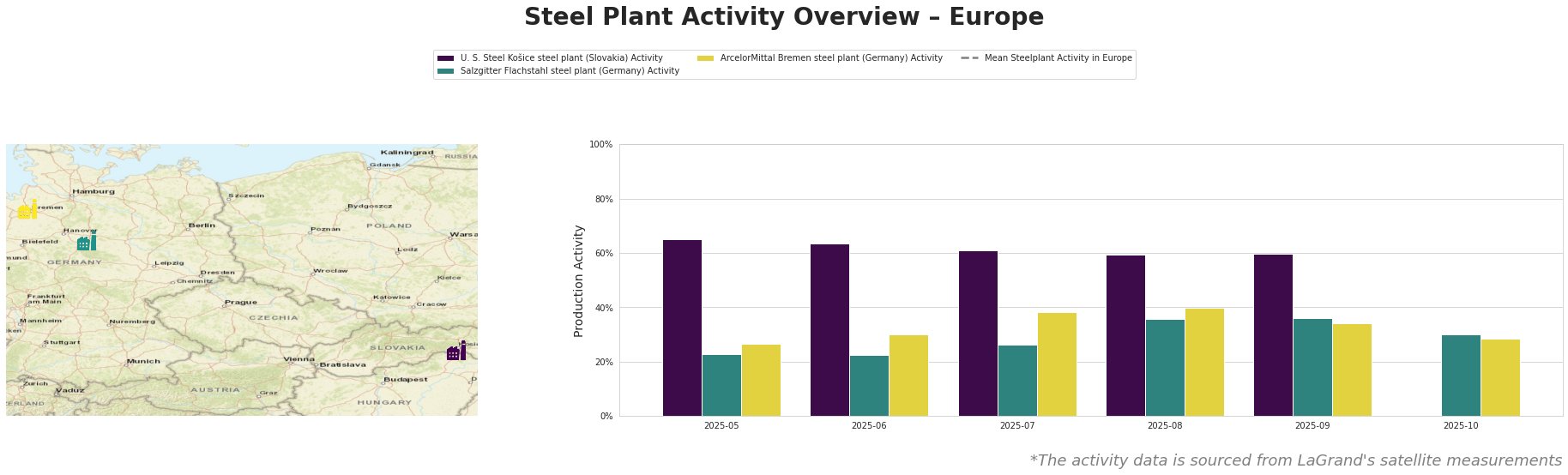

The mean steel plant activity in Europe has been volatile, peaking in July and August, then declining sharply in September and October.

U. S. Steel Košice steel plant, a major integrated steel producer in Slovakia with a 4.5 million tonne BOF capacity, saw a gradual decrease in activity from 65% in May to 59% in August, before a slight increase to 60% in September. There is no activity data available for October. No direct connection can be established between this trend and the provided news articles.

Salzgitter Flachstahl, a German integrated steel plant with a 5.2 million tonne BOF capacity focusing on flat steel products, experienced a fluctuating activity level, rising from 23% in May to 36% in August and September, before decreasing to 30% in October. These fluctuations don’t have an explicitly evident link to the provided news, although Salzgitter’s planned transition to hydrogen-based steel production (mentioned in its plant details) may influence future investment and production decisions, but this is not evident in the recent activity data.

ArcelorMittal Bremen, another German integrated steel plant with a 3.8 million tonne BOF capacity producing primarily flat rolled products, showed a steady increase in activity from 27% in May to 40% in August, followed by a decrease to 34% in September and 29% in October. Like U.S. Steel Košice and Salzgitter Flachstahl, the observed decline in activity at ArcelorMittal Bremen from August through October has no explicit connection to the provided news.

The news article “EU cold-rolled coil market eyes increasing tightness” discusses a fire at Marcegaglia’s Italian plant. There is no satellite activity data for the plant available, so it’s impossible to correlate activity to the news article.

The fire at Marcegaglia’s CRC plant, as highlighted in “EU cold-rolled coil market eyes increasing tightness“, exacerbates existing supply concerns related to import restrictions and quota changes. Despite mills trying to raise prices as discussed in “European HRC factories continue to raise prices, but buyers are cautious amid CBAM and import market turmoil,” the ongoing uncertainty and recent production disruptions indicate a negative overall market sentiment.

-

Supply Disruption: The fire at Marcegaglia, detailed in “EU cold-rolled coil market eyes increasing tightness“, is expected to tighten the CRC market, particularly in Italy, where domestic buyers are already redirecting sourcing.

-

Procurement Actions: Given the CRC supply tightness linked to the Marcegaglia fire and import restrictions noted in “EU cold-rolled coil market eyes increasing tightness“, steel buyers relying on CRC should:

- Secure orders well in advance to mitigate potential delays and price increases.

- Diversify sourcing options, exploring alternative suppliers within and outside the EU, considering the impact of CBAM and import duties on overall costs, as highlighted in “European HRC factories continue to raise prices, but buyers are cautious amid CBAM and import market turmoil“.

- For buyers operating in the UK, exploit the oversupply conditions described in the news article “EU cold-rolled coil market eyes increasing tightness” as a potential advantage.