From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUS-China Trade Deal Boosts Asian Steel: Yantai Walsin Surges Amid Tariff Easing

Progress in US-China trade relations is impacting Asian steel markets. News articles titled “Zölle und Tiktok: Offenbar Annäherung zwischen China und den USA,” “Treffen in Malaysia: Zölle, Tiktok: Vorläufige Einigung zwischen USA und China,” “Vorläufige Einigung im Zollstreit zwischen USA und China,” and “US, China Tee Up Sweeping Trade Deal For Trump, Xi To Finish” suggest a potential easing of trade tensions, which could stabilize and potentially increase demand for steel. This positive sentiment, as indicated in “Gipfel in Südkorea: Trump senkt die Zölle und China die Exportrestriktionen,” is correlated with increased activity at Yantai Walsin, although a direct causal link cannot be definitively established based solely on the provided information. While the news indicates a shift in global policy that impacts steel plants, the other plants do not directly correlate with the news provided.

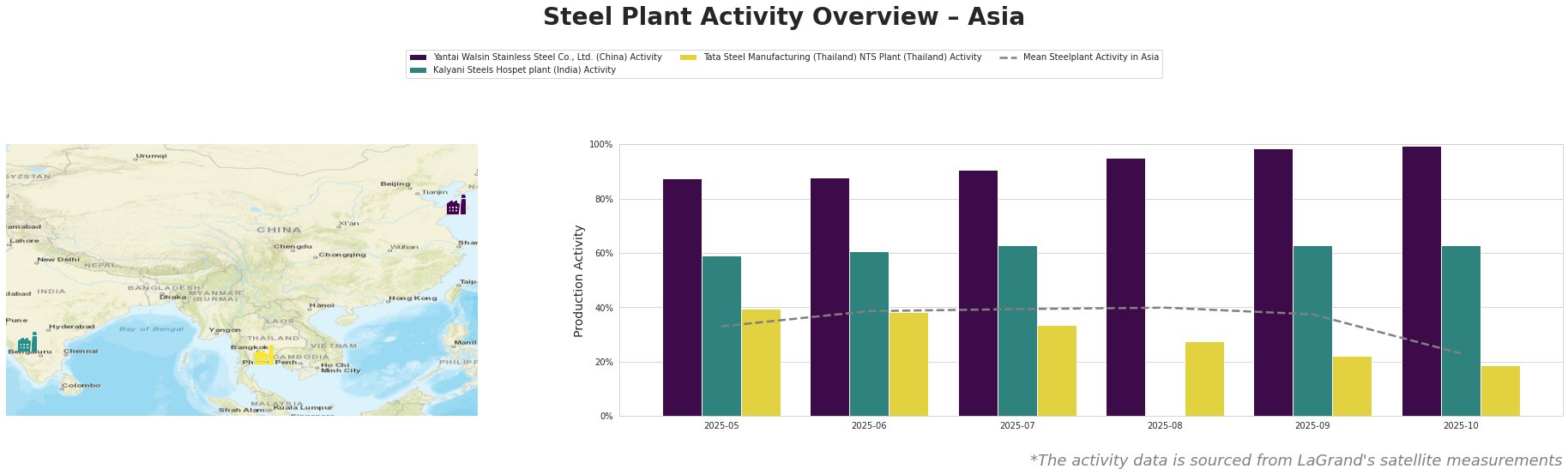

The average steel plant activity in Asia fluctuated, peaking in August 2025 at 40% and declining to 23% by October 2025. Activity at Yantai Walsin Stainless Steel Co., Ltd. steadily increased from 88% in May 2025 to 100% in October 2025, consistently exceeding the mean activity. Kalyani Steels Hospet plant showed moderate activity, ranging from 59% to 63% between May and October 2025. Tata Steel Manufacturing (Thailand) NTS Plant experienced a steady decline from 40% in May 2025 to 19% in October 2025, significantly below the mean.

Yantai Walsin Stainless Steel Co., Ltd., a Chinese steel plant specializing in stainless steel products with an EAF-based production of 1.4 million tonnes of crude steel annually, shows a consistent and substantial increase in activity. The plant’s activity has risen from 88% in May 2025 to reach its maximum observed level of 100% in October 2025. This increase could be linked to the news of easing trade tensions between the US and China, potentially anticipating increased export opportunities or domestic demand. The news articles “Zölle und Tiktok: Offenbar Annäherung zwischen China und den USA,” “Treffen in Malaysia: Zölle, Tiktok: Vorläufige Einigung zwischen USA und China,” “Vorläufige Einigung im Zollstreit zwischen USA und China,” and “US, China Tee Up Sweeping Trade Deal For Trump, Xi To Finish,” suggest a potential boost in trade activities, which may be influencing Yantai Walsin’s production.

Kalyani Steels Hospet plant, an integrated steel plant in India with a crude steel capacity of 860,000 tonnes using both BF and DRI routes, maintained a relatively stable activity level around 60% throughout the observed period. The satellite data shows a activity level of 63% in October of 2025, showing a minor increase. However, no direct connection to the provided news articles can be established based on the available information.

Tata Steel Manufacturing (Thailand) NTS Plant, an EAF-based steel plant with a capacity of 800,000 tonnes of crude steel, experienced a significant decline in activity. The plant’s activity dropped from 40% in May 2025 to 19% in October 2025. No direct correlation can be established between this decline and the provided news articles concerning US-China trade relations.

The observed increase in activity at Yantai Walsin, potentially linked to easing US-China trade tensions, alongside a decline in activity at the Tata Steel Thailand plant, suggests a possible shift in regional steel dynamics.

Evaluated Market Implications:

- Potential Supply Disruptions: The decline in activity at Tata Steel Thailand, if sustained, could lead to localized supply shortages, particularly for bars, rebars, and wire rods in the Thai construction sector.

- Procurement Actions:

- Steel Buyers: Given the increasing activity at Yantai Walsin and the potential for increased exports from China, steel buyers in regions that import stainless steel products should evaluate their sourcing strategies to potentially capitalize on competitive pricing from Chinese suppliers. Buyers should closely monitor policy shifts and news related to trade relations.

- Market Analysts: Analysts should monitor the sustainability of the activity changes at Yantai Walsin and Tata Steel Thailand, factoring in potential shifts in trade policies and regional demand dynamics. The US and China trade negotiations impact on specific product segments warrants further investigation.