From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChinese Steel Sector Remains Robust Despite EU Trade Measures: Activity Analysis

China’s steel sector demonstrates resilience amidst evolving global trade dynamics. While the “European Commission Unveils Major New Trade Measure to Shield EU Steelmakers Amid Global Overcapacity and Accelerate Green Transition“, the satellite-observed activity suggests limited immediate impact on key Chinese steel producers. No direct correlation between the EU trade measures discussed in the news articles, including “EU proposal considers trade agreements, value chains“ and “Overcapacity, protectionism impact European steel“, and the observed Chinese steel plant activity levels can be explicitly established based on the current data.

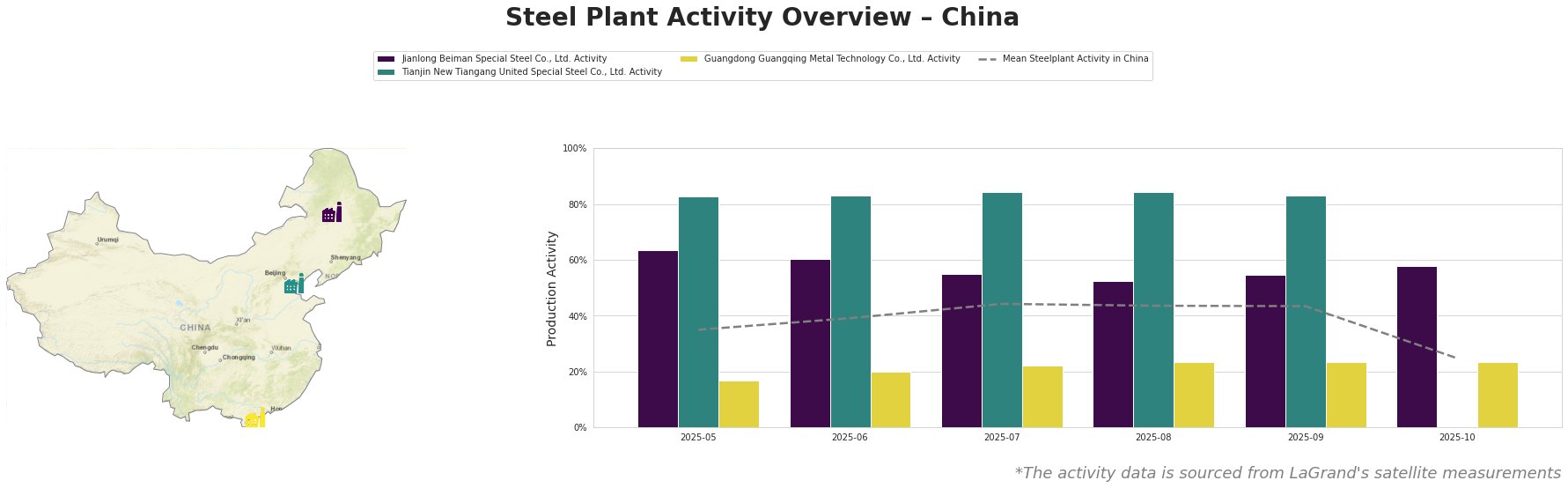

The mean steel plant activity in China experienced a peak in July and August at 44%, declining to 25% in October. The Tianjin New Tiangang United Special Steel Co., Ltd. Activity shows the highest consistent activity levels between 83% and 84% over the observed period but no value in October. Jianlong Beiman Special Steel Co., Ltd. maintained comparatively stable activity, hovering between 53% and 63%, showing only a slight decrease from May to August followed by a rise again. Guangdong Guangqing Metal Technology Co., Ltd. had the lowest activity initially at 17% in May, rising to 24% at the end of the observation period.

Jianlong Beiman Special Steel Co., Ltd., located in Heilongjiang, operates as an integrated steel plant with a crude steel capacity of 2200ktpa, producing semi-finished and finished rolled products like continuous casting round billet, stainless heat-resistant steel, tool steel, and bearing steel, using BF, BOF, and EAF technologies. Its activity levels have remained relatively stable, fluctuating between 53% and 63% across the observed months, ending at 58% in October, indicating consistent production despite global market shifts. No direct connection between the EU trade measures discussed in the news articles and the activity of this plant can be established.

Tianjin New Tiangang United Special Steel Co., Ltd. in Tianjin boasts a larger crude steel capacity of 4500ktpa, focusing on finished rolled and semi-finished products like angle steel and continuous casting billet, utilizing BF and BOF processes. Activity at this plant remained consistently high, ranging between 83% and 84% until September. No data is available for October. The high consistent levels of activity suggest robust domestic or regional demand. No direct connection between the EU trade measures discussed in the news articles and the activity of this plant can be established.

Guangdong Guangqing Metal Technology Co., Ltd., based in Guangdong, operates an electric steel plant with a crude steel capacity of 2000ktpa, manufacturing finished rolled products such as continuous casting billet, cold rolled steel coil, white coil, and black coil. Its activity gradually increased from 17% in May to 24% in September and October, which could indicate a response to growing regional demand, potentially unrelated to European market dynamics. The rise suggests increasing production and market share within its specific product segment. No direct connection between the EU trade measures discussed in the news articles and the activity of this plant can be established.

While the “European Commission Unveils Major New Trade Measure to Shield EU Steelmakers Amid Global Overcapacity and Accelerate Green Transition,” combined with concerns about “Overcapacity, protectionism impact European steel” and the measures discussed in “EU proposal considers trade agreements, value chains”, aim to reshape the global steel market, the direct impact on the observed Chinese steel plants is not immediately evident in the satellite data. The general decline in Chinese Steelplant Activity to 25% in October, however, may reflect preparation for winter production cuts, or reflect a real global demand shift.

Procurement Recommendations:

- Monitor Closely: Continue close monitoring of Chinese steel production data (especially for Guangdong Guangqing Metal Technology Co., Ltd. and Tianjin New Tiangang United Special Steel Co., Ltd.), as any potential future decline may indicate a broader shift in global trade flows as a delayed response to EU measures.

- Diversify Sourcing: Given the general decline in Chinese Steelplant Activity to 25% in October, and the potential for supply disruptions due to evolving trade policies, steel buyers should consider diversifying their sourcing to mitigate risks.

- Evaluate Regional Demand: Consider regional demand for angle steel and continuous casting billet from Tianjin New Tiangang United Special Steel Co., Ltd., or cold rolled steel coil, white coil, and black coil from Guangdong Guangqing Metal Technology Co., Ltd., as any disruptions could have an impact on local supply.