From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market: Trade Tensions Rise Amidst Steady Plant Activity

North American steel markets face uncertainty as trade talks between the US and Canada collapse, as reported in “Trump cancels trade talks with Canada“. This coincides with generally stable, albeit slightly declining, steel plant activity across North America. However, no direct link between the trade dispute and immediate changes in steel plant activity can be explicitly established based on provided data.

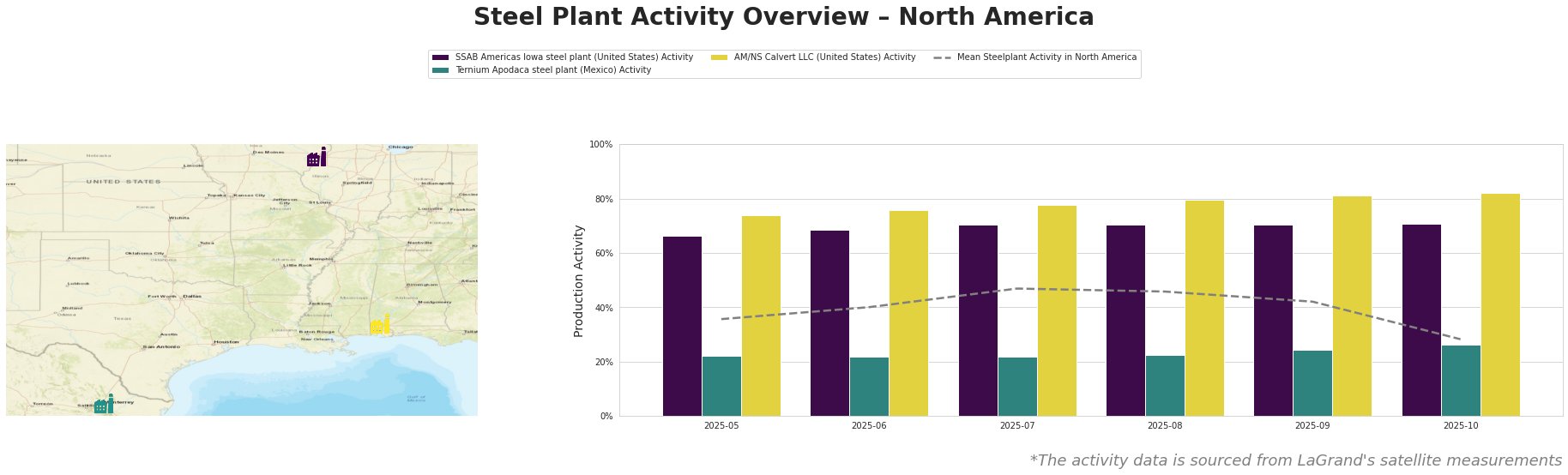

Here’s a summary of steel plant activity, displayed as percentage of all time high:

Overall, the mean steel plant activity in North America peaked in July at 47% and fell to 28% in October, a significant decline, but this cannot be directly linked to the trade tensions described in “Trump cancels trade talks with Canada“.

SSAB Americas Iowa steel plant: This US-based EAF steel plant, with a capacity of 1.25 million tonnes per annum, focuses on heavy plate and coil production for the energy and transportation sectors. The observed activity level has remained relatively stable, hovering around 70%, even increasing to 71% in October. There is no immediate apparent impact from the news reported in “Trump cancels trade talks with Canada” on the plant’s observed activity.

Ternium Apodaca steel plant: Located in Mexico, this EAF-based plant produces 600,000 tonnes of crude steel annually, specializing in billets and rebar for the building and infrastructure sectors. Its activity has shown a slow, steady increase from 22% in May to 26% in October. Given its Mexican location and the US-Canada specific nature of the trade dispute reported in “Trump cancels trade talks with Canada“, no direct connection can be established based on available information.

AM/NS Calvert LLC: Operating in Alabama, this EAF steel plant boasts a capacity of 1.5 million tonnes per annum, producing hot-rolled, cold-rolled, and coated sheet products for various sectors including automotive and energy. The plant exhibited a consistent increase in activity, rising from 74% in May to 82% in October. No direct impact from the news reported in “Trump cancels trade talks with Canada” on the plant’s observed activity can be established.

The cancellation of trade talks reported in “Trump cancels trade talks with Canada” introduces uncertainty regarding future steel trade policies and tariffs. Despite stable activity at the selected plants, the breakdown in negotiations could lead to future supply chain disruptions.

Procurement Actions:

* Monitor Policy Developments: Closely monitor the US Supreme Court ruling on the legality of tariffs, as noted in “Trump cancels trade talks with Canada,” and any subsequent policy changes impacting steel imports and exports.

* Evaluate Supplier Diversification: Given the potential for increased tariffs or trade barriers, assess alternative steel suppliers, particularly for Canadian steel, to mitigate potential price increases or supply disruptions.

* Review Contractual Clauses: Examine existing steel supply contracts, paying attention to clauses addressing tariffs, force majeure, and price volatility, to understand potential risks and liabilities.