From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Shows Resilience Despite EU Trade Shifts: Procurement Opportunities Emerge

Asia’s steel market exhibits robust activity amid potential shifts in global trade dynamics driven by the EU’s evolving steel safeguards. While the news focuses on Europe, the implications for Asian steel production and exports are significant. Observed plant activity reveals varying trends across key producers, but no direct relationship between the news articles regarding EU policies and these activities can be established.

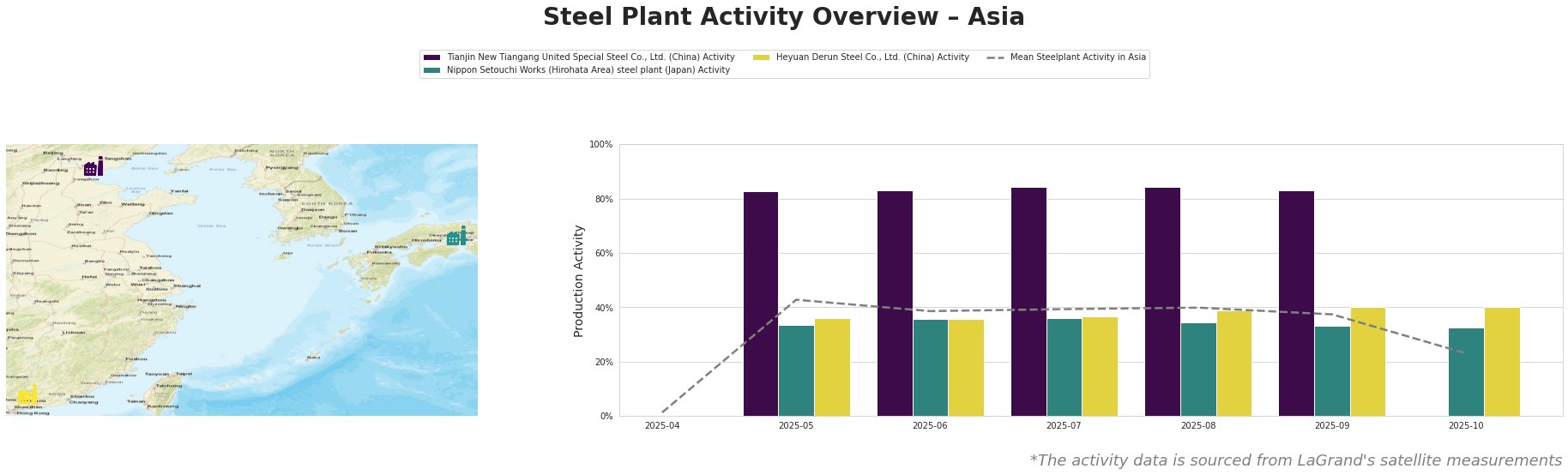

Overall, the mean steel plant activity in Asia has decreased significantly from 43% in May to 23% in October. Individual plant activity shows a less consistent trend, which is discussed in the following plant details.

Tianjin New Tiangang United Special Steel Co., Ltd., a major integrated steel producer in Tianjin, China, with a crude steel capacity of 4.5 million tonnes per annum (mtpa) via BOF technology, exhibited consistently high activity. From May to September, the activity remained relatively stable at approximately 83-84%, significantly above the Asian average. The sudden absence of activity data for October makes it impossible to further interpret this trend. Given the steel plant’s integrated production route and reliance on BF/BOF processes, developments related to EU policies, like the Carbon Border Adjustment Mechanism (CBAM) as described in “EU proposal considers trade agreements, value chains,” could indirectly impact its export competitiveness to Europe in the future, even though no impact is visible in the observed activity.

Nippon Setouchi Works (Hirohata Area) steel plant, located in the Kansai region of Japan, demonstrates a significantly lower level of activity compared to Tianjin New Tiangang. This plant has a crude steel capacity of 2.816 mtpa, predominantly through BOF processes. From May to October, activity fluctuated slightly between 33% and 36%. No direct connection between these observed fluctuations and the news articles concerning EU trade policies can be established.

Heyuan Derun Steel Co., Ltd., an EAF-based steel producer in Guangdong, China, with a crude steel capacity of 1.2 mtpa, shows a moderate level of activity. The activity rose steadily from 36% in May to 40% in September and remained stable in October. The increase is not significant, and no direct connection can be established between these activity levels and the reported EU trade policy changes in the news articles.

With potential trade shifts arising from the EU’s evolving trade policies, as discussed in “Commission trade proposal a ‘major shift’, says Motyka,” Asian steel buyers should:

-

Closely monitor the availability and pricing of semi-finished steel products, especially billets and rebar, from producers such as Heyuan Derun Steel. “The quotas proposed by the EU may reflect changes in the market” by including such products.

-

Assess potential supply chain adjustments for finished rolled products due to EU trade policy shifts, which may affect demand from plants like Tianjin New Tiangang United Special Steel.