From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOceania Steel: Mixed Activity Signals Amidst EU Market Uncertainty

Oceania’s steel market presents a mixed picture, with varying plant activity levels alongside unease surrounding EU market dynamics due to regulatory changes. While EU HRC prices remain stable according to “EU HRC prices hold steady; market seeks direction at Blechexpo” and “HRC prices in the EU remain stable; the market is looking for a direction at Blechexpo,” no direct relationship can be established between these European trends and the observed activity levels in Oceania. The news articles “Fresh bookings in European domestic HRC market; buyers resist price rises” and “New orders on the domestic HRC market in Europe; buyers resist price increases” highlight buyer resistance to price increases in Europe due to uncertainty around CBAM, suggesting potential implications for global steel trade, although these cannot be directly linked to the production activity levels in Oceania.

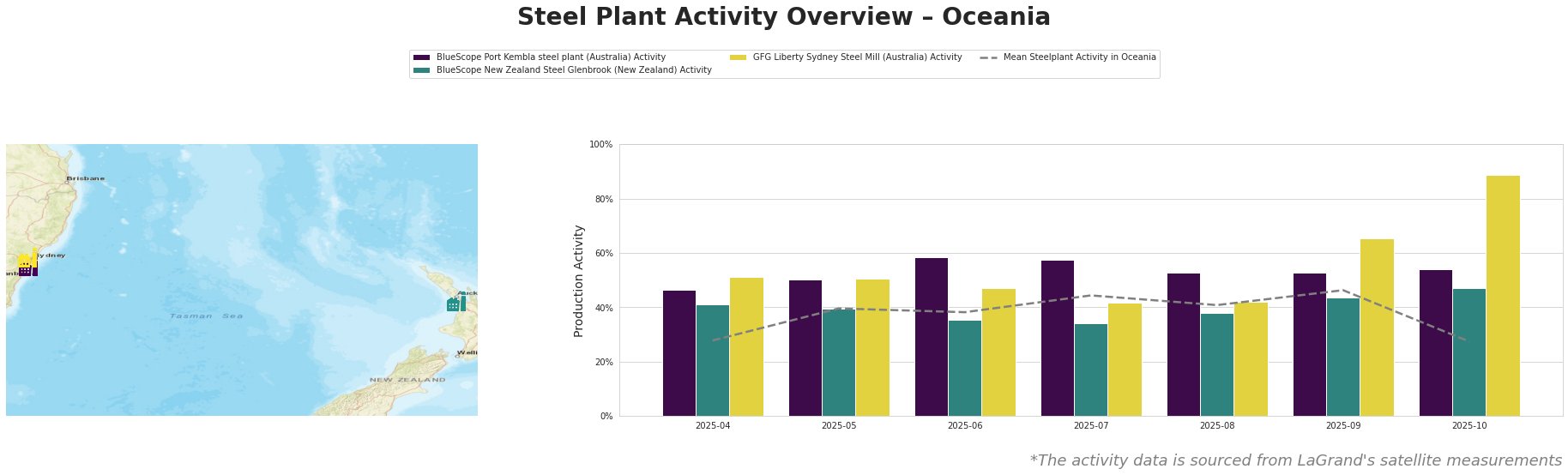

The average steel plant activity in Oceania fluctuated, peaking at 46% in September before falling to 27% in October. BlueScope Port Kembla has shown consistent activity levels, ranging from 46% to 58%, with no dramatic drops or rises. BlueScope New Zealand Steel Glenbrook experienced a low of 34% activity in July and reached 47% in October. GFG Liberty Sydney Steel Mill saw a sharp increase in activity, from 65% in September to 89% in October. No direct connection can be established between these Oceania activity levels and the European steel market news.

BlueScope Port Kembla, an integrated steel plant in New South Wales with a 3.2 million tonnes per annum (ttpa) BOF capacity, primarily produces slabs, hot-rolled coil, and plate for the building and infrastructure sectors. The plant has consistently operated above the Oceania average, reaching 58% activity in June, settling at 54% activity in October. As there are no significant drop in activity, there is no direct indication of impacts from the European CBAM uncertainty.

BlueScope New Zealand Steel Glenbrook, located in South Auckland, operates an integrated DRI-based steel plant with a capacity of 650,000 ttpa. The plant produces slabs, hot and cold-rolled products for building, packaging, and machinery. While the plant’s activity remained below the Oceania average until October, reaching 47% activity, no explicit connection can be made to recent European HRC market dynamics or the CBAM-related uncertainties mentioned in the news articles.

GFG Liberty Sydney Steel Mill, an EAF-based plant in New South Wales with a 750,000 ttpa capacity, specializes in long products, including reinforcing bar and mesh, for building, energy, and transport sectors. The mill’s activity surged to 89% in October, significantly exceeding the Oceania average, however, no direct link can be established between this upswing and the provided news articles.

Given the neutral market sentiment and stable activity at BlueScope Port Kembla and BlueScope New Zealand Steel Glenbrook, along with a significant rise at GFG Liberty Sydney Steel Mill, steel buyers should:

* Monitor GFG Liberty’s output closely. The sharp increase in activity to 89% in October could signal increased availability of long products. Buyers reliant on these products should engage with GFG Liberty to explore potential procurement opportunities.

* Closely monitor steel production in November. While the European HRC market is responding to uncertainty with the CBAM, October numbers show a sharp decline in Oceania steel plant activity, driven primarily by a significant drop in the mean activity. Steel buyers should carefully monitor the output of their Oceania suppliers, as there is a heightened risk of supply disruptions.