From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: CBAM Uncertainty & Cautious Buyers Signal Ongoing Price Fragility

European steel markets face continued fragility as buyers remain cautious amid uncertainty surrounding the Carbon Border Adjustment Mechanism (CBAM) and new trade measures. This aligns with the sentiment expressed in “European HRC buyers stay cautious; mills push for higher prices amid policy-driven optimism” and “European HRC mills persist with price hikes, but buyers cautious amid CBAM and import market disorder“. However, no direct relationship could be established between these articles and the satellite-observed changes in plant activity levels.

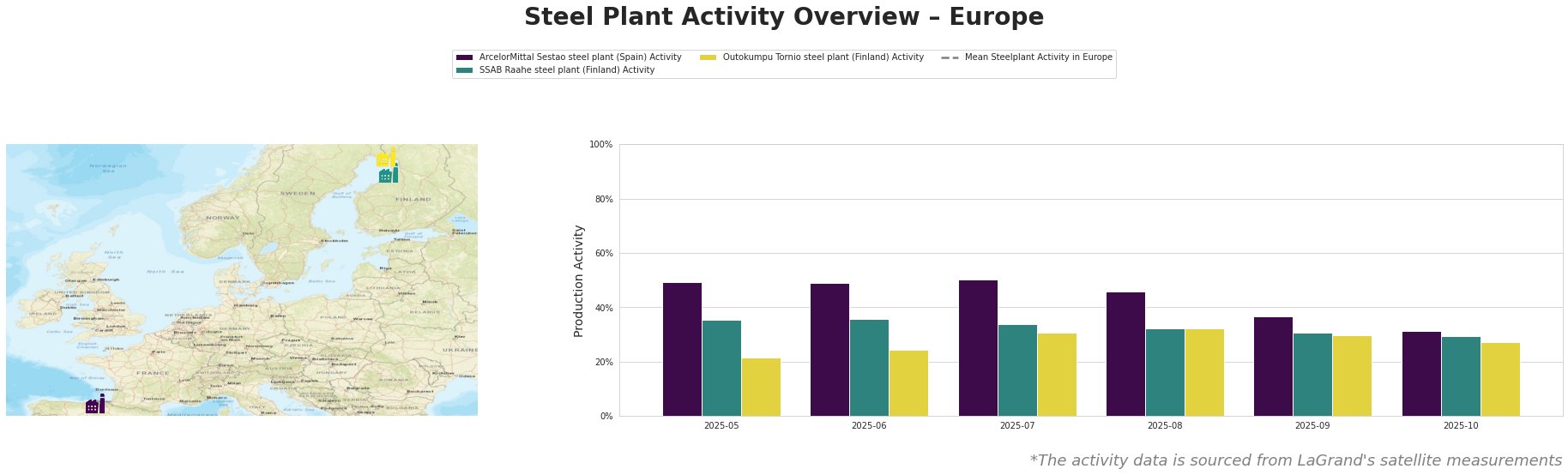

Overall, the mean steel plant activity in Europe has shown a decreasing trend, from 407779664.0 in July and August, to 271853108.0 in October. All three plants decreased their activity in the period, reflecting a general slowdown. The ArcelorMittal Sestao plant shows the most pronounced decrease in activity, from 50% in July to 31% in October.

ArcelorMittal’s Sestao plant, a 2 million tonne EAF-based HRC producer relying on 100% renewable energy and DRI from Gijon, saw its activity fall significantly from 50% in July to 31% in October. This drop does not directly correlate with any of the provided news articles, so a direct connection could not be established. Given its EAF process, Sestao is less directly impacted by CBAM initially, but uncertainty around the mechanism could influence production decisions.

SSAB’s Raahe plant, a 2.6 million tonne integrated BF/BOF producer, experienced a steady decline from 36% activity in June to 29% in October. This is slightly below the average decrease in observed steel plant activity. Although SSAB aims to transition to EAF production by 2030, its current reliance on BF/BOF makes it particularly sensitive to CBAM and import regulations, however, we cannot establish any explicit connection between these issues and the plant’s observed activity.

Outokumpu’s Tornio plant, a 1.2 million tonne EAF-based stainless steel producer using recovered process gasses, showed a decrease in activity from 32% in August to 27% in October. This plant’s lower activity compared to the other two could be attributed to the current prices of stainless steel, however, there is no clear evidence in the provided news articles to explain this.

Evaluated Market Implications:

Considering the observed decline in steel plant activity and the cautious market sentiment highlighted in “European HRC buyers stay cautious; mills push for higher prices amid policy-driven optimism” and “European HRC mills persist with price hikes, but buyers cautious amid CBAM and import market disorder,” procurement professionals should anticipate potential supply disruptions, especially for HRC. Given ArcelorMittal Sestao’s significant activity decrease from 50% to 31%, buyers relying on its HRC production may experience longer lead times.

Recommended Procurement Actions:

- Diversify HRC suppliers: Given the uncertainty surrounding CBAM and its impact on import prices, as well as observed production slowdowns, proactively diversify HRC sourcing to mitigate risks associated with individual plant disruptions. Explore alternative European suppliers, particularly those less reliant on imported raw materials.

- Negotiate index-linked contracts: As suggested in “European factories are delaying roll production due to uncertainty“, index-linked contracts might become more prevalent. Evaluate the feasibility of such contracts to manage price volatility, but carefully assess the underlying index’s relevance to your specific steel grades and supply chain.

- Monitor CBAM developments closely: The news articles emphasize the significant market uncertainty surrounding CBAM. Continuously monitor official announcements and interpretations of the CBAM regulations to adapt procurement strategies accordingly, particularly in relation to import decisions. Specifically, assess the CBAM costs for imports from different countries to make informed sourcing decisions.