From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Market Faces Uncertainty Amidst Ukraine Aid Disputes and Supply Chain Concerns

Europe’s steel market faces uncertainty as EU leaders grapple with internal disputes over Ukraine funding and potential repercussions from supply chain regulations. Specifically, observed activity fluctuations at key steel plants may reflect these broader political and economic tensions.

The EU summit, as reported in “EU-Staaten zerstreiten sich über Ukraine-Finanzierung” and “Gipfel in Brüssel: EU-Staaten zerstreiten sich über Ukraine-Finanzierung,” highlighted disagreements on utilizing frozen Russian assets to aid Ukraine. The article “Lieferkettenrichtlinie: Merz nennt EU-Votum „fatale Fehlentscheidung“ – und warnt vor den Folgen” suggests potential disruptions stemming from the EU’s supply chain law. While these political issues are discussed, no direct links to immediate changes in European steel plant activity levels can be explicitly established based on the provided news articles.

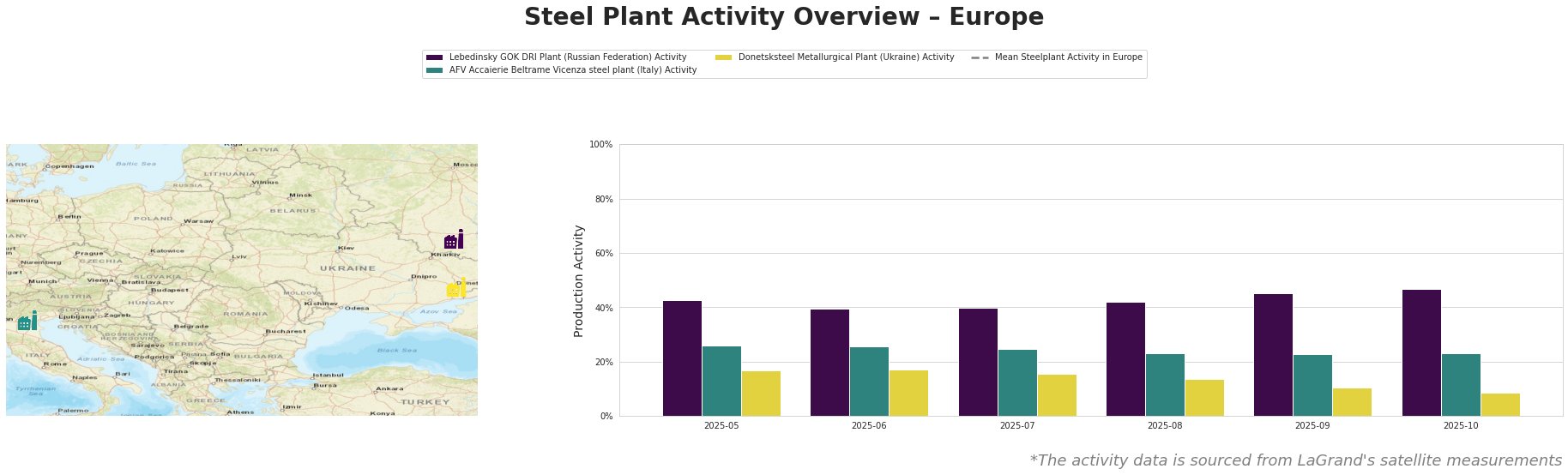

The data shows that the mean steel plant activity in Europe shows considerable fluctuations. Lebedinsky GOK DRI Plant activity has seen a gradual increase from 43% in May to 47% in October. AFV Accaierie Beltrame Vicenza steel plant experienced a slight activity decrease, fluctuating between 26% and 23% during the observed period. Donetsksteel Metallurgical Plant saw a significant activity decrease, from 17% in May to 9% in October.

Lebedinsky GOK DRI Plant, located in Belgorod, Russia, possesses a DRI production capacity of 4.5 million tonnes per annum. As a major producer of HBI (DRI), its activity has steadily increased from 43% in May to 47% in October. Given the ongoing EU discussions around sanctions against Russia, outlined in “Worüber auf dem EU-Gipfel debattiert wird“, steel buyers should closely monitor potential disruptions to HBI supply chains originating from this plant, although no direct sanctions impact on plant activity can be confirmed from the data.

AFV Accaierie Beltrame Vicenza steel plant, an EAF-based producer in Italy with a capacity of 1.2 million tonnes of crude steel, primarily serves the building, infrastructure, tools, machinery, and transport sectors. Its activity has remained relatively stable, fluctuating between 26% and 23% over the observed months. No clear connection between this minor activity variation and the cited news articles could be established.

Donetsksteel Metallurgical Plant, located in Donetsk, Ukraine, has a blast furnace ironmaking capacity of 1.5 million tonnes. Its observed activity shows a concerning decline from 17% in May to 9% in October, reflecting the ongoing conflict in the region. Given the EU’s discussions on aid for Ukraine, discussed in “EU-Staaten zerstreiten sich über Ukraine-Finanzierung“, this plant’s struggles underscore the significant supply chain risks associated with relying on steel production in conflict zones.

The articles “EU-Staaten zerstreiten sich über Ukraine-Finanzierung,” “Gipfel in Brüssel: EU-Staaten zerstreiten sich über Ukraine-Finanzierung,” and “Kommentar zu Merz beim EU-Gipfel: Tacheles allein reicht nicht” highlight the EU’s struggle to finalize financial support for Ukraine. The activity decline at Donetsksteel further emphasizes these risks. Steel buyers should prioritize diversifying their supply chains away from conflict regions and consider sourcing alternatives to pig iron to mitigate potential disruptions. Given the ongoing political debates highlighted in “Lieferkettenrichtlinie: Merz nennt EU-Votum „fatale Fehlentscheidung“ – und warnt vor den Folgen“, buyers should also prepare for potential cost increases associated with complying with evolving EU supply chain regulations, though the specific impacts remain unclear.