From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Resilient Amid Gold-Driven Uncertainty: KSP Steel Boosts Output

Asia’s steel market demonstrates resilience amidst global economic uncertainties, notably a surge in gold prices. The observed plant activity changes, specifically an increase at KSP Steel, do not directly correlate with the factors driving gold prices described in articles such as “Trump’s Geopolitics and Tariffs have overheated Gold” or “WGC: Gold is still in a good position“. Despite this lack of direct causation, geopolitical and economic uncertainties mentioned in these articles may have contributed to broader market dynamics influencing steel production indirectly.

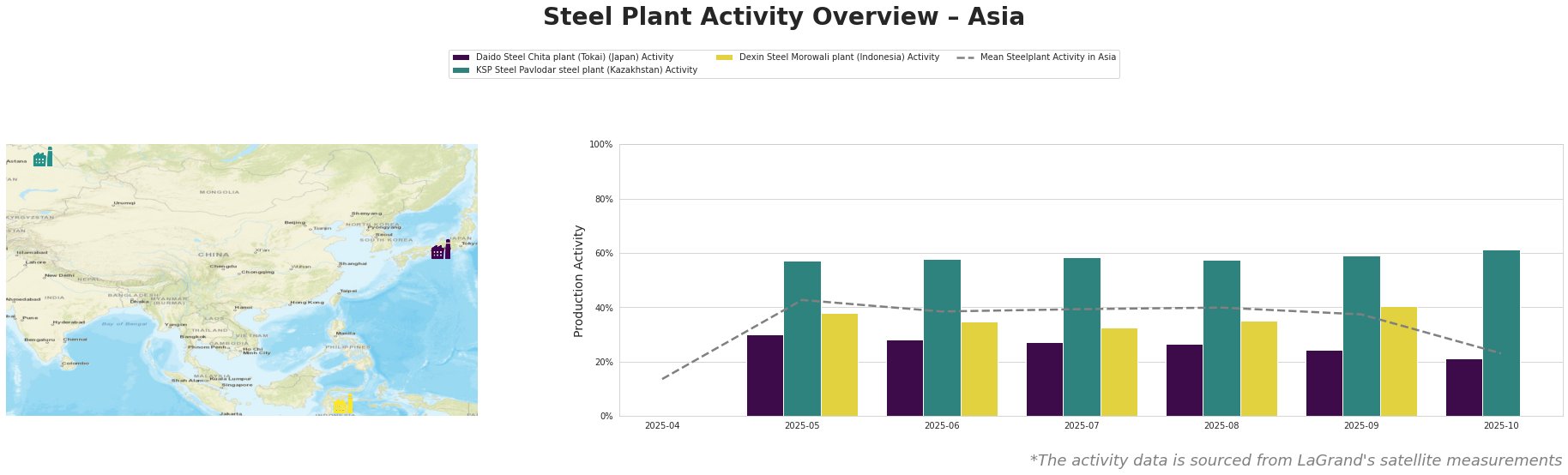

Observed activity levels across the three monitored steel plants in Asia are shown below:

The mean steel plant activity in Asia rose sharply from 14% in April to 43% in May before gradually declining to 23% by October. Daido Steel Chita plant showed a steady decline in activity from 30% in May to 21% in October. KSP Steel Pavlodar steel plant consistently operated above the mean, peaking at 61% in October. Dexin Steel Morowali plant’s activity fluctuated, peaking at 40% in September, before data became unavailable.

Daido Steel Chita plant (Tokai): This Japanese plant, with a 1.5 million tonne EAF capacity, focuses on high-grade specialty steels for the automotive and tooling sectors. Its activity consistently decreased from 30% in May to 21% in October. There is no direct link between this decline and the gold market news.

KSP Steel Pavlodar steel plant: Located in Kazakhstan, this plant boasts an 800,000-tonne EAF capacity, producing semi-finished and finished rolled products. Activity increased from 57% in May to 61% in October, consistently above the Asian mean. There is no direct link between this rise and the gold market news; however, this rise might indicate increased domestic or regional demand not directly tied to global uncertainties affecting gold prices.

Dexin Steel Morowali plant: This Indonesian integrated BF-BOF plant, with a 3.5 million tonne crude steel capacity, produces wire rod, slabs, bars, and billets. Activity fluctuated between 33% and 40% from May to September, with no data available for October. No connection between its activity and the gold market news can be established.

Evaluated Market Implications:

Despite the rise in gold prices and related market concerns discussed in articles like “Alfa Investor: Will gold rise in price to $10,000,” steel production at KSP Steel in Kazakhstan is increasing, suggesting regional demand is healthy.

Recommended Procurement Actions:

Steel buyers focused on the Central Asian market should consider securing supply contracts with KSP Steel. Given the consistent high activity levels, anticipate potential lead time extensions and negotiate contracts proactively to mitigate risks. For consumers relying on Dexin Steel Morowali in Indonesia, actively monitoring future activity levels and seeking alternative suppliers may be prudent due to the lack of recent data.