From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: EU Trade Changes Impacting Indian Exports, Mixed Plant Activity Signals

The Asian steel market is reacting to trade dynamic shifts with the EU, particularly impacting Indian HRC export prices as highlighted in “India-EU coil prices drop on proposed safeguard changes” and “Coil prices in India and the EU have decreased due to proposed changes in protective measures“. These articles attribute the price drops to the European Commission’s proposal to reduce quotas and increase tariffs, creating uncertainty among Indian exporters. While these articles focus on pricing and policy impacts, no direct relationship could be established to specific plant activity levels via satellite observation.

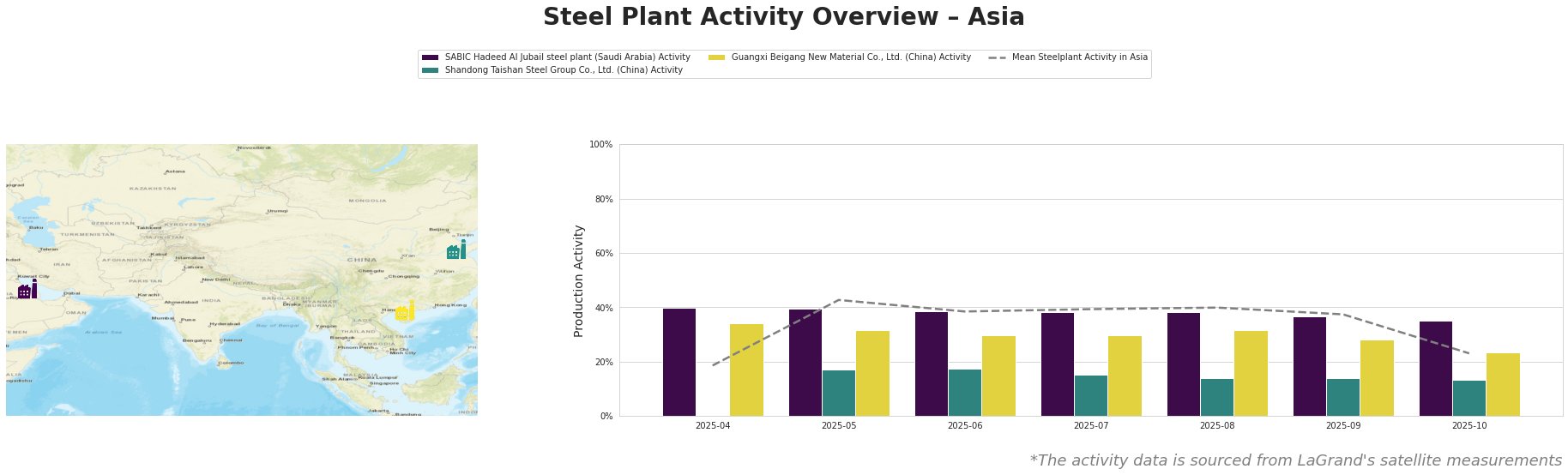

The average steel plant activity across Asia shows a significant drop in October 2025, falling to 23% from a high of 43% in May.

SABIC Hadeed Al Jubail steel plant in Saudi Arabia, a major producer utilizing DRI and EAF technologies with a 6000 ttpa crude steel capacity, has shown relatively stable activity. Starting at 40% in April, activity gradually decreased to 35% by October. This plant’s activity consistently exceeded the Asian mean. No direct link between the observed activity and the news articles could be established.

Shandong Taishan Steel Group Co., Ltd. in China, an integrated BF-based steel plant with 5000 ttpa crude steel capacity and focus on hot and cold rolled coil, had consistently low activity levels, ranging from 13% to 18%. Its activity level is far below the mean steel plant activity level in Asia. The plant’s activity remained consistently low with a marginal drop from 17% in May to 13% in October. No direct link between the observed activity and the news articles could be established.

Guangxi Beigang New Material Co., Ltd. in China, producing hot and cold rolled coil using BF and EAF technologies with a 3400 ttpa crude steel capacity, demonstrated higher activity than Shandong Taishan, though lower than SABIC Hadeed. The plant began with 34% activity in April but fell to 23% in October, mirroring the Asian average trend. No direct link between the observed activity and the news articles could be established.

Evaluated Market Implications:

Based on the provided information, the proposed EU trade policy changes are creating price pressure for Indian HRC exports. The news articles indicate a cautious approach from Indian exporters, suggesting potential adjustments in production or export strategies. The rapid filling of EU import quotas mentioned in “Steel quotas vanish fast for some products as EU buyers race ahead of CBAM” suggests increased demand in the short term to avoid future tariffs.

Recommended Procurement Actions:

- For steel buyers reliant on Indian HRC: Monitor quota allocations and FTA negotiations between India and the EU, as mentioned in “India-EU coil prices drop on proposed safeguard changes” and “Coil prices in India and the EU have decreased due to proposed changes in protective measures“. Consider securing supply in the short term if EU demand continues to surge due to CBAM anticipation.

- For steel analysts: Closely track European steel prices, monitoring for increases due to CBAM implementation in 2026 as suggested in “European prices to rise, conditions remain difficult“. Evaluate alternative supply chains to mitigate potential disruptions.