From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Steel Market: HRC Price Resistance & Plant Activity Dip Signal Uncertainty

Italy’s steel market faces headwinds driven by rising HRC prices and declining plant activity. The situation is compounded by buyer resistance to price hikes, as indicated in “European HRC prices face upward pressure despite buyer resistance over impending trade measures” and “European HRC prices rise as mills push for higher levels as expected“. While no direct connection to plant activity can be explicitly established from the named news articles, the general market hesitancy coincides with observed output decreases.

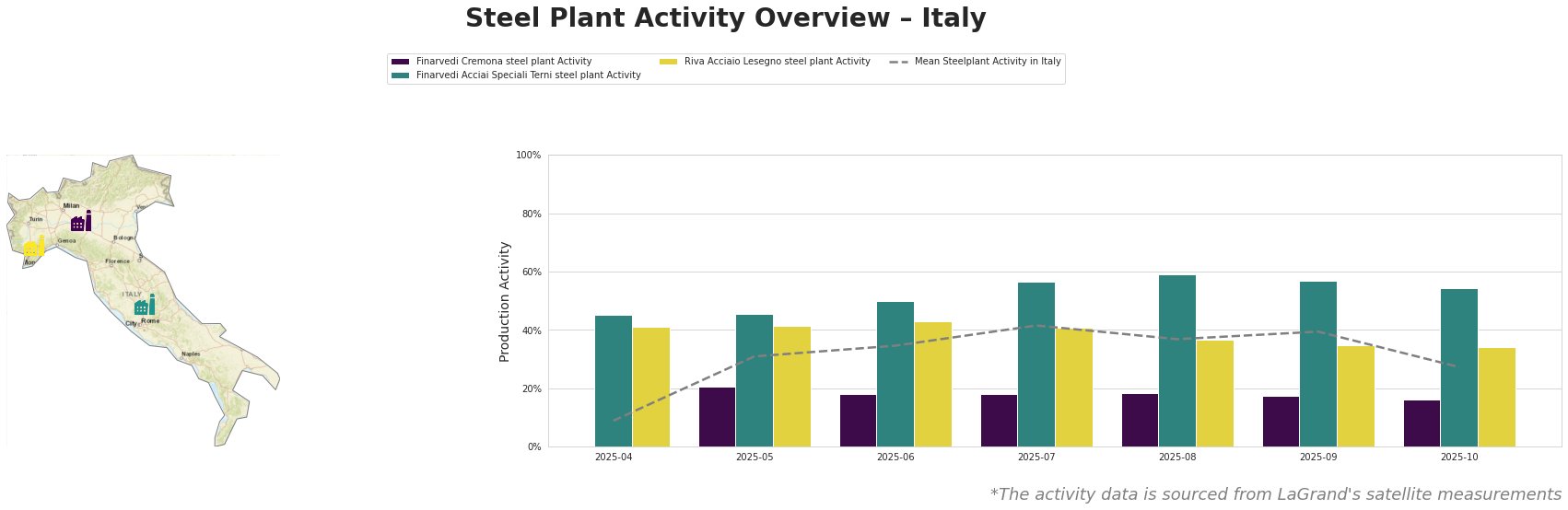

The mean steel plant activity in Italy decreased from 39% in September to 27% in October. Finarvedi Cremona, a plant focusing on hot rolled coil and galvanized products with a 3850 ttpa EAF capacity, showed a slight decrease, from 17% to 16%, a relatively low activity level over the observed period. Finarvedi Acciai Speciali Terni, producing stainless steels and forged products with a 1450 ttpa EAF capacity, saw a decrease from 57% to 54%, but the plant’s activity still remains significantly above the Italian average. Riva Acciaio Lesegno, producing billets and rods with a 600 ttpa EAF capacity, experienced a similar decline, from 35% to 34%. No direct connection between these activity changes and the cited news articles can be explicitly established.

The anticipation of CBAM’s impact, as highlighted in “CBAM effect pushes up prices, demand in Europe’s heavy steel plate market,” could be contributing to market uncertainty, although there is no observed impact on plant activity from the available data.

Given the buyer resistance to HRC price increases and the observed decline in average plant activity, steel buyers should prioritize short-term procurement strategies, closely monitor price fluctuations, and carefully evaluate inventory levels. Buyers should delay large-volume purchases until price stabilization and consider diversifying suppliers to mitigate potential risks arising from CBAM and safeguard regulations. The high activity levels at Finarvedi Acciai Speciali Terni suggests stainless steel product availability may be less constrained than other steel categories.