From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Poised for Growth: CBAM Impact Uncertain Amidst Fluctuating Plant Activity

The Asian steel market presents a mixed outlook. While overall sentiment leans positive, European demand shifts driven by the upcoming Carbon Border Adjustment Mechanism (CBAM) may create both opportunities and challenges. Activity levels at key regional steel plants have shown recent fluctuations, the direct drivers of which are not possible to attribute with current information. This report analyzes these dynamics to provide actionable insights.

European buyers are actively managing their steel procurement strategies in anticipation of CBAM, as highlighted in “Steel quotas vanish fast for some products as EU buyers race ahead of CBAM.” This surge in demand is primarily impacting flat steel products. While the article notes that long steel markets remain largely stable due to existing import pressures, understanding the broader Asian steel production landscape is critical. Unfortunately, it is not possible to directly link news from the EU markets with steel plant activity in Asia.

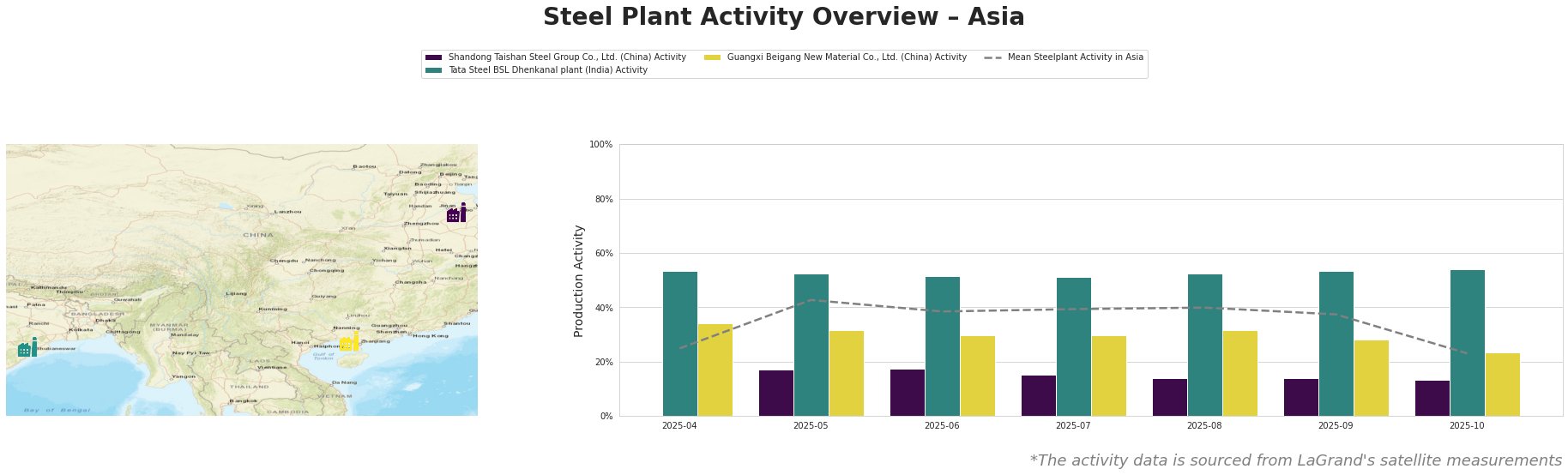

The mean steel plant activity in Asia fluctuated considerably over the observed period, peaking at 43% in May before declining to 23% in October.

Shandong Taishan Steel Group Co., Ltd., a Chinese integrated steel producer with a 5000ktpa crude steel capacity focusing on hot-rolled coil (HRC) and cold-rolled coil (CRC), has shown a consistent downward trend in activity, decreasing from 17% in May to 13% in October. No direct connection can be established between this decline and the European market dynamics discussed in the provided news articles.

Tata Steel BSL Dhenkanal plant, an Indian integrated steel plant with both BF and DRI production routes and a 5600ktpa crude steel capacity, has maintained a relatively stable activity level, hovering around 51-54% throughout the observed period. Its product portfolio includes HRC and cold-rolled products. No connection can be established between the EU market situation and the stable activity at this plant.

Guangxi Beigang New Material Co., Ltd., a Chinese steel plant relying on both BF and EAF routes and a ferronickel capacity of 3400ktpa and a crude steel production capacity of 3400ktpa, experienced a decrease in activity from 34% in April to 23% in October. The company produces a mix of products including cold-rolled coil, hot-rolled coil, nickel-chromium alloy slab, square tube, and round tube. Again, the decline in activity cannot be attributed to the news about European steel market activity in anticipation of CBAM.

Evaluated Market Implications:

The observed data paints a picture of stable, yet fluctuating steel production in Asia. The upcoming CBAM, as reported in “Steel quotas vanish fast for some products as EU buyers race ahead of CBAM,” could potentially shift European demand towards Asian suppliers. However, the European steel market situation cannot be directly connected with steel plant activity in Asia, according to the data provided.

Recommended Procurement Actions:

Given the stable activity levels at Tata Steel BSL, steel buyers seeking a reliable source of HRC in Asia should consider engaging with them to understand their export capabilities and pricing strategies, as well as future growth capabilities. Given the recent news of improved demand in the EU market, the Tata Steel BSL plant can serve as a source of stability for steel buyers.