From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina’s Steel Export Surge Defies Expectations, India’s Plant Activity Mixed

Asia’s steel market shows diverging trends, influenced by China’s rising exports and varying plant activity levels across the region. China’s increased steel exports are highlighted in three news articles: “China increased steel exports by 9.2% y/y in January-September,” “China’s Steel Exports Rise by 9.2% in the First Nine Months of 2025,” and “China’s steel exports again above 10 million mt in Sept, up 9.2 percent in Jan-Sept.” While increased exports could be correlated to domestic steel plant activity, a direct relationship between increased Chinese export and satellite-observed Chinese plant activity levels for Jianlong Xilin Iron and Steel Co., Ltd. cannot be explicitly established based on the information provided.

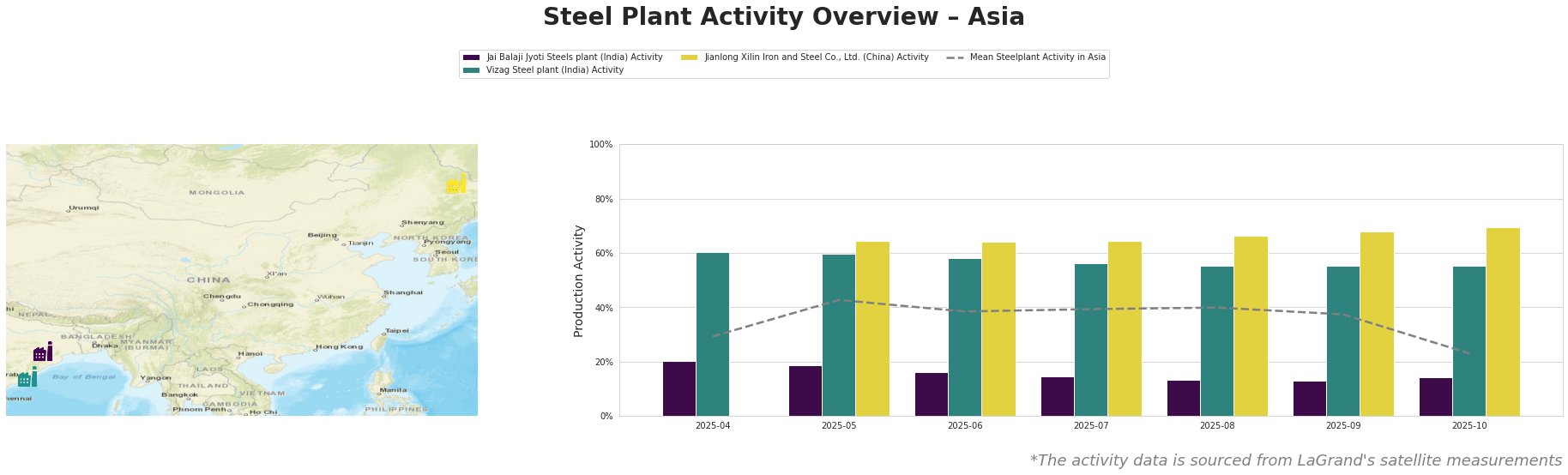

The mean steel plant activity in Asia shows fluctuation, peaking at 43% in May 2025 and dropping to 23% by October 2025. Activity at Jai Balaji Jyoti Steels plant in India has shown a consistent decline, reaching its lowest point of 13% in August and September before slightly recovering to 14% in October, significantly below the Asian mean. Vizag Steel plant in India has shown relatively stable activity, fluctuating between 60% and 55% during the observed period, consistently outperforming the Asian mean. Jianlong Xilin Iron and Steel Co., Ltd. in China exhibited a steady increase in activity, rising from 64% in May to 70% in October, also consistently above the Asian mean.

Jai Balaji Jyoti Steels plant, located in Odisha, India, operates as an integrated DRI-EAF based steel plant with a crude steel capacity of 92 ttpa. Activity levels at this plant have consistently decreased between April and September 2025, from 20% to 13%, before experiencing a slight uptick to 14% in October. The decline in activity is markedly below the average Asian steel plant activity. No direct connection can be established between the observed activity drop and the news articles concerning China’s steel exports.

Vizag Steel plant, situated in Andhra Pradesh, India, utilizes the BF-BOF route with a crude steel capacity of 7300 ttpa, significantly higher than Jai Balaji. Activity at Vizag Steel has been relatively stable, ranging between 55% and 60% and is considerably higher than the Asian mean activity during the observed period. There is no explicitly identifiable link between Vizag Steel’s stable activity and the news articles on China’s steel exports.

Jianlong Xilin Iron and Steel Co., Ltd., based in Heilongjiang, China, uses the BF-BOF process with a crude steel capacity of 4200 ttpa. The plant’s activity has shown a consistent increase from May to October 2025, from 64% to 70%, indicating strong operational performance. While China’s overall export increase is reported in the news articles, no direct connection can be explicitly established between these reports and the increasing activity at Jianlong Xilin Iron and Steel Co., Ltd.

Given the increasing steel exports from China as highlighted in the provided news articles, and the increasing activity at Jianlong Xilin Iron and Steel Co., Ltd., steel buyers should anticipate potential competitive pricing from Chinese steel. However, buyers should closely monitor shipping costs and lead times, as increased export volume might strain logistical infrastructure. The consistent low activity at Jai Balaji Jyoti Steels plant, producing DRI-based steel, might indicate potential supply constraints for buyers relying on this plant, and sourcing diversification should be considered.