From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Mixed Signals Amidst Stable Production and Geopolitical Uncertainty

Steel market activity in Asia shows mixed trends, with stable production at some plants contrasting against a backdrop of global geopolitical uncertainty stemming from the US. Notably, no immediate, direct relationship could be established between the provided news articles concerning US-related political events and the observed steel plant activity levels in Asia. However, potential future economic impacts of events described in “Liveblog USA unter Trump: Xi hatte nur einen schlechten Moment | FAZ“, specifically potential tariffs, on the broader Asian steel market cannot be ruled out, although current activity shows no immediate impact.

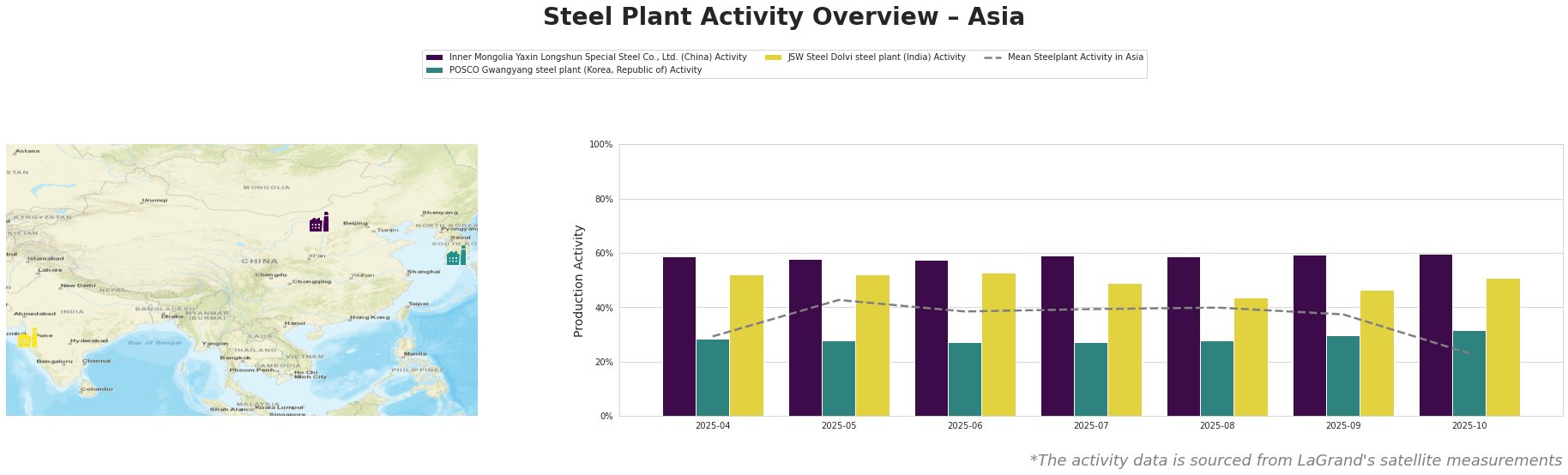

Measured Activity Overview:

The average steel plant activity across Asia saw a decrease to 23% in October, a notable drop from 40% in August. Inner Mongolia Yaxin Longshun Special Steel Co., Ltd. consistently showed high activity, ranging from 57% to 60% over the observed period. POSCO Gwangyang steel plant’s activity remained relatively stable, fluctuating between 27% and 32%. JSW Steel Dolvi steel plant experienced a decrease from 53% in June to 44% in August before increasing again to 51% in October.

Inner Mongolia Yaxin Longshun Special Steel Co., Ltd., a BF/BOF-based integrated steel plant with a 2 million tonne crude steel capacity, focusing on finished rolled products like high-strength rebar, maintained a consistently high activity level around 59-60% throughout the observed period. This suggests stable demand for its products, which may be driven by domestic infrastructure projects. No immediate connection could be established between this activity and the provided news articles.

POSCO Gwangyang steel plant, a major integrated steel producer in South Korea with a 23 million tonne crude steel capacity, utilizes both BF and EAF technologies to produce a diverse range of finished rolled products. Its activity level remained relatively stable, fluctuating between 27% and 32%. The slight increase to 32% in October may indicate a response to changes in regional demand. No explicit connection could be established between these activities and the provided news articles.

JSW Steel Dolvi steel plant, an integrated steel plant in India using BF and DRI processes with a 5 million tonne crude steel capacity and focus on finished and semi-finished products, experienced a notable decrease in activity from 53% in June to 44% in August. However, activity increased again to 51% in October. This fluctuation could reflect adjustments in production schedules or responses to changing market conditions within India. No direct link could be established to the provided news articles.

Evaluated Market Implications:

Given the stable activity at Inner Mongolia Yaxin Longshun Special Steel Co., Ltd. and the fluctuations at JSW Steel Dolvi, buyers relying on these plants for specific products (rebar from the former, and wire rod, cold rolled, or hot rolled steel from the latter) should closely monitor production schedules and maintain open communication with suppliers to mitigate potential supply chain disruptions. POSCO Gwangyang’s stable, albeit low, activity suggests a consistent supply of its diverse product range, but buyers should stay informed of any potential impacts from global economic events described in the US-related news articles, though no immediate impact is evident.