From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Production Climbs Amid Export Shifts: Opportunities & Challenges for European Buyers

In Europe, Ukrainian steel production is showing signs of recovery alongside shifts in export destinations, creating both opportunities and challenges for European steel buyers. According to “Consumption of steel products in Ukraine grew by 39.5% y/y in January-September,” domestic steel consumption in Ukraine has increased significantly. This growth, coupled with reports of altered export patterns as noted in “Ukrainian steelmakers cut exports of semi-finished products by 38% y/y in January-September” and “Ukraine’s total steel exports down 12.2 percent in Jan-Sept 2025,” suggests a reallocation of Ukrainian steel supply, potentially influencing availability and pricing in the European market. It’s important to note that a direct relationship between these articles and plant activity in the broader European region cannot be explicitly established based on the provided data.

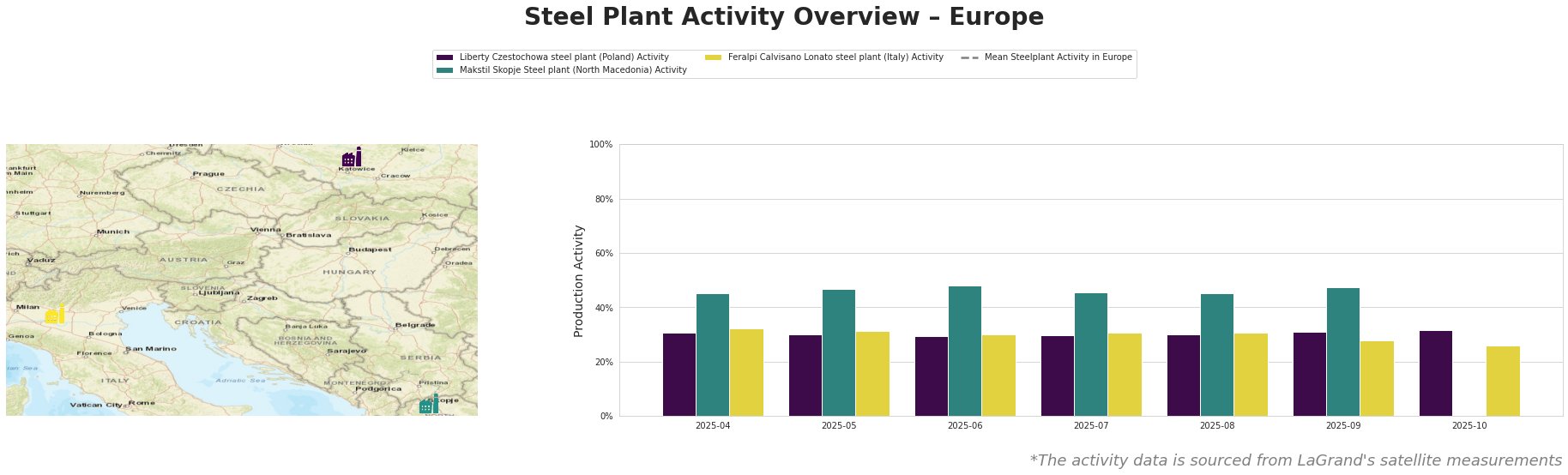

The mean steel plant activity in Europe shows fluctuations throughout the observed period, peaking in May, July and August 2025. Liberty Czestochowa’s activity in Poland remains relatively stable between 30% and 32%. Makstil Skopje in North Macedonia shows fluctuating activity between 45% and 48%. Feralpi Calvisano Lonato in Italy has experienced a small decrease to 26% activity in October. Overall, these plants show a lower activity compared to the European mean. No direct connection between these activity levels and the aforementioned news articles can be established.

Liberty Czestochowa, located in Silesia, Poland, operates an EAF-based steel plant with a crude steel capacity of 840,000 tons per year, focusing on semi-finished products like plate. Its activity has remained relatively stable around 30-32% during the observed period, showing only a small increase in October. Considering the news article “Exports of Ukrainian semi-finished steel products fell by 38.5%” the stability in plant activity may indicate its independent market position, however, no direct relationship between the article and the activity levels can be established.

Makstil Skopje, a North Macedonian steel plant with a 550,000-ton crude steel capacity and EAF technology, primarily produces semi-finished slabs. The plant shows stable activity between 45% and 48%. The consistent production levels don’t show a clear correlation with the aforementioned news articles.

Feralpi Calvisano Lonato, situated in the Province of Brescia, Italy, utilizes EAF technology to produce approximately 600,000 tons of crude steel annually, specializing in semi-finished billets. The plant saw a decrease in activity to 26% in October. While the decline in activity at Feralpi Calvisano Lonato could potentially be linked to shifts in European steel dynamics as suggested by the news regarding Ukrainian steel exports, a direct causal relationship cannot be definitively established without further information.

The news articles detail changes in the Ukrainian steel sector, particularly regarding domestic consumption and export patterns, that may influence the broader European market. Given the reported increase in domestic consumption and the decrease in semi-finished product exports from Ukraine (“Consumption of steel products in Ukraine grew by 39.5% y/y in January-September” and “Ukrainian steelmakers cut exports of semi-finished products by 38% y/y in January-September“), European buyers sourcing semi-finished products should:

- Diversify suppliers: Given the potential reduction in semi-finished steel exports from Ukraine, actively explore alternative supply sources to mitigate potential disruptions and maintain competitive pricing.

- Monitor import trends: closely track import volumes and pricing from other European countries and beyond to identify potential alternative sources and anticipate price fluctuations.

- Engage in forward buying: Based on the information provided and your company´s risk assessment, consider forward buying strategies to secure supply and hedge against potential price increases, particularly for semi-finished steel products. This is a high risk strategy that requires robust risk assessment.

- Evaluate scrap alternatives: Given the increase of scrap export as mentioned in “Scrap exports from Ukraine reached 311,000 tons in January-September,” and potential zero quota that may be put in place, EAF steelmakers should monitor the scrap market in Ukraine and Poland, to anticipate any changes in input prices.