From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Safeguards Threaten Serbian Plant, Impacting European Supply; Plant Activity Declines Noted

Europe’s steel market faces potential disruption due to proposed EU steel safeguard measures, particularly affecting Serbian steel exports. The article “Serbia eyes EU negotiations over proposed trade measure” directly relates to concerns over the future of the HBIS Group Serbia Iron & Steel plant, with its production potentially impacted by tariffs. The activity of observed European Steel Plants reveals fluctuations, potentially related to market uncertainty surrounding EU safeguard measures.

Serbia’s concerns regarding EU trade measures are highlighted in “Serbia seeks talks with EU on new steel safeguard measures,” “Serbia is closely following the EU negotiations on the proposed trade measures,” and “Serbia to seek exemption from EU’s proposed steel safeguards“. These articles underscore the potential for reduced steel supply from Serbian plants, particularly the HBIS-owned Smederevo steel plant, if tariffs are imposed. Vucic fears these measures will negatively impact Serbia’s steel exports, particularly from the Smederevo steel plant, potentially harming the country’s investment appeal and regional competitiveness.

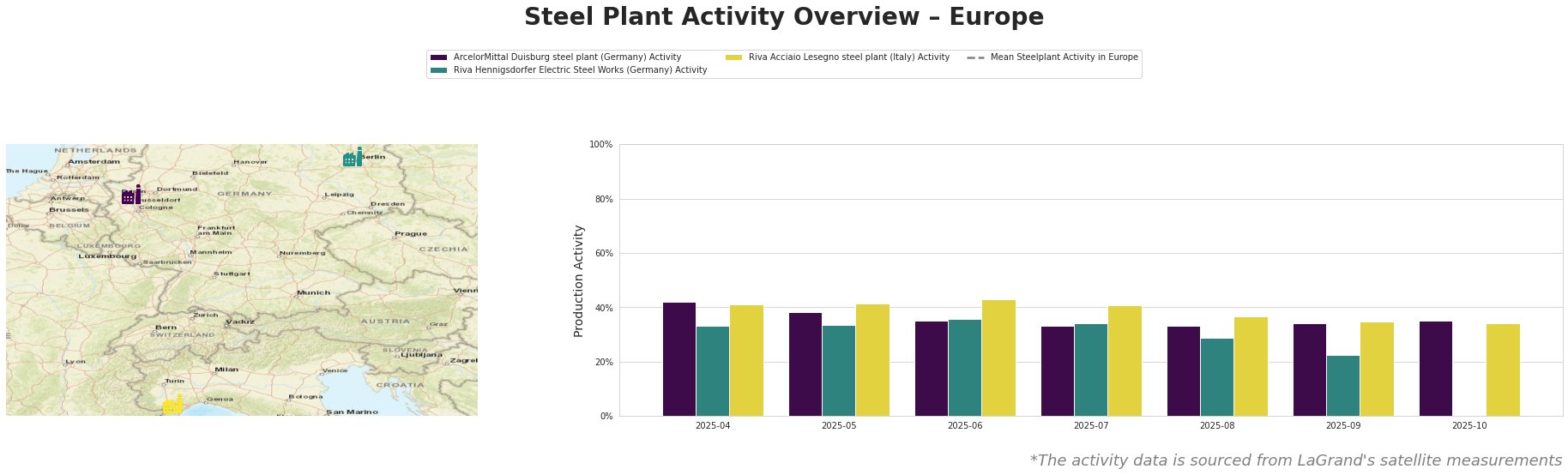

The mean steel plant activity in Europe has fluctuated significantly over the observed period, peaking in May and July/August before declining to its lowest point in October.

-

ArcelorMittal Duisburg steel plant (Germany): This plant, with a 1.3 million tonne BOF capacity, shows a gradual decline in activity from April (42%) to July/August (33%), followed by a slight increase to 35% in October. No direct link can be established between these fluctuations and the provided news articles regarding Serbian steel safeguards.

-

Riva Hennigsdorfer Electric Steel Works (Germany): This EAF-based plant, producing 1 million tonnes of crude steel annually, exhibits a more pronounced activity decrease, dropping from 33% in April to a low of 22% in September, before data becomes unavailable. No direct link can be established between these fluctuations and the provided news articles regarding Serbian steel safeguards.

-

Riva Acciaio Lesegno steel plant (Italy): This plant, with a 600,000-tonne EAF capacity, has shown relatively stable activity, ranging between 34% and 43%. No direct link can be established between these fluctuations and the provided news articles regarding Serbian steel safeguards.

The Serbian government’s concern over potential tariffs on steel imports is directly linked to the HBIS Group Serbia Iron & Steel plant, a major steel producer. A potential reduction in output from this plant would primarily affect supply chains reliant on semi-finished and finished rolled products typically used in automotive and other manufacturing sectors, as indicated by the plant details referenced in “Serbia to seek exemption from EU’s proposed steel safeguards“.

Evaluated Market Implications:

-

Potential Supply Disruptions: The proposed EU steel safeguard measures directly threaten steel supply chains reliant on the HBIS Group Serbia Iron & Steel plant. Given its focus on semi-finished and finished rolled products for the automotive and manufacturing sectors, any disruption will disproportionately impact these industries.

-

Recommended Procurement Actions:

- Steel Buyers in Automotive and Manufacturing: Given the explicit concerns raised by Serbia and the potential impact on supply chains, prioritize diversifying steel sourcing away from suppliers heavily reliant on Serbian steel production, especially if they are linked to HBIS. This is crucial to mitigate risks associated with potential tariffs or reduced production at the HBIS Smederevo plant. Immediately evaluate alternative suppliers.

- Market Analysts: Closely monitor the outcome of negotiations between Serbia and the EU, focusing on any exemptions or quotas granted to Serbian steel producers. Track import/export data between Serbia and EU countries. Any policy changes impacting Serbian steel exports should be immediately factored into supply and demand models for the European steel market.