From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Optimistic: Metinvest’s Recovery and Dillinger’s Activity Surge Signal Positive Trends

Europe’s steel market displays a very positive sentiment, underscored by Ukrainian steelmaker Metinvest’s strategic positioning for recovery amidst the war. This is directly linked to “Ukraine steelmaker Metinvest positions for steel market recovery amid war,” indicating efforts to modernize and expand. While these strategic moves are underway, no direct link can be made between these actions and the satellite observed activities of the OMK Ecolant steel plant. However, the news is supplemented by the satellite observation of activity levels, which have implications for European steel supply.

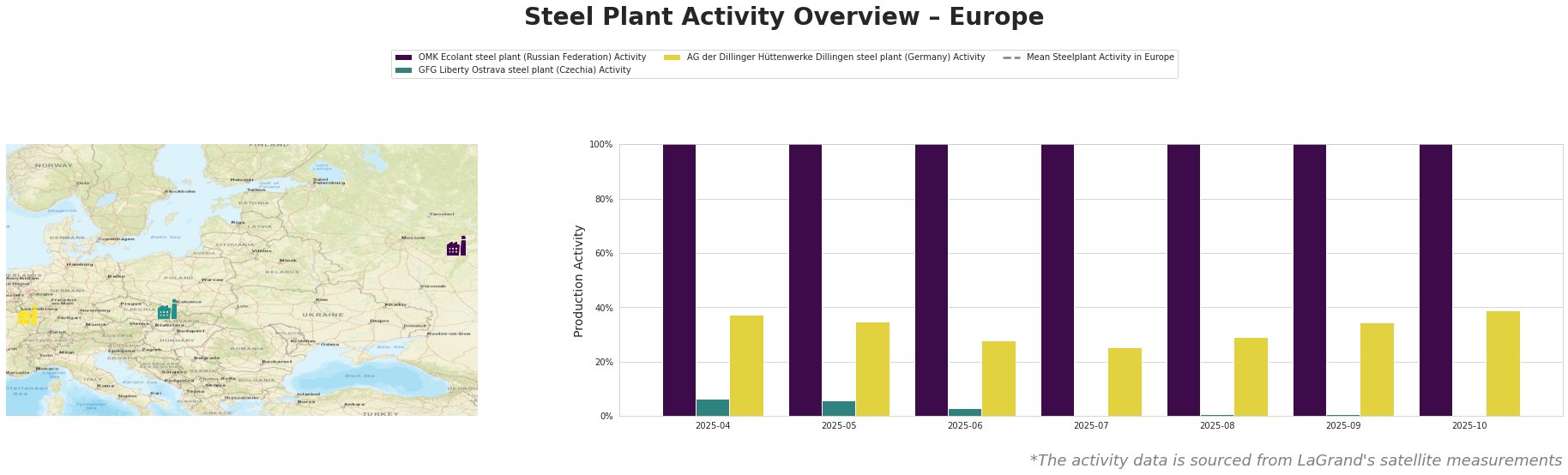

The mean steel plant activity in Europe shows fluctuations, with a significant drop in October 2025. OMK Ecolant steel plant activity remains consistently high relative to the European mean. GFG Liberty Ostrava steel plant shows very low activity. AG der Dillinger Hüttenwerke Dillingen steel plant exhibits a general upward trend from July to October 2025, reaching 39%.

OMK Ecolant, a Russian Federation-based steel plant, operates with a DRI-EAF integrated process and a crude steel capacity of 1.8 million tonnes, mainly producing semi-finished products for building, energy and transport sectors. The plant activity has remained constantly high throughout the entire observed period, far exceeding the mean European activity. No explicit connection can be established between this activity and the provided news articles.

GFG Liberty Ostrava steel plant, located in Czechia, primarily uses a BF-BOF integrated process with a crude steel capacity of 3.6 million tonnes. It produces both semi-finished and finished rolled products. The plant’s activity shows a concerning decline, hitting 0% in July 2025. No explicit connection can be established between this activity and the provided news articles.

AG der Dillinger Hüttenwerke Dillingen steel plant in Germany, an integrated BF-BOF producer with a capacity of 2.76 million tonnes, focuses on high-quality flat steel products. The plant’s activity has generally increased from 25% in July 2025 to 39% in October 2025, outperforming the mean European activity. No explicit connection can be established between this activity and the provided news articles.

Evaluated Market Implications:

The ongoing conflict in Ukraine, as highlighted in “Ukraine steelmaker Metinvest positions for steel market recovery amid war,” introduces potential supply chain risks, particularly within Metinvest’s operational scope. However, the company’s strategic focus on recovery, as well as its demonstration as a top 10 tax payer in Ukraine (“Metinvest is among the top 10 largest private taxpayers in Ukraine“), suggests an intention to maintain operations, or even expand through investment, at facilities like Kamet Steel.

Procurement Actions:

- For steel buyers: Closely monitor the output of Metinvest’s operational steel plants. Given the war and Metinvest’s active involvement in supporting veterans (“Metinvest ranked among Forbes’ top 30 best employers for veterans“) and the Ukrainian state, prioritize relationship management with Metinvest to ensure stable supply despite logistical challenges. Consider diversifying sources to mitigate potential disruptions linked to the conflict, bearing in mind the expansion to Adria in Italy.

- For market analysts: Track the modernization projects at Kamet Steel. As the company invests and shifts its production strategies, assess the long-term implications on the European steel market. Also, pay close attention to the increasing activity level of AG der Dillinger Hüttenwerke Dillingen steel plant in Germany and the low activity observed at GFG Liberty Ostrava steel plant, as they may indicate shifts in regional supply dynamics.