From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineBrazilian Steel Market Shows Strength Despite COP30 Uncertainty: Plant Activity Analysis & Procurement Insights

Brazil’s steel market exhibits overall positive sentiment despite uncertainties surrounding COP30. Recent plant activity levels, combined with Brazil’s climate commitments, present a complex picture for steel buyers. “Pre-Cop leaves most negotiations to Belem” suggests potential policy shifts impacting the sector. We examine activity levels at selected steel plants to provide actionable procurement insights, referencing the provided news articles where direct connections can be established.

The pre-COP discussions in Brazil focus on reducing emissions and sustainable economies as noted in “Fossil fuels in Cop 30 action agenda spotlight“. Although it is hard to tie it directly to the current production levels.

Observed Plant Activity:

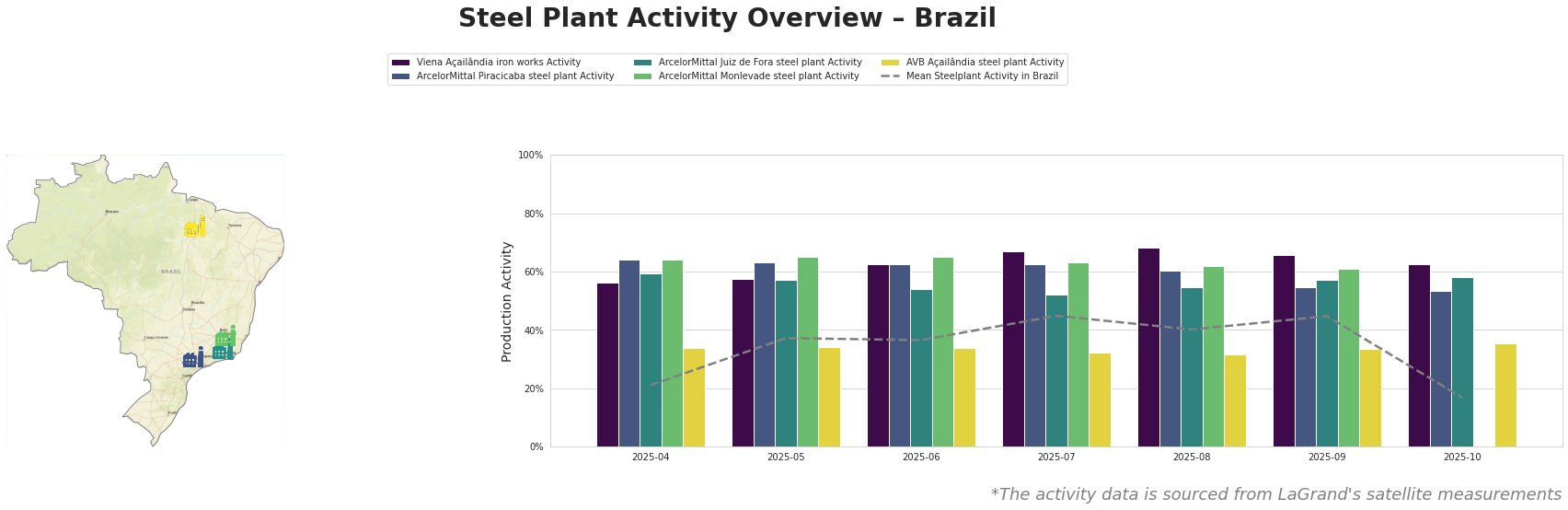

The average steel plant activity in Brazil fluctuated between April and September, peaking at 45% in July and September, before experiencing a significant drop to 17% in October. Viena Açailândia iron works consistently operated above the average. ArcelorMittal Piracicaba steel plant activity was above average until October. ArcelorMittal Juiz de Fora steel plant activity was at the higher end of average. ArcelorMittal Monlevade steel plant activity was at the higher end of average. AVB Açailândia steel plant consistently showed activity below the average.

Viena Açailândia iron works, located in Maranhão, primarily focuses on iron production using blast furnaces, with a capacity of 500 ttpa. Observed activity remained consistently high, ranging from 56% to 68% between April and September, before dropping to 63% in October. This could be in support of Brazil’s forestry restoration commitments noted in “TFFF, REDD+ can generate $9bn/yr for deforestation“.

ArcelorMittal Piracicaba steel plant in São Paulo, an EAF-based plant with a crude steel capacity of 1100 ttpa, produces finished rolled products for the building and infrastructure sectors. Activity levels declined from 64% in April to 53% in October. No direct connection to the provided news articles can be established for this decline.

ArcelorMittal Juiz de Fora steel plant in Minas Gerais, produces 1100 ttpa of crude steel using BF and EAF processes and targets building, infrastructure, tools, and machinery sectors. Activity ranged from 52% to 59% before stabilising at 58% in October. No direct connection to the provided news articles can be established for this stable activity.

ArcelorMittal Monlevade steel plant in Minas Gerais has a crude steel capacity of 1200 ttpa and relies on BF and BOF technologies. The available data shows a decline from 64% in April to 61% in September. This plant’s focus on automotive sector products could be influenced by discussions around phasing out fossil fuels in hard-to-abate sectors as highlighted in “Fossil fuels in Cop 30 action agenda spotlight”, but a direct causal relationship cannot be established.

AVB Açailândia steel plant in Maranhão, with a 600 ttpa crude steel capacity utilizes BF and BOF processes, producing semi-finished and finished rolled products for diverse sectors. The activity was stable at the lower end, between 32% and 35%. No direct connection to the provided news articles can be established for this low activity.

The sharp drop in average plant activity in October, while individual plants show varied responses, necessitates careful observation. The focus on multilateral climate action highlighted in “Cop 30 presidency looking to ‘advance negotiations’” and “COP presidency advances action agenda” could result in policy changes that will require further attention.

Specifically, steel buyers and analysts should:

- Monitor Policy Outcomes: Closely track COP30 negotiations and resulting policies, particularly those related to carbon emissions, renewable energy adoption, and fossil fuel phase-out. The degree to which Brazil’s climate action agenda highlighted in “COP presidency advances action agenda” impacts steel production costs and regulations needs close scrutiny.

- Assess Supply Chain Risks: Due to a drop in the average steel plant activity in Brazil, procurement professionals should diversify supply sources and develop contingency plans to mitigate potential disruptions from policy changes or reduced production capacity.

- Engage with Suppliers: Discuss with key suppliers their strategies for adapting to potential policy changes stemming from COP30 and their commitments to sustainable steel production.

- Factor Climate Finance into Cost Models: As highlighted in “TFFF, REDD+ can generate $9bn/yr for deforestation”, Brazil’s increasing involvement in climate finance mechanisms might lead to new taxes or incentives for the steel industry. Incorporate these potential costs or benefits into future pricing models.