From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Optimism Amidst Polish Restructuring and Steady Production

Europe’s steel market shows overall positive sentiment despite restructuring efforts in Poland. The observed activity data indicates stable production, while government support may mitigate potential disruptions from “Poland’s JSW has begun preparations for a large-scale restructuring“, “Polish government plans to support JSW restructuring“, and “Poland’s JSW prepares for business restructuring to stabilize liquidity“. These articles highlight JSW’s financial challenges and restructuring plans, but no direct immediate impact on the satellite-observed steel plant activity levels is currently evident.

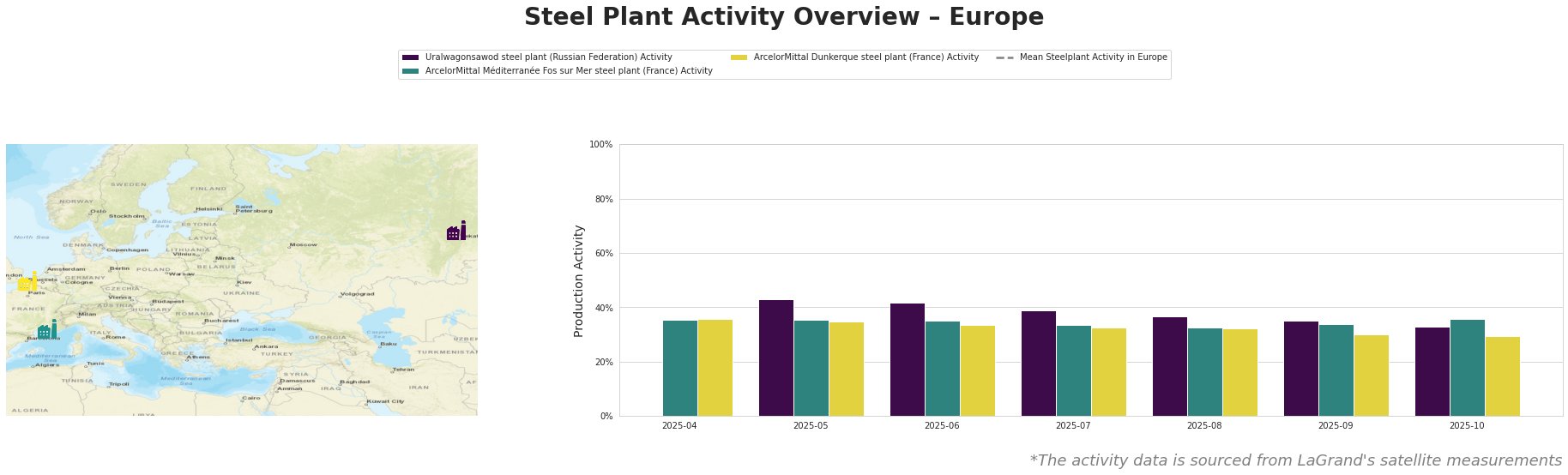

The following table summarizes the satellite-observed monthly activity levels of selected steel plants in Europe:

Activity at the Uralwagonsawod steel plant shows a gradual decline from 43% in May to 33% in October. ArcelorMittal Méditerranée Fos sur Mer showed steady activity, fluctuating between 33% and 36%. ArcelorMittal Dunkerque’s activity decreased from 36% in April to 29% in October. The mean activity in Europe also shows decline towards the end of the period, however, no direct connection to the news from Poland can be established.

Uralwagonsawod, a steel plant in the Rostov region of Russia, primarily serves the defense sector. Activity at this plant decreased by approximately 10 percentage points between May and October. Given its focus on defense, the decline may reflect shifting demands or supply chain adjustments, but this cannot be directly tied to the restructuring of JSW.

ArcelorMittal Méditerranée Fos sur Mer, located in Provence-Alpes-Côte d’Azur, France, has an integrated BF production route with a crude steel capacity of 4000 ttpa. It produces slabs, hot-rolled products, and coil for automotive, construction, energy, and other sectors. Its activity remained relatively stable during the observed period, ranging between 33% and 36%. This stability suggests consistent demand for its products despite broader market adjustments. No direct connection to the JSW news can be established.

ArcelorMittal Dunkerque, situated in Haus-de-France, also operates an integrated BF route, boasting a higher crude steel capacity of 6750 ttpa. It produces similar products as Fos sur Mer. The activity saw a slight decrease, dropping from 36% in April to 29% in October. It is not possible to relate these changes to the above-mentioned Polish news items.

Evaluated Market Implications:

Although JSW’s restructuring may eventually affect coking coal supply to European steelmakers like ArcelorMittal, the observed steel plant activity data has currently not shown a directly attributable impact on ArcelorMittal’s plant activities. No immediate action is required. For steel buyers and market analysts, continuous monitoring of coking coal pricing and supply dynamics remains crucial, alongside tracking progress of the JSW restructuring.