From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel Market Surges Amid Export Shifts and Rising Domestic Demand: Key Insights for Buyers

Ukraine’s steel sector exhibits a very positive sentiment, marked by increased domestic consumption, export shifts, and production adjustments. “Consumption of steel products in Ukraine grew by 39.5% y/y in January-September,” indicating strong internal demand. Simultaneously, “Ukraine increased its pig iron exports by 62% y/y in January-September,” highlighting a focus on specific product exports, particularly to the United States. This surge in pig iron exports does not appear to be directly correlated with observed activity levels at the selected steel plants.

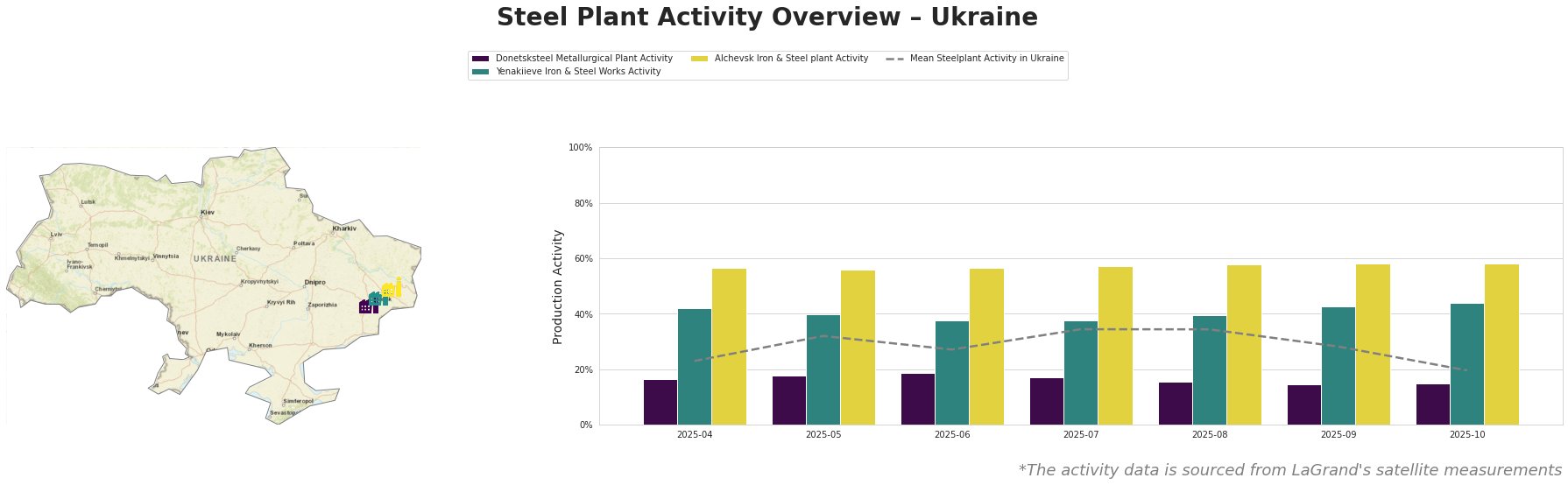

The Mean Steelplant Activity in Ukraine shows a peak in July-August at 34% and a subsequent decline to 20% by October. Donetsksteel Metallurgical Plant consistently showed the lowest activity, ranging from 15% to 19%. Yenakiieve Iron & Steel Works activity varied between 38% and 44%, while Alchevsk Iron & Steel Plant demonstrated the highest and most stable activity, ranging from 56% to 58%. A dip in “Mean Steelplant Activity in Ukraine” in September and October, coupled with the news of “Exports of Ukrainian semi-finished steel products fell by 38.5%” may suggest a link between overall steel production and export volumes.

Donetsksteel Metallurgical Plant, an integrated plant with a BF capacity of 1500 ttpa focused on pig iron, exhibited consistently low activity levels between April and October, fluctuating between 15% and 19%. This might indicate ongoing operational constraints. While “Ukraine increased its pig iron exports by 62% y/y in January-September”, the specific impact on Donetsksteel is not directly ascertainable from the satellite data, as activity levels have been consistently low.

Yenakiieve Iron & Steel Works, an integrated plant with a crude steel capacity of 3300 ttpa using BOF technology to produce semi-finished and finished rolled products, showed moderate activity levels ranging from 38% to 44%. The increase to 43% in September and 44% in October, against the overall trend of declining mean activity, may indicate a strategic focus on domestic supply or specific export agreements. No direct connection can be established between this observed activity and any specific news articles.

Alchevsk Iron & Steel plant, an integrated plant with a crude steel capacity of 5472 ttpa focused on semi-finished and finished rolled products, maintained the highest and most stable activity levels, ranging from 56% to 58%. The steadiness of production may indicate consistent demand for its products (slabs, square billets, and structural shapes), primarily for domestic consumption, given that “Ukraine’s total steel exports down 12.2 percent in Jan-Sept 2025” while domestic sales increased.

Given the increase of “Scrap exports from Ukraine reached 311,000 tons in January-September” and the Ministry of Economy’s proposal to introduce export licensing and quotas with a zero quota for 2025, domestic steel buyers should anticipate potential scrap supply constraints and price increases. Buyers relying on semi-finished products should proactively secure alternative sources due to the reported “Exports of Ukrainian semi-finished steel products fell by 38.5%.” Furthermore, the reported surge in pig iron exports coupled with stable activity at the Donestksteel plant may imply limited production and potential supply constraints for pig iron in the domestic market. Buyers are advised to secure supply contracts as early as possible.