From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Safeguards Threaten South Korean Exports; Vietnamese Plants Surge

Asia’s steel market exhibits a complex interplay of regional dynamics and global trade shifts. The EU’s tightening of steel import safeguards, as reported in “South Korea’s steel exports under threat as EU tightens safeguard measures,” is a key factor. Meanwhile, rising activity levels at Vietnamese steel plants, observed via satellite, suggest capacity adjustments in response to potential market dislocations, although a direct correlation between Vietnamese plant activity and the EU safeguard measures cannot be established based on the provided news articles.

The EU’s actions, prompted by global overcapacity concerns as per “The EU prefers the “steel pact” in favor of Trump,” are poised to reshape trade flows. Federacciai’s view in “Federacciai: EU’s permanent safeguard regime is an “overall positive measure”” highlights the EU’s intent to protect its industry, potentially impacting Asian exporters. These shifts do not have a direct impact on the observed regional increase in steel plants activities.

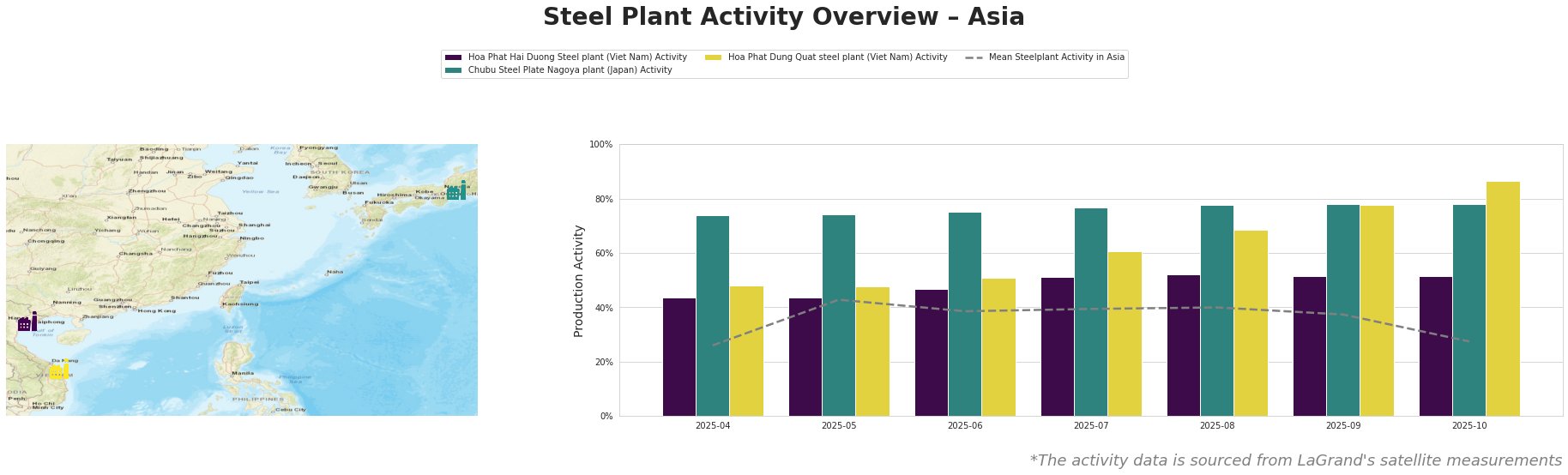

Measured activity overview:

The mean steel plant activity in Asia fluctuated, starting at 26.0% in April 2025, peaking at 43.0% in May, and then generally trending downward to 27.0% by October.

Hoa Phat Hai Duong Steel plant, an integrated BF/BOF producer in Vietnam with a crude steel capacity of 2.5 million tonnes, saw its activity remain relatively stable at between 44% and 52% but ultimately reducing to 51%. These levels consistently exceeded the Asian mean, with a peak of 52% in August. This stable activity, in contrast to the overall Asian mean, could be an indication that the plant is not subject to the same international trade pressures as the rest of the Asian steel producers. No direct link to the provided news articles can be established.

Chubu Steel Plate Nagoya plant, a Japanese EAF-based plate producer with a 700,000-tonne capacity serving sectors like automotive and infrastructure, showed high and stable activity, ranging from 74% to 78%. Activity exceeded the Asian mean. The high production rate might reflect strong domestic demand and the resilience of Japanese manufacturing despite global trade tensions. No direct link to the provided news articles can be established.

Hoa Phat Dung Quat steel plant, another major integrated BF/BOF producer in Vietnam with a 5.6 million-tonne crude steel capacity, showed a steady increase in activity from 48% in April to a high of 86% in October, significantly above the Asian mean. This upward trend suggests increased production capacity utilization. No direct link to the provided news articles can be established.

The EU’s move to tighten safeguards, as stated in “South Korea’s steel exports under threat as EU tightens safeguard measures,” coupled with the rising activity observed at Vietnamese plants, present actionable intelligence for steel buyers:

- Potential Supply Disruptions: South Korean steel exports to the EU are explicitly threatened, potentially creating supply gaps, as reported in “South Korea’s steel exports under threat as EU tightens safeguard measures.”

- Procurement Action: Steel buyers reliant on South Korean steel should immediately diversify their supply base and explore alternative sources within Asia, such as from Vietnamese producers, who exhibit increased production, to mitigate potential price increases and supply shortages resulting from the EU safeguard measures. While Federacciai supports the EU’s measures, these can also be used by Asian exporters to increase their market presence in the EU, pending WTO challenges.