From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOceania Steel Market: Pilbara Iron Ore Expansion Fuels Optimistic Outlook Despite Recent Plant Activity Dip

Oceania’s steel market sentiment remains very positive, driven by significant iron ore investments in Western Australia. The “Rio Tinto and partners invest $733 million in ore mining development in Pilbara“, “Robe River Joint Venture to invest $733 million to extend West Angelas iron ore mine in Western Australia” and “Robe River JV to develop new iron ore deposits at West Angelas mine” news articles highlight a commitment to maintaining iron ore supply. However, recent satellite data reveals a dip in steel plant activity, with no immediately apparent direct relationship to the iron ore expansion news.

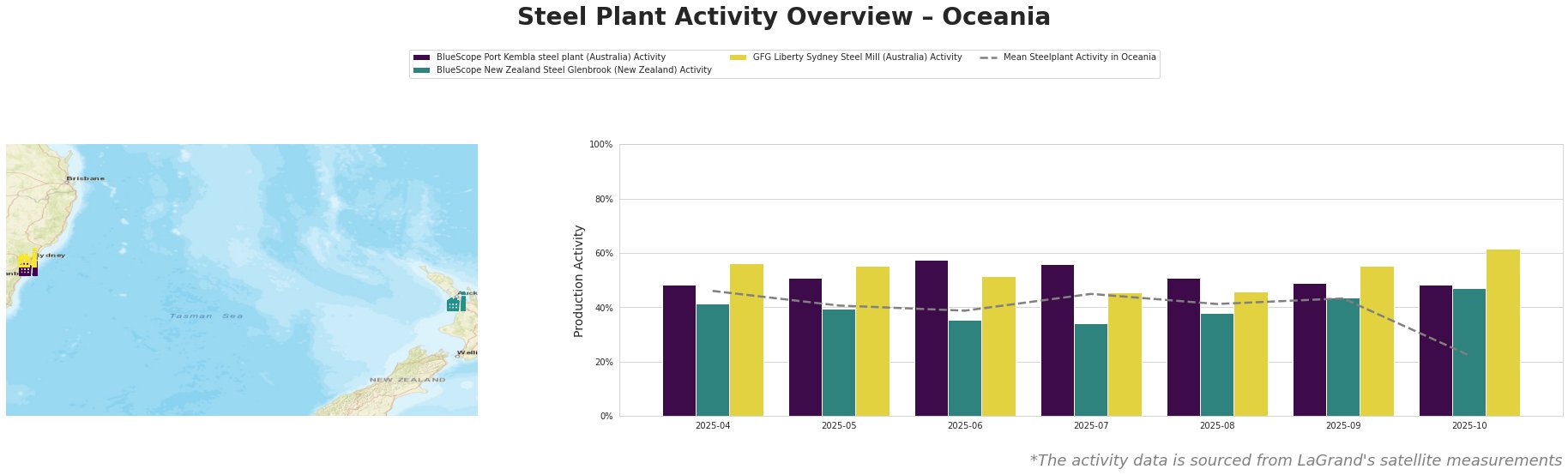

The mean steel plant activity in Oceania has decreased significantly, dropping to 22% in October 2025. BlueScope Port Kembla, an integrated BF/BOF steel plant in Australia with a 3.2 million tonne crude steel capacity, maintained relatively stable activity around 50% throughout the observed period, with a peak of 58% in June, ending at 48% in October. BlueScope New Zealand Steel Glenbrook, an integrated DRI/BOF plant with a 650,000 tonne crude steel capacity, saw activity fluctuate between 34% and 47%, peaking in October, indicating a potential recovery after a low of 34% in July. GFG Liberty Sydney Steel Mill, an EAF-based plant, showed the most volatility, increasing activity from 56% in April to 62% in October, bucking the overall downward trend. The October dip across the region could not be directly linked to any of the provided articles.

Evaluated Market Implications:

The news regarding iron ore expansion projects in Pilbara suggests long-term stability in raw material supply, specifically for BF-BOF steelmakers, but does not directly correlate to near-term production levels. The substantial drop in overall mean steel plant activity to 22% in October, despite stable iron ore outlook, raises concern for potential supply disruptions across Oceania in the short term. Given the increased activity at GFG Liberty Sydney Steel Mill, and its use of EAF technology, it may have fewer supply distruptions in the short term.

Recommended Procurement Actions:

- Steel buyers should closely monitor activity levels, especially from the Port Kembla and Glenbrook plants.

- Given the overall drop in activity, steel buyers are recommended to secure supply via hedging strategies and forward contracts, or consider short-term supply from the GFG Liberty Sydney Steel Mill to mitigate potential shortfalls, as they ramp up production despite the recent drop in plant activity.

- Due to the strong investment in the Robe River Joint Venture, it is recommended steel buyers look toward long-term relationships with them to secure future supply.