From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineTurkish Steel Imports Surge Despite Export Fluctuations: Asian Production Trends Mixed

In Asia, Turkish steel imports are on the rise, while export performance varies across different product categories. “Turkey’s billet imports up 58.1 percent in Jan-Aug 2025” directly supports increased overall production for domestic use or exports with further processing. “Turkey’s HRC imports up five percent in Jan-Aug 2025” also indicates elevated demand for hot-rolled coil, potentially affecting regional supply dynamics. No direct relationships between these import trends and specific steel plant activity levels have been established through the provided data.

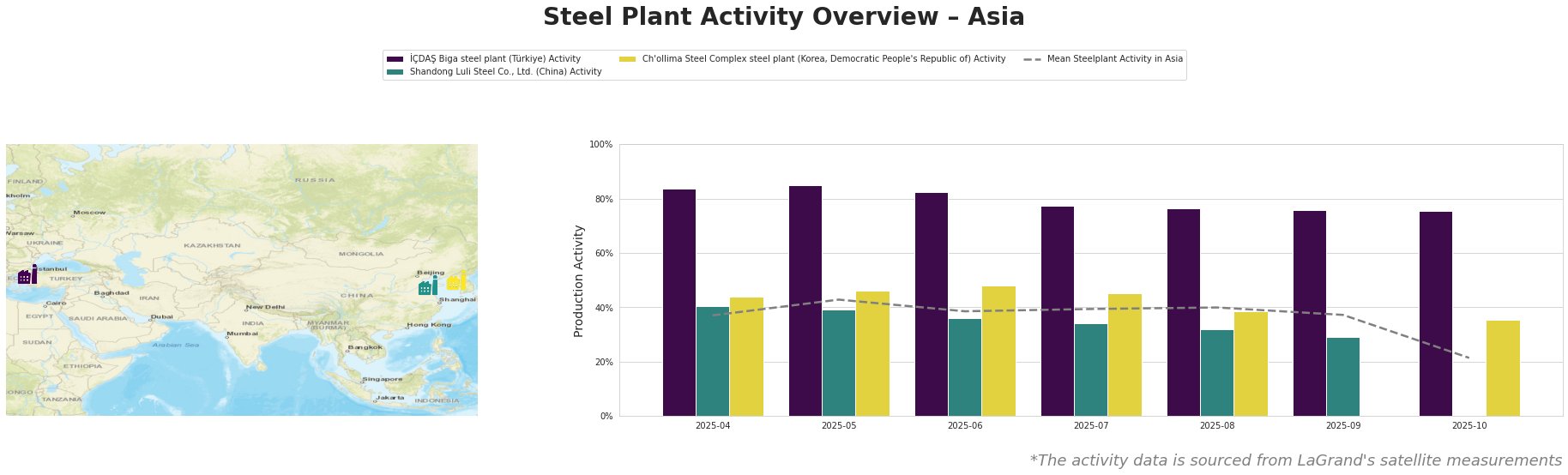

The mean steel plant activity in Asia shows a general downward trend, hitting a low of 21% in October 2025. İÇDAŞ Biga steel plant consistently operated far above the Asian average, maintaining relatively stable high activity throughout the observed period. Shandong Luli Steel Co., Ltd. experienced a notable decline in activity, falling from 40% in April 2025 to 29% in September 2025. Ch’ollima Steel Complex activity fluctuated, peaking in June 2025, followed by declines to 35% in October.

İÇDAŞ Biga steel plant, located in Çanakkale, Turkey, operates an EAF-based steelmaking process with a crude steel capacity of 2.5 million tonnes per annum. The plant specializes in semi-finished and finished rolled products, including billets and wire rod, serving the building, infrastructure, energy, and transport sectors. The observed satellite data indicates consistent, high levels of activity at İÇDAŞ Biga, suggesting that it is operating at or near full capacity. This high activity level is not directly linked to specific news about Turkish steel exports or imports, implying that its production may be primarily driven by domestic demand or pre-existing export contracts. The increase in Turkish billet imports, as reported in “Turkey’s billet imports up 58.1 percent in Jan-Aug 2025”, may indirectly support İÇDAŞ Biga’s production by freeing up its own billet production for other product lines like wire rod.

Shandong Luli Steel Co., Ltd., based in Shandong, China, is an integrated steel plant with a crude steel capacity of 1.4 million tonnes per annum, utilizing BF and BOF processes. Its primary products include hot-rolled ribbed steel bars and billets. The satellite data shows a clear declining trend in activity at Shandong Luli Steel Co., Ltd. from April to September 2025. No direct connection between this activity decline and specific news about Turkish steel imports or exports can be established from the provided information.

Ch’ollima Steel Complex, located in South Pyongan, Democratic People’s Republic of Korea, has a crude steel capacity of 760,000 tonnes per annum, producing plates and wire rod. Activity levels at Ch’ollima Steel Complex have fluctuated. There is no direct correlation could be established from the provided data.

Based on the information provided, Turkish steel buyers and market analysts should note the following:

- Procurement Action: Given the “Turkey’s billet imports up 58.1 percent in Jan-Aug 2025”, steel buyers sourcing billets should explore Turkish suppliers to leverage potentially increased availability.

- Monitoring: Closely monitor the activity of Shandong Luli Steel Co., Ltd. for further production declines, which could impact the supply of hot-rolled ribbed steel bars and billets. Consider diversifying suppliers.

- Sourcing Recommendation: Due to increased Turkish Hot rolled coil imports, buyers looking for HRC should assess Turkish offers carefully as price pressure might exist.