From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Faces Downturn Amidst Trade War and Export Restrictions

China’s steel market is showing signs of contraction as new tariffs and export restrictions impact production. The drop in overall steel plant activity, particularly in October, may reflect the impact of both the US tariff policy and China’s restrictions on rare earth exports, as reported in “China verschärft Exportbeschränkungen für seltene Erden” and “Trump Announces Additional 100% China Tariff, Tech Controls“. These trade-related developments are likely contributing to the overall negative market sentiment.

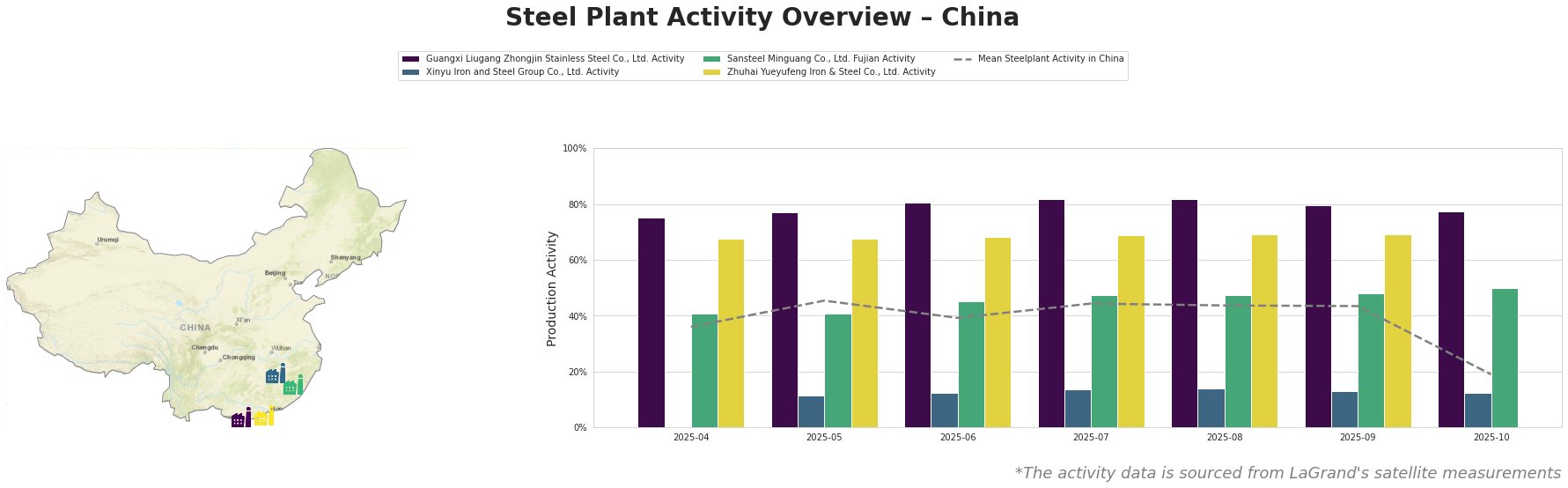

The mean steel plant activity across China shows a notable decline in October, dropping from 43% to 19%. This suggests a broad downturn in steel production.

- Guangxi Liugang Zhongjin Stainless Steel Co., Ltd.: This plant, with a capacity of 1.2 million tonnes of crude steel produced via the BOF process, has maintained a relatively high and stable activity level, ranging from 75% to 82% between April and September, dropping slightly to 78% in October. As the plant focuses on stainless steel coil, it is likely affected by the general market sentiment stemming from “Trump kündigt Extra-Zölle von 100 Prozent für China an” but it is unclear if the steel is on the list of affected products.

- Xinyu Iron and Steel Group Co., Ltd.: This large integrated steel plant, with a 10 million tonne crude steel capacity primarily using BOF, has exhibited consistently low activity levels between 11% and 14% from April to October. No direct connection to the named news articles can be established based on activity data alone.

- Sansteel Minguang Co., Ltd. Fujian: This plant, producing 6.8 million tonnes of crude steel via BOF, has shown stable activity levels, fluctuating between 41% and 50% from April through October. No direct connection to the named news articles can be established based on activity data alone.

- Zhuhai Yueyufeng Iron & Steel Co., Ltd.: With a 3.05 million tonne BOF-based crude steel capacity, this plant has maintained a stable activity level around 68%-69% from April to September; October data is not available. No direct connection to the named news articles can be established based on the activity data alone.

The imposition of 100% tariffs on Chinese goods as detailed in articles such as “Handelsstreit USA-China – Trump will zusätzliche 100-Prozent-Zölle gegen China einführen” is expected to significantly impact export-oriented steel producers. The drop in mean activity from 43% to 19% in October indicates a tangible response to the changed trade landscape, potentially compounded by China’s export restrictions of rare earth, as stated in “China verschärft Exportbeschränkungen für seltene Erden“.

Evaluated Market Implications:

- Potential Supply Disruptions: The most significant risk arises from a broad reduction in Chinese steel output, as indicated by the mean activity drop in October. This suggests that a portion of the producers might be affected by trade policies. Specifically, the trade dispute, including potential restrictions on rare earth elements mentioned in “„Moralische Schande“: Trump kündigt hohe Zölle gegen China an – Aktienmärkte rutschen ins Minus“, could constrain the production capabilities of some plants, indirectly impacting steel availability. While specific plants most at risk are not identifiable based on the provided data, steel buyers should consider alternative sources to mitigate these risks.

- Recommended Procurement Actions:

- Diversify Sourcing: Steel buyers reliant on Chinese suppliers should immediately begin exploring alternative sources outside of China. Given the uncertainty surrounding tariffs, shifting some procurement to other regions can mitigate price volatility and supply chain disruptions.

- Monitor Export Policies: closely monitor official announcements regarding specific steel products affected by both US tariffs and Chinese export restrictions.

- Negotiate Contract Terms: Review existing contracts with Chinese steel suppliers and negotiate clauses that address potential tariff increases or export limitations. Seek price flexibility and consider including clauses that allow for adjustments based on trade policy changes.

- Focus on Stainless Steel: As Guangxi Liugang Zhongjin Stainless Steel Co., Ltd. still exhibits high activity, prioritize this plant in your book.