From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: India Production Surge & Vietnam Import Decline Signal Procurement Opportunities

Asia’s steel market presents a mixed picture with India increasing production while Vietnam reduces imports, potentially shifting regional supply dynamics. Increased domestic production in India, as reported in “India’s steel imports down 36% in September, remains net importer,” may offer procurement alternatives. Conversely, the trend of falling imports in Vietnam, outlined in “Vietnam’s steel imports down 15.3 percent in September 2025 from August,” could constrain supply options. No direct relationship between the two news articles could be established

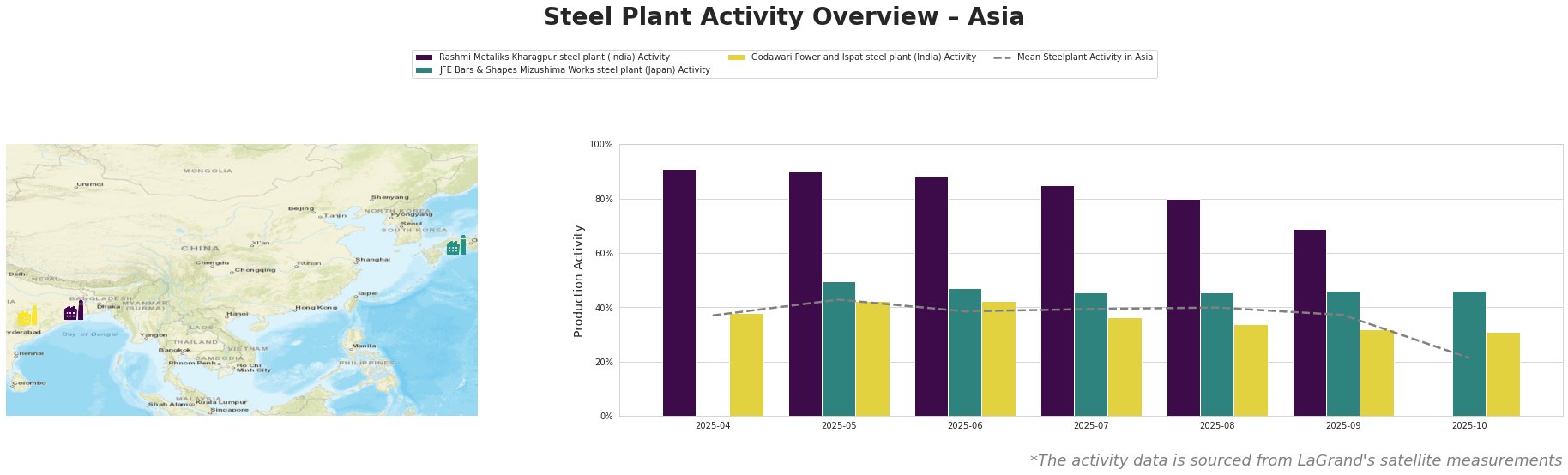

Measured Activity Overview

Across the observed period, the mean steel plant activity in Asia fluctuated, peaking at 43% in May and declining to 21% by the end of October. Rashmi Metaliks Kharagpur showed consistently high activity, starting at 91% in April and decreasing to 69% by September, before data became unavailable for October. JFE Bars & Shapes Mizushima Works saw relatively stable activity, ranging from 45% to 50%. Godawari Power and Ispat showed a gradual decline from 38% in April to 31% in October. The high activity at Rashmi Metaliks in the first half of the period is notably above the Asian mean, while Godawari Power and Ispat’s activity remains consistently close to the mean. No direct connection between plant activity and news articles could be established.

Rashmi Metaliks Kharagpur, a plant with a 1500 TPA crude steel capacity utilizing both BF and DRI production technologies, experienced a significant drop in activity from 91% in April to 69% in September. This decline does not have an explicit direct relationship with the provided news articles. However, given its DRI capacity, any shifts in global scrap consumption as reported in “Global scrap consumption fell by 6.9% y/y in 1H2025” could indirectly influence its operations, but this cannot be definitively confirmed based solely on the provided data.

JFE Bars & Shapes Mizushima Works, an EAF-based plant with a 950 TPA crude steel capacity, maintained a relatively stable activity level around 46% throughout the observed period. This stable performance does not show a clear connection with the market trends highlighted in the news articles. Given it relies on EAF technology, the global scrap consumption trends might exert some influence, but there is no explicit support for this relationship in the provided data.

Godawari Power and Ispat, an integrated DRI-based plant with a 400 TPA crude steel capacity, shows a gradual decrease in activity, starting at 38% in April and falling to 31% by October. Similar to Rashmi Metaliks, its DRI operations could be sensitive to global scrap market dynamics, though the news articles provide no explicit link to this plant’s activity.

Evaluated Market Implications

Based on the news and activity data, the following implications and recommendations can be made:

-

Potential Supply Shifts in India: The article “India’s steel imports down 36% in September, remains net importer” coupled with the observed high relative activity at Rashmi Metaliks until September, although declining, suggests increased domestic supply.

- Procurement Action: Steel buyers should explore opportunities to source finished steel products like TMT bars and DI pipes from Indian producers to leverage increased domestic production and potentially lower import reliance.

-

Vietnam Import Reduction: The “Vietnam’s steel imports down 15.3 percent in September 2025 from August” article indicates reduced import volumes.

- Procurement Action: Steel buyers reliant on Vietnamese imports should diversify their supply base to mitigate potential price increases due to reduced import availability. Consider alternative sources in countries like India, where production is increasing, as mentioned above. Also, negotiate long term contracts now to hedge against supply disruption.

-

Scrap Market Influence: The global scrap consumption decrease, as stated in “Global scrap consumption fell by 6.9% y/y in 1H2025” impacts the EAF, and DRI steel making processes.

- Procurement Action: Buyers should closely monitor scrap prices and their impact on steel production costs, particularly for plants using EAF technology, like JFE Bars & Shapes Mizushima Works, and DRI based plants like Rashmi Metaliks Kharagpur and Godawari Power and Ispat. Assess the feasibility of switching to steel products produced via blast furnace/BOF route if scrap prices increase significantly.