From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Market Booming: Capacity Expansions and Plant Activity Surge Signal Positive Outlook

India’s steel sector is experiencing robust growth driven by capacity expansions and strong infrastructure demand. Recent plant activity levels, while volatile, generally support this positive trend.

The launch of new steel plants, as highlighted in “Jindal India has launched a new steel plant in West Bengal worth $169 million” and “Jindal Stainless commissions first stainless steel fabrication unit in Maharashtra,”” signals increased production capacity and caters to the growing needs of the construction and infrastructure sectors. These developments cannot be directly linked to specific observed changes in plant activity data. However, the commencement of “Indian steelmaker to build 2Mt/yr greenfield steel mill,” although a future project, reinforces the overall positive sentiment in the Indian steel market.

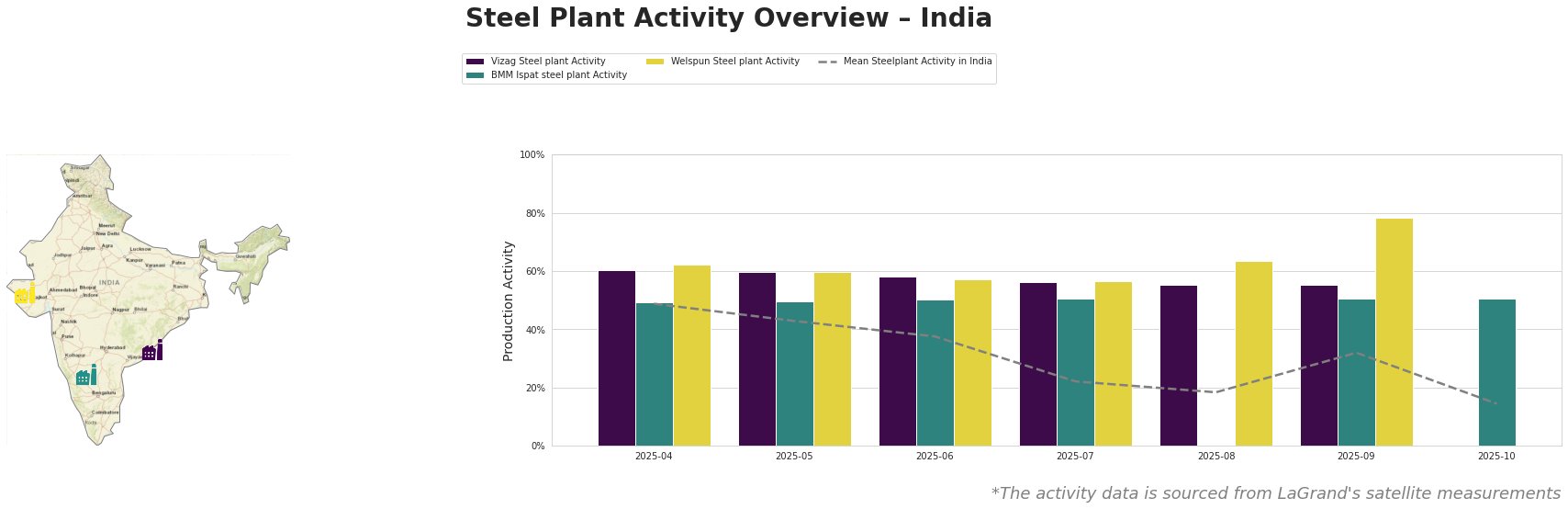

Overall, the mean steel plant activity in India shows a declining trend, falling from 49.0% in April to 14.0% in October. Vizag Steel plant consistently showed above-average activity until September, whereas BMM Ispat steel plant activity remained relatively stable. Welspun Steel plant reached its highest activity level in September (78.0%) but data is missing for October.

Vizag Steel, an integrated plant in Andhra Pradesh utilizing BF and BOF technologies with a crude steel capacity of 7.3 million tons, maintained a relatively high activity level, fluctuating between 60% and 55% until September. The absence of data for October prevents definitive conclusions about recent performance. No explicit connection can be established between Vizag Steel’s observed activity levels and the provided news articles.

BMM Ispat, a DRI-based integrated steel plant in Karnataka with a 2.2 million ton crude steel capacity, demonstrated stable activity, consistently around 50-51% between April and October. There is no observable correlation between BMM Ispat’s activity and the news articles provided.

Welspun Steel, a Gujarat-based DRI plant focusing on TMT rebars with a smaller 0.288 million ton crude steel capacity, showed a notable activity surge to 78% in September before data became unavailable in October. This peak cannot be directly linked to any of the provided news articles.

The observed decline in mean steel plant activity, coupled with missing October data for Vizag and Welspun, warrants careful monitoring by procurement professionals. Although new capacity is coming online, the recent activity dip indicates potential short-term supply constraints. Steel buyers should consider diversifying their sourcing and closely track plant-specific updates for more granular supply chain risk assessments. Given Jindal Stainless’s expansion into fabrication (Jindal Stainless commissions first stainless steel fabrication unit in Maharashtra), buyers requiring stainless steel structural components should explore potential partnerships with JSL to secure supply amidst increasing infrastructure demand.